Helping Axian Telecom to develop digital and telecoms infrastructure through a USD420 million, 5-year debut bond

Project experience | Transaction support

“Analysys Mason has carried out a large number of projects in Africa that gave us an edge in understanding the constraints and opportunities offered in such growing markets. Our credibility to investors across both developed and emerging countries helped Axian in its bond debut by demonstrating the robustness of those markets.”

– Alessandro Ravagnolo, Partner, Analysys Mason

The challenge

Axian Telecom required detailed market information for its upcoming bond

As part of Axian Telecom’s mission to invest in technology and innovation in developing markets, it sought financing for certain important projects. The most significant of these was the acquisition of Tigo Tanzania. In advance of seeking funding through its first-ever bond process. Axian retained financial advisors (J.P. Morgan, Standard Bank, Société Générale) to prepare an offering memorandum. This included an industry section covering essential aspects of the telecoms markets in which it operates. Analysys Mason was hired by Axian Telecom to carry out a detailed review of its group businesses in order to present a thorough and balanced overview for investors.

Our approach

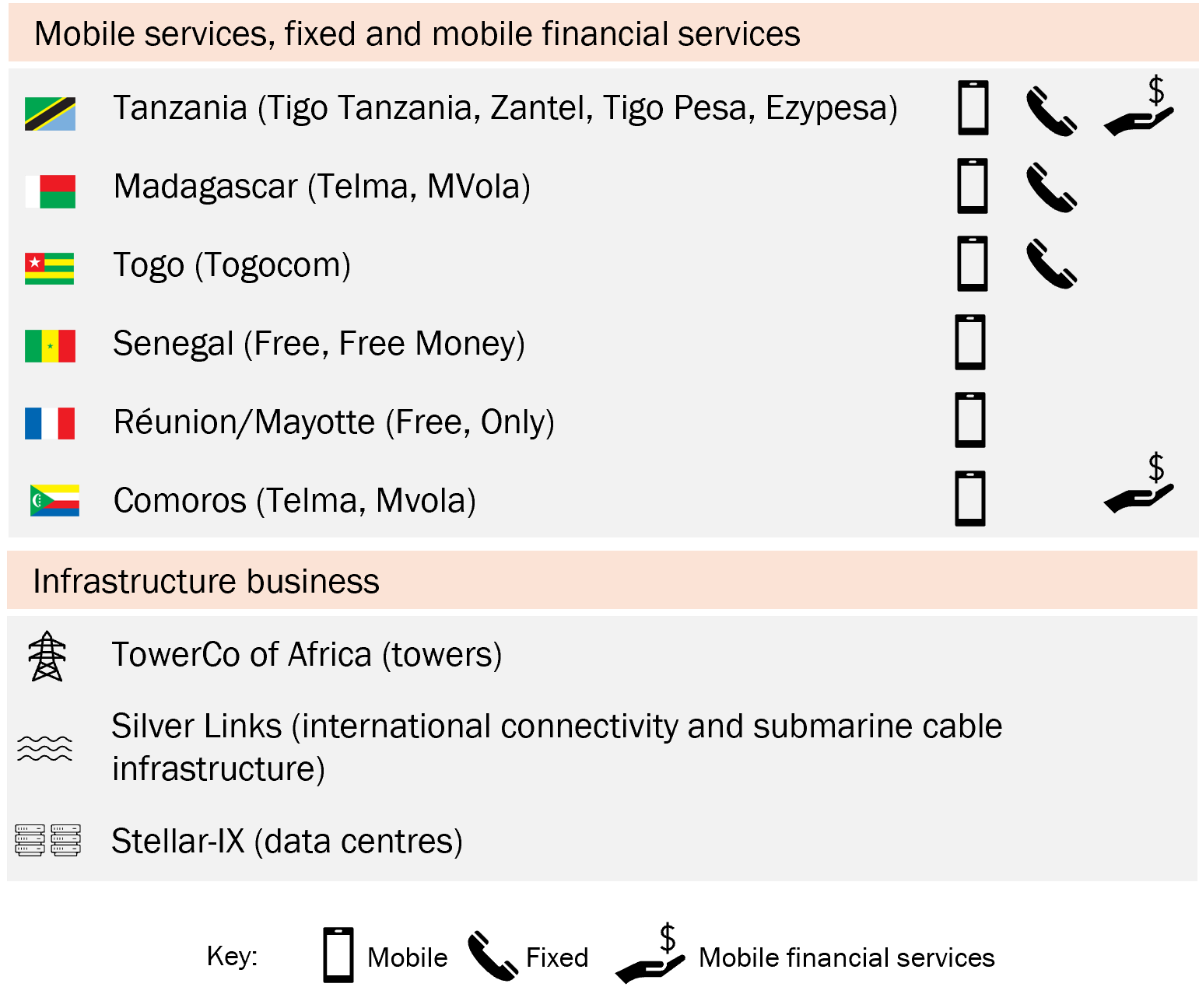

Our review covered the company’s African markets and vertical sectors

Source: Analysys Mason

We produced a report and a data book with the most relevant key performance indicators (KPIs). We included those of interest to potential investors interested in financing a telecoms company operating across multiple African markets and sectors. The KPIs covered areas such as demographics, macroeconomics, infrastructure, mobile services, fixed and mobile financial services. Within those, we examined the company’s user base, user engagement, monetisation ability and technical capabilities.

The review also assessed Axian Telecom’s separate infrastructure businesses: its data centres (Stellar-IX), towers (TowerCo of Africa), international connectivity and submarine cable infrastructure (Silver Links).

As part of this, we conducted interviews with local management teams to understand the company’s strategy and competitive positioning. We then were able to develop a customised market sizing model for each market, covering both historical and forward-looking views of demand that encompassed current dynamics and long-term appraisals on the evolution of markets, value chains and supporting infrastructure.

The impact

The successful bond benefitted the company’s operations and wider economic conditions

Axian Telecom successfully issued its first bond in February 2022, with the order book oversubscribed by 2.2x. It was supported by orders from four anchor investors, all of which were development finance institutions. It was the first issuance in Africa in 2022 and helped generate activity in African bonds for that year.

The funding helped Axian fund the acquisition of Tigo Tanzania and attain its operational goals, including enhanced mobile network service quality and coverage in its six markets. Its investments enabled job creation and improved access to financial services and education in Tanzania, Togo and Uganda and contributed to socioeconomic development in the targeted markets.

Contact

Alessandro Ravagnolo

Partner, expert in transaction servicesRelated content

Article

Operators that set ambitious KPIs will be better placed to gain capital from sustainability-linked finance

Country report

Tanzania: state of the telecoms market 2024

Project experience

Analysys Mason is acting as the Lenders’ Technical Advisor on a FTTH PIN in two areas of France