Accelerated investment in AI data centres in the GCC region will reach USD5–7 billion in 2026

08 December 2025 | Strategy, Transaction Support, Transformation and Value Creation

Predictions | AI | Data centres

The race to claim a stake in the evolving AI ecosystem has seen some competitors sprinting off the start line, and others gathering speed more cautiously. 2026 will see a substantial acceleration from Gulf Co-operation Council (GCC) countries, through a huge programme of investment in data-centre infrastructure that should position the region among the fastest-growing data-centre markets in the world.

Across the Middle East, AI has been identified as both a priority and a strategic growth catalyst. This ambition is becoming a reality through heavy investment in AI-focused data centres. Public announcements point to more than USD30 billion being invested in GCC countries to establish AI data-centre capacity between now and 2030, an average of over USD6 billion per annum. Major announced investments across the GCC countries include the following.

- Saudi Arabia established a new national AI champion in early 2025, called HUMAIN, to invest and operate across the AI value chain, aimed at deploying AI data centres, developing AI models and offering AI solutions. HUMAIN recently announced a strategic partnership with Blackstone-backed data-centre operator AirTrunk to build AI data centres in Saudi Arabia, with a planned investment of USD3 billion over the coming years. Saudi Arabia’s largest data-centre company by operational capacity, center3, has also announced an ambitious multi-billion-dollar plan to expand its capacity by 2030, including AI, cloud and hyperscaler services. Other major providers in Saudi Arabia have also unveiled plans to deploy AI data-centre capacity in the coming years.

- The UAE announced an AI data-centre ‘mega-project’ in May 2025, called Stargate UAE, bringing together partners such as G42, OpenAI, Oracle, NVIDIA, Cisco and SoftBank Group. The initiative aims to deploy 1 gigawatt (GW) of AI data-centre capacity in the country, backed by an investment of between USD8 billion and USD10 billion, with 200 megawatts (MW) expected to be operational by 2026–2027. Separately, Microsoft announced a major expansion of its AI and cloud infrastructure in the UAE in November 2025, to be delivered through Khazna Data Centers, with an investment of USD7.9 billion over 2026–2029. Other key players in the UAE’s data-centre landscape are also moving fast: du, for example, plans to build an AI data centre in partnership with Microsoft, investing more than USD500 million.

- This trend is evident across the GCC region. In Qatar, Ooredoo’s data-centre subsidiary, Syntys, has launched sovereign AI cloud services, backed by a USD1 billion investment – including the largest-ever USD550 million financing facility in Qatar’s technology industry – to expand capacity to over 120MW. Data-centre operator MEEZA is also expanding its AI and data-centre capacity in Qatar, supported by a USD200 million funding facility. In Kuwait, hyperscalers Google Cloud and Microsoft Azure have unveiled plans to establish a cloud region, including AI capacity, aimed at digitising government services and boosting the productivity of public-sector employees. In parallel, Kuwait’s sovereign wealth fund, the Kuwait Investment Authority, has also joined the AI Infrastructure Partnership to accelerate global investment in next-generation AI infrastructure. In Bahrain, telecoms operator stc and its affiliate center3 are advancing the Bahrain Data Center Park and the 2Africa Pearls submarine cable landing projects, with a combined investment of USD320 million. Meanwhile, Oman continues to see steady growth in data-centre capacity as global and regional providers progress with their investments.

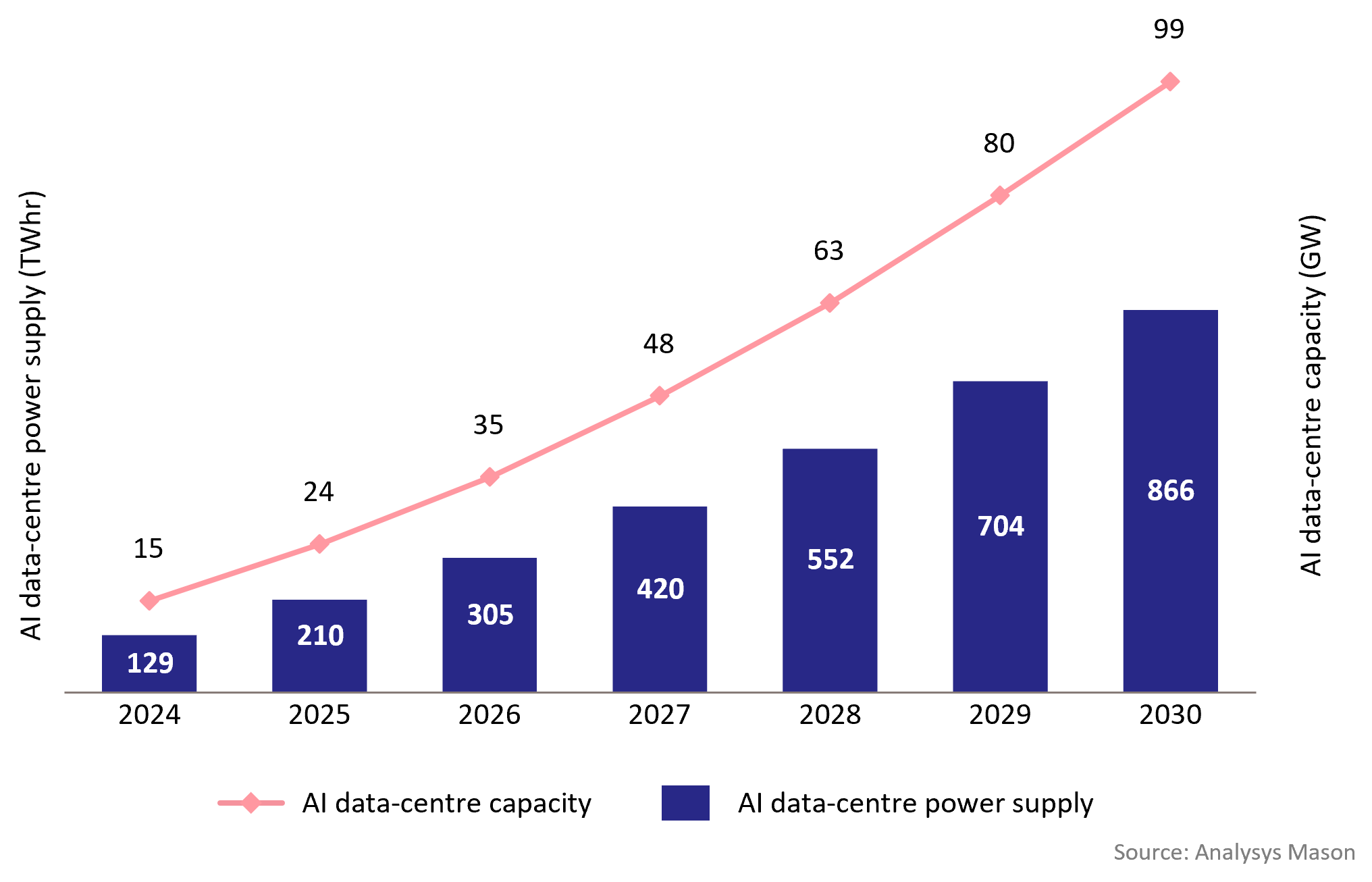

Figure 1: Forecast of global AI data-centre capacity and AI data-centre power supply

Clearly, developments in the GCC region are taking place within the broader context of rapid global growth. Worldwide, we estimate that total installed AI data-centre capacity will reach around 100GW by 2030, up from less than 25GW today. This is based on a detailed analysis of projected AI chipset shipments globally, pricing trends per chipset and increases in computing power.

GCC countries currently hold a relatively modest share of global data-centre capacity. However, the scale and speed of planned AI-focused investments look set to give the region a share of global installed AI data-centre capacity that reflects its share of global GDP.

Author

Arun Pai

Principal, expert in TMT strategy, fintech and AIRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads