COVID-19: the telecoms industry will suffer less than many others, and can thus help to support the economy

The telecoms industry has an important role to play in the COVID-19 pandemic

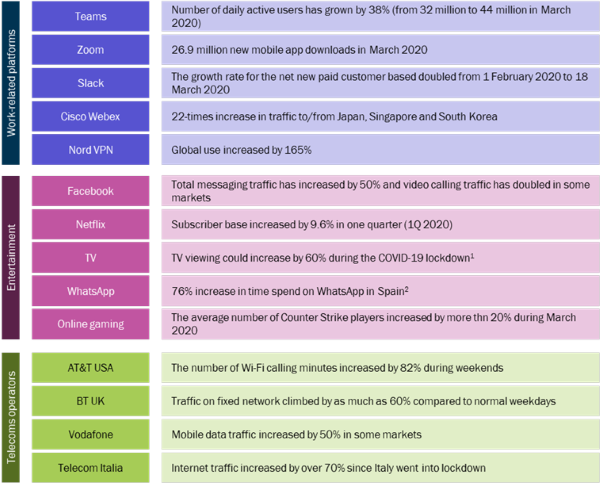

Most countries in the world have implemented physical distancing and stay-at-home/confinement policies to try to limit the rate of hospitalisation during the COVID-19 pandemic and economic activity, social interactions and entertainment have become increasingly dependent on telecommunications as a result. This has led to an overall surge in the use of ICT services and in the amount of associated traffic (Figure 1). Telecoms operators worldwide are reporting traffic increases of 20–70% during the daytime, driven by increased use of videoconferencing, video and cloud-based ICT services.

Figure 1: Increase in demand increase for selected services and applications during the COVID-19 pandemic

Source: Analysys Mason and public sources, 2020

Streaming platforms such as Netflix and YouTube have temporarily reduced the quality of their multimedia content in Europe to ease the pressure on the network, but additional capacity may be required in the long term. This will generate some additional costs, but regulatory responses may assist. For example, the regulator in the USA has granted T-Mobile access to additional spectrum on a temporary basis to enable greater capacity to be delivered rapidly.

The telecoms industry is suffering, but much less so than many others

A surge in telecoms service usage could provide operators with an opportunity for increased revenue under normal circumstances, but the response from the industry has been quite different in these difficult times. Indeed, some telecoms operators are providing additional free services/data.

COVID-19 will cause problems for the industry. Analysys Mason Research is forecasting a 3.4% decline in revenue for operators in high income countries in 2020.3 There is likely to be a number of specific impacts as the global economy deteriorates and many industries are badly hit.

- Working capital and bad debt. The working capital and bad debt ratios for telecoms operators are expected to increase because customers and small and medium-sized enterprises (SMEs) may need more-favourable payment terms or may even be unable to pay their telecoms bills, especially as time goes on. Operators and governments have implemented initiatives meaning that telecoms services will not be terminated in the case of payment delay, for instance.

- Loss of roaming net revenue. Severe travel restrictions and border closures will drastically reduce the international roaming net revenue (that is, the roaming revenue net of roaming costs). This will affect some markets and operators particularly badly.

- Reduction in customer numbers. A reduction in travel may affect the overall mobile penetration due to the loss of migrant workers who would otherwise be mobile customers in a particular country, as was seen in China in early 2020.

- Reduction in the volume of mobile top-ups. Unbanked, prepaid subscribers in developing markets may struggle to buy airtime vouchers or physical top-ups due to their high dependency on indirect physical channels, which may be closed during lockdowns. This in turn could lead to slump in mobile recharge volumes (by as much as 35%, as reported in India4).

- Disruption of network operations and maintenance. Operations and maintenance (O&M) processes will be put to the test as measures are taken to protect the spread of the virus among operators’ employees.

- Discretionary investments may be reduced. Operators are likely to try to preserve cash due to the global financial uncertainty. This will affect their investment levels and discretionary spending, particularly for network upgrades, including those to 5G (unless these upgrades have the direct effect of increasing the network capacity). Additional factors that are likely to slow down investments in specific locations or for specific vendors include the following.

- Major global sporting, tourism and trade events have been delayed. For example, global events such as the Tokyo Olympic Games and Expo 2020 Dubai have been, or are being, delayed. These events were themselves drivers for the early roll-out of 5G technologies and services.

- The supply chains for electronics and ICT hardware have been disrupted because China was one of the early epicentres of the epidemic. This greatly affects the logistics of acquiring and deploying new telecoms equipment, even though telecoms vendors are trying to mitigate this impact. For example, Huawei re-opened its Chinese factories (that it closed down in December 2019 due to COVID-19) in February 2020 because of its intention to meet the demand for 5G equipment.

There is a lot to play for in the post-COVID-19 era

Many organisations have accelerated their digital transformations thanks to travel restrictions and the increase in home working. These forced digital transformations, combined with a behavioural shift in favour of online services, may have a lasting effect on trade and collaboration. This in turn will create an overall increase in the demand for telecoms services in the post-COVID-19 era, which may develop into a real longer-term opportunity for telecoms operators.

Operators are stepping up to these unique circumstances. Operator executives should remain focused on the immediate day-to-day developments regarding the pandemic, but they should not lose sight of the opportunities that may be available in the ‘new normal’ that will emerge post-COVID-19.

Analysys Mason has helped many operators and investors to identify and assess strategic opportunities in the TMT sector. We can assist telecoms operators, vendors and financial institutions to navigate the challenges that COVID-19 continues to present. All related articles and insights can be found at https://www.analysysmason.com/covid19.

1 Nielsen (2020), The impact of COVID-19 on media consumption across North Asia. Available at: https://www.nielsen.com/apac/en/insights/report/2020/the-impact-of-covid-19-on-media-consumption-across-north-asia/.

2 Kantar (2020), COVID-19 Barometer: Consumer attitudes, media habits and expectations. Available at: https://www.kantar.com/Inspiration/Coronavirus/COVID-19-Barometer-Consumer-attitudes-media-habits-and-expectations.

3 Analysys Mason Research: COVID-19 will lead telecoms revenue to decline by 3.4% in developed markets in 2020 - https://www.analysysmason.com/Research/Content/Short-reports/covid-19-operator-revenue-impact/

4 The Economic Times (2020), Lockdown triggers 35% slump in mobile recharge volumes. Available at: https://economictimes.indiatimes.com/industry/telecom/telecom-news/lockdown-triggers-35-slump-in-mobile-recharge-volumes/articleshow/74998587.cms?from=mdr.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Authors

Johann Adjovi

Partner, expert in strategyRelated items

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

Why spectrum renewal policy matters for network investment and service quality

Article

Does the mobile market need additional sub-1GHz spectrum?