US state governments can learn from challenges met by European rural broadband projects

The sparse population across large areas of the US territory makes it challenging to provide ubiquitous, high-speed telecoms infrastructure. There is broad consensus across broadband operators, state governments and other stakeholders that the country is at a pivotal moment in the ongoing campaign to address the growing digital divide in rural parts of the USA. The Broadband Equity, Access and Deployment (BEAD) programme is a government initiative that brings together over USD42 billion of public funding with private-sector match funding to extend coverage of telecoms infrastructure in rural areas. State governments need to act decisively to ensure that operators are attracted to apply for the funds available and are incentivised to achieve a fast and efficient roll-out.

The BEAD programme aims to close the digital divide

The BEAD programme’s scope covers the planning, procurement, delivery and monitoring of projects that are intended to improve broadband connectivity in unserved and underserved areas nationwide,1 primarily in rural regions. The level of funding available through the BEAD programme creates significant opportunities for both achieving policy objectives and potentially helping to support a new wave of commercial investment. It also makes the BEAD scheme a key priority for broadband stakeholders across the USA.

Analysys Mason has been following the BEAD programme closely and comparing the USA’s challenges and approaches to equivalents across Europe. As the economics of broadband deployment is driven by population density, there are many similarities between the issues being faced in the USA and the rural broadband projects and interventions that we have been involved in across Europe. This article highlights some of the specific concerns over the process, market interest and capacity to address the scale of the US rural broadband issue.

The BEAD programme raises market concerns

Several themes are emerging in relation to the challenges faced by the BEAD programme:

- Sequencing. State broadband offices and state governments have concerns regarding the programme’s sequencing. States that take longer to begin the initial phases of planning and implementation could face supply-chain issues as resources are already allocated, which could lead to higher costs of delivery and lower coverage than initially planned:

- Since the NTIA2 allocated funding to the states, there has been a ‘gold rush’ attitude to get proposals and processes set up, and this has also led to concerns about how quickly the NTIA will be able to review proposals and approve state programmes. Delays in approving programmes may cause uncertainty for operators (or ‘sub-grantees’, as described in BEAD terminology), which could limit interest in BEAD funding.

- Business models. Broadband operators of all sizes have expressed concerns about how to ensure the stability of their business models, particularly regarding the potential impact of any ‘low-cost broadband service option’ mandated by states (via the NTIA). This presents a significant financial sustainability risk for operators, as this obligation lies outside their control:

- BEAD funding only covers capital costs; restricting operators’ possible revenue could limit their returns. This could compromise network profitability, or even limit the operator’s ability to cover costs – operators have argued that this could lead to funding recipients ultimately going out of business.

- Many operators, particularly those in rural areas, have relied on tariff subsidies from the Affordable Connectivity Programme (ACP) to help drive adoption of broadband services in poorer rural areas. With the programme’s termination, this reliance is now disrupted, potentially affecting adoption rates and weakening the financial viability of BEAD-funded networks (which may not be covered by the revenue generated from ‘low-cost broadband service option’ tariffs).3

- Lack of interest. Perhaps the most pressing concern in the market is the possibility of operators not bidding for BEAD funding, due to the factors discussed above, the general uncertainty on timing and the overall perceived lack of flexibility in managing BEAD-funded projects:

- To maximise efficiencies and achieve value for money, states should carefully consider the size of projects to attract operators with sufficient scale and capacity that can ensure the long-term sustainability of their operations.

US stakeholders can learn from projects in Europe

From our experience in supporting broadband interventions across Europe (on behalf of both governments and operators), we know that the approach to three critical elements of any broadband intervention scheme will influence its chances of success:

- specification (for example, technology and operational performance characteristics)

- coverage of the technical solution (for example, level of coverage required, and the definition of coverage/premises required to be covered)

- available subsidy (for example, the amount of funding allocated in relation to the coverage and what the funding can be used for).

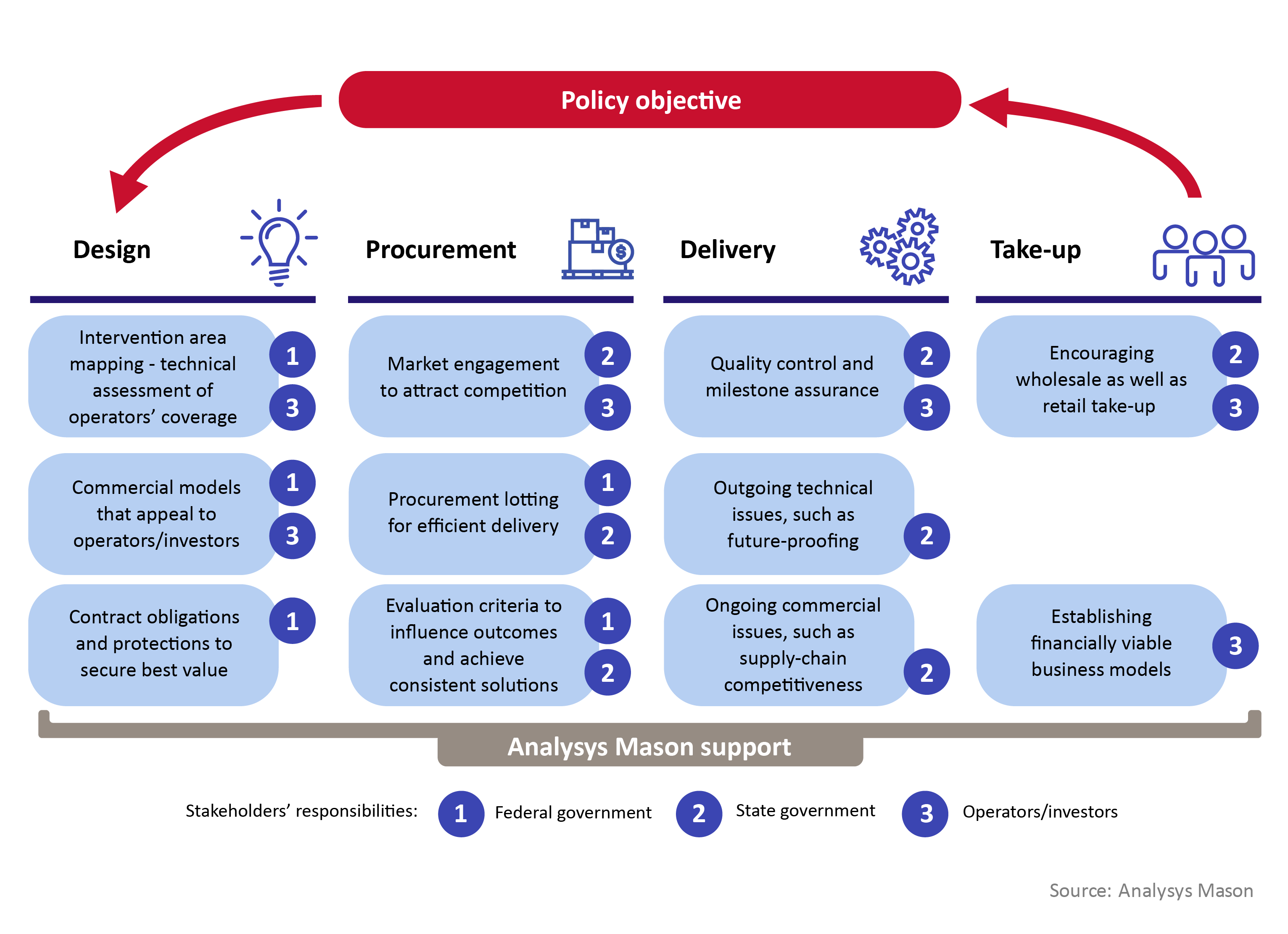

These three elements, along with other important aspects that need to be considered across the four main stages of delivery of a successful broadband intervention scheme, are illustrated in the figure below.

Figure 1: Key considerations for the successful delivery of a broadband intervention scheme

The three crucial elements of any broadband intervention scheme are interdependent and act as the means through which a scheme can adapt to changes, and maximise successful outcomes. The definition of these elements needs to be very clearly defined and understood by the market. Therefore, there is still a chance for state governments and other stakeholders in the USA to learn from challenges that some broadband intervention schemes across Europe have encountered, and thereby avoid repeating their mistakes.

About us

Analysys Mason has extensive experience in supporting all types of stakeholders to design, deliver and monitor many different schemes, in Europe and elsewhere. We can draw on this experience to help give greater certainty and assurance to state governments that funding objectives will be met over the long term. Please contact Patrick Kidney (Partner), Ian Adkins (Partner) and Oliver Loveless (Principal) for an initial conversation about how Analysys Mason can support your interests in the BEAD programme.

Many of the insights shared in this article have been informed by the authors’ attendance of the Connected America 2024 conference (organised by Total Telecom) and subsequent conversations with key industry stakeholders.

1 Locations with access to less than 25Mbit/s download speed (unserved) or less than 100Mbit/s download speed (underserved).

2 National Telecommunications and Information Administration (NTIA), located within the US Department of Commerce.

3 ACP was terminated in May 2024, and it appears unlikely that it will be revived in the short term.

Article (PDF)

DownloadAuthors

Oliver Loveless

Principal, expert in broadband intervention

Ian Adkins

Partner, expert in broadband and digital infrastructureRelated items

Article

National broadband plans: shared objectives but different approaches to public intervention

Article

Network operators need more information before bidding for US government broadband funding

Article

Rural coverage initiatives: stakeholders can learn from the successes and failures of past efforts