Unlocking 5G

5G mobile networks and services are expected to help shape day-to-day experiences worldwide in the next decade, promising to enhance telecoms networks,1 facilitate interactions between consumers and enterprises (massive/mission-critical IoT)2 and develop new value chains.3

To unlock the full potential of 5G, a widely available/highly capillary network infrastructure will be required, as will the availability of an appropriate mix of suitable spectrum.

5G technology will facilitate network slicing, higher capacity/ speeds, which may open new perspectives

5G represents a significant step forward compared with currently available (for example, 4G) technologies. 5G capabilities – in particular, network slicing – will support the provision of end-to-end logical (virtual), network-dedicated capacity. This may enable non-traditional players (such as web/OTT and vendors) to enter the market and directly compete for end users. These developments will pave the way for the provision of applications and services that previously failed to find a business case.

5G may also enable a large(r) amount of spectrum to be aggregated – even across different frequency bands – to achieve higher peak/average speeds: for an equal amount of spectrum, 5G is only marginally more efficient than 4G, but the aggregation can achieve peak/advertised speeds in the order of 1Gbit/s.4

For operators, access to the appropriate (amount of) spectrum is a prerequisite of a successful early 5G launch

Specific frequencies are being made available worldwide to deploy 5G. In the EU, spectrum will initially be available in the 3.4–3.8GHz, 700MHz and 26GHz frequencies.

Operators with a sufficient amount of spectrum will therefore be able to influence and/or flexibly respond to changing competitive dynamics (for example, through truly unlimited offers, higher QoS/average speeds, higher peak/nominal speeds, and the provision of new services including massive/mission-critical IoT).

Low frequencies are particularly useful for providing wide-area/indoor coverage; larger blocks of high frequencies are typically used to provide high capacity/speed services. It is therefore ideal for operators to acquire 80–100MHz in the 3.4–3.8GHz frequency and evaluate the acquisition of 700MHz spectrum, considering (reserve) prices/competition and low frequency spectrum holdings (e.g. 800MHz). An operator with less spectrum may be at a disadvantage and will need to seek alternatives: operators may have to pursue wholesale agreements that include network sharing or spectrum pooling to aggregate/use different bands, or they may have to rely heavily on building more sites – either through densification or by using small cells.

Notably, spectrum is particularly scarce in markets where there are four or five operators. Operators may need to assess the viability of other options before making an outright purchase of spectrum: competing for expensive spectrum may be less effective than alternative solutions such as network sharing and wholesale access.

5G deployments require a substantial investment in spectrum acquisition and network roll-out

The challenge for mobile operators when deploying 5G will be to address the expected increases in traffic volumes without significantly increasing network costs and capture new market opportunities.

Fortunately, the technical advantages with 5G New Radio (5G NR) include features such as Massive MIMO, which greatly increases the range of high-frequency spectrum (for example, 3.4–3.8GHz), making the spectrum suitable for a macro network deployment.5 5G deployment with low-frequency spectrum (such as 700MHz) will also complement the high-frequency 5G layer, opening up a large part of the massive IoT opportunity. However, almost-ubiquitous (indoor) coverage, together with ultra-reliable/stable network systems, will be required to support certain mission-critical IoT applications, which will trigger the need for capillary fixed (fibre) and mobile (small-cells) hybrid infrastructures.

Nevertheless, operators must consider that the 5G NR macro network equipment (specifically with massive MIMO capabilities) is expensive,6 and therefore deployment costs are expected to be substantial and possibly not economical without sufficient spectrum, despite roll-outs being largely on existing sites.

Network sharing can achieve substantial cost savings without significant drawbacks, especially during explorative phases

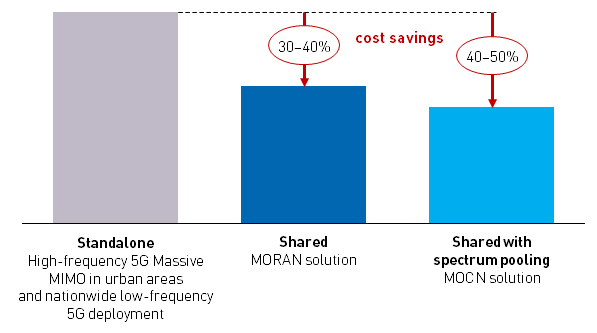

Network sharing is a mechanism that allows, depending on the configuration, an optimal use of spectrum and substantial cost savings (see Figure 1) – depending on the configuration, savings of 40–50% are achievable.

Network sharing has evolved from a non-native technical concept of the 3G/4G networks (with and without pooling spectrum)7 to a fundamental feature of 5G, which also extends the paradigm to a multi-tenancy type model with provision for networks-as-a-platform solutions (through network slicing). As such, network sharing models/configurations may also evolve over time (for example, moving from a MOCN to a MORAN model).

Figure 1: Indicative costs savings for macro network 5G deployments (total cost of ownership)8 [Source: Analysys Mason, 2018]

National operators are expected to begin deploying 5G networks from the early 2020s and such ‘greenfield’ deployment outlines a new level playing field for operators.

If operators do share, equalisation mechanisms are likely to be required to balance different relative positions and contributions to the shared network (including sites and spectrum) of the participating operators.

Additional benefits of network sharing include:

- faster roll-out

- potentially higher indoor and outdoor coverage/reach9

- potentially better QoS through densification10

- environmental efficiencies.

Approval of relevant regulatory and competition laws should not represent insurmountable obstacles

While there are concerns that network sharing will reduce the level of competition, regulators and competition authorities increasingly consider network sharing to be an accelerator of 5G with positive effects/outcomes for consumers and operators alike. In addition, it is considered to be a mechanism that allows operators to reap the benefits of high(er) QoS, network ubiquity and (ultra)reliability, therefore unlocking the full 5G potential.

The entry (with or without public intervention) of neutral host players using shared11 and/or proprietary spectrum may also assist in the creation of ubiquitous and ultrareliable 5G networks.

The authors wish to thank Caroline Gabriel, Pedro Braz Caria, David de Antonio Monte and Emil Arnell for their contributions to this article.

Analysys Mason is ideally positioned to help operators explore 5G strategic alternatives, covering spectrum strategies and deployment options (including network sharing). For more information, please contact Joan Obradors, Partner, Consulting.

1 Enhanced networks include improvements such as higher speeds, better quality of service (QoS) and larger bandwidths for mobile users.

2 Massive IoT (for example, wearables, smart home/buildings and smart meters) allows connections between multiple devices.

3 Serving as a multi-service platform that can support several industry verticals, including applications requiring ultra-reliable/low latency networks (mission-critical IoT), such as: automotive/logistics (such as self-driving vehicles and drones), automation (for example, industry 4.0) and healthcare sectors (for example, remote surgery).

4 The International Telecommunication Union (ITU) has drafted the first technical standards for 5G (the so-called Release15), which clarifies that a carrier size of up to 100MHz is required to achieve peak/advertised speeds of up to 1Gbit/s. Later releases are expected to further enhance such speeds.

5 Offering high antenna gains that compensate for higher-frequency path loss.

6 The cost per megabyte provided over a 5G network is substantially cheaper than an equivalent megabyte provided over a legacy 3G/4G network.

7 MORAN = Multi-operator radio access network (solution without spectrum pooling), MOCN = multi-operator core network (solution with spectrum pooling).

8 Total cost of ownership: cumulative RAN and backhaul capex and opex.

9 For example, by enabling economic coverage of areas where an operator standalone would have not deployed.

10 For example, through wider access to locations/sites, which would increase capacity and speeds.

11 Where allowed by local legislation and regulations.

Downloads

Article (PDF)Authors

Joan Obradors

Managing Partner, expert in regulation and policyLatest Publications

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

Why spectrum renewal policy matters for network investment and service quality

Article

Does the mobile market need additional sub-1GHz spectrum?