Private networks: trends and analysis of LTE-based and 5G-based networks

03 September 2021 | Regulation and policy

Janette Stewart | Ibraheem Kasujee

Article | PDF (5 pages) | Private Networks

The major 5G mobile network operators (MNOs) are currently focusing on applications based on consumer-oriented mobile broadband (MBB) services. However, the 5G standards are designed to support a variety of other applications. For example, the same technology that is used in major 5G mobile networks can be tailored to be used in private LTE/5G networks that address the complex and highly bespoke nature of the 5G services that enterprises and a range of sectors might be interested in.

Analysys Mason’s Private LTE/5G networks tracker provides useful data on the range of private LTE/5G networks that are currently being deployed. In this article, we use this data to illustrate the trends in the use of private LTE networks and private 5G networks and explain these trends in terms of new 5G standards and spectrum availability.

What are private LTE/5G networks?

A private LTE/5G network is a cellular network that is built specifically for an individual enterprise. Such networks are most commonly deployed on a single site (for example, in a factory or a mine). Private LTE/5G networks can also be deployed to address wide-area network requirements such as a utility’s need to monitor a transmission network. Private LTE/5G networks differ from public mobile networks; the latter are typically currently designed to support the wide-area network requirements of the consumer smartphone market.

There are several deployment models that can be used for private LTE/5G networks. Some of the key differences between these models are the type of spectrum used, the core network architecture and how the network is deployed (for example, by an MNO, specialist company, equipment vendor, system integrator or the user itself).

Private LTE/5G networks are often used to connect a diverse range of device types. Private 5G networks in particular are being used to wirelessly connect a large number of sensors and different device types and to provide wireless connections with performance that is comparable to that from fixed cabling. This is needed to maintain the high reliability and low latency that is required for real-time data analytics, image analysis and control-type applications.

The main users of private LTE networks are different to those of private 5G networks

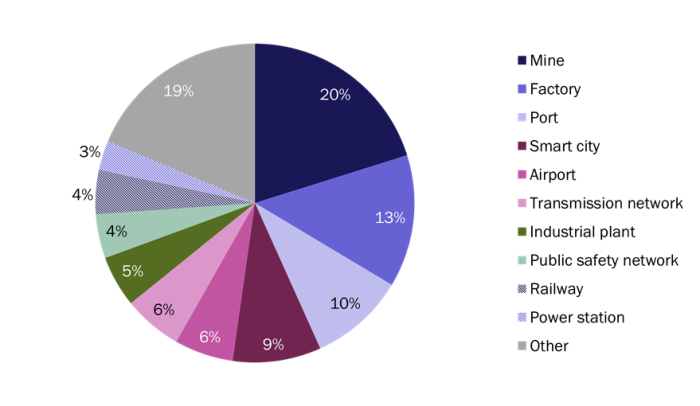

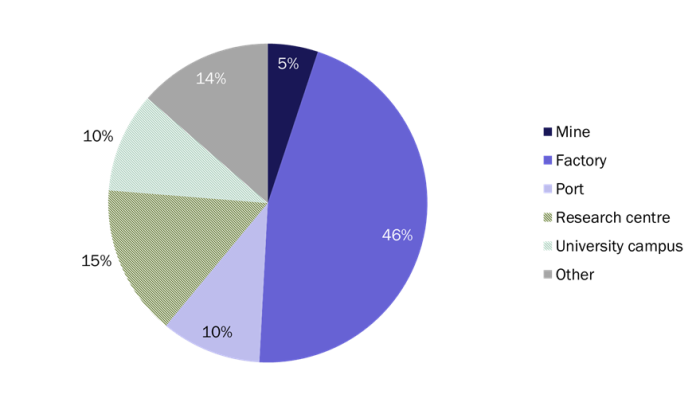

Our latest data indicates that a growing variety of applications and sectors are using private networks. A wider range of vertical markets are using LTE-based private networks than 5G-based networks, largely because LTE technology has been available for longer (Figures 1 and 2).

Figure 1: Users of LTE-based private networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

Figure 2: Users of 5G-based private networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

Nearly half of the 5G private networks that are currently listed in our tracker are deployed in factories. LTE-based private network use is more fragmented; the main users include factories, ports and mines.

5G networks support more-advanced applications than LTE networks

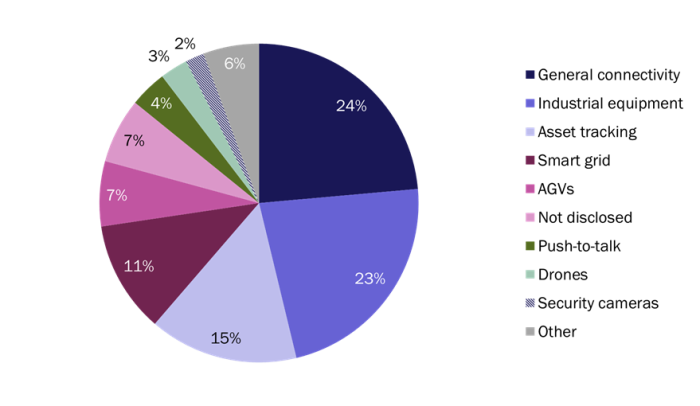

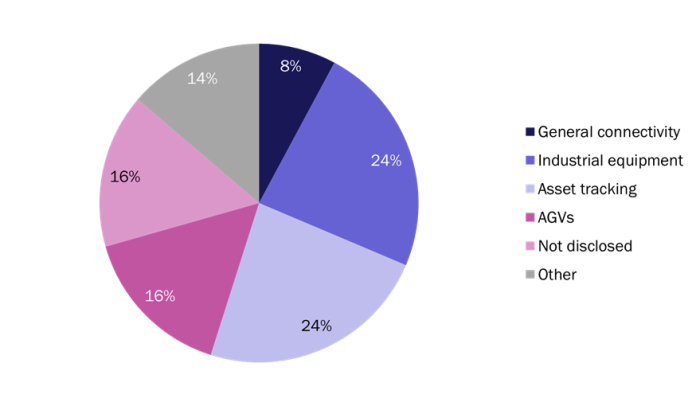

LTE-based private networks have mostly been used for MBB connectivity (for example, mobile workforce), industrial equipment connectivity and asset tracking, as shown in Figure 3. Private 5G networks are also being used for industrial equipment connectivity and asset tracking, but are additionally used in automatic guided vehicles (AGVs) (Figure 4). These applications use 5G’s low-latency capabilities to enable real-time data capture, real-time process analysis and intelligent maintenance. Advanced applications can also make use of the new spectrum that is available for 5G networks that has wider contiguous channels and advanced antenna systems to provide the additional capacity and network performance needed for the most demanding applications.

Figure 3: Applications most commonly supported by LTE-based private networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

Figure 4: Applications most commonly supported by 5G-based private networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

New spectrum is enabling additional use cases for private 5G networks

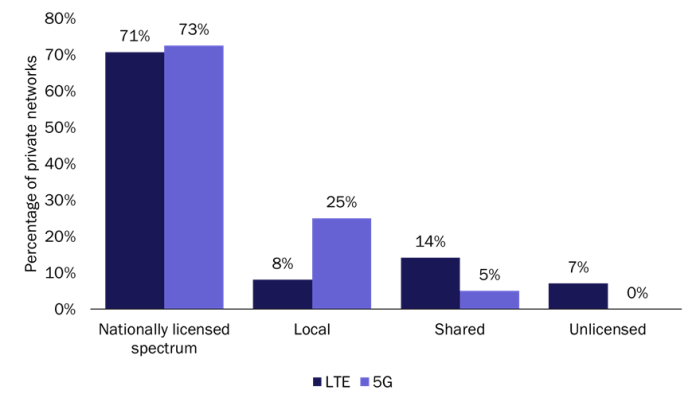

Analysys Mason’s Private LTE/5G networks tracker indicates that private LTE/5G networks use either licensed mobile spectrum, shared access spectrum (such as CBRS spectrum in the USA) or local access licences. The latter are becoming more prevalent with 5G now that specific bands for local 5G use have been made available in several markets. These bands vary between different countries, but prominent examples include the 3.7–3.8 GHz band in Germany, the 3.8–4.2 GHz band in the UK and the 2570–2620 MHz band in France.1 CBRS spectrum in the 3.5 GHz band has been available for some time in the USA for use in both LTE and 5G private networks on a shared access basis.

Most of the systems listed in Analysys Mason’s tracker are still reported to be using licensed mobile spectrum (that is, spectrum licensed to MNOs). However, a growing number of private 5G networks are making use of locally licensed spectrum that regulators have made available to support private network deployments (Figure 5).

Figure 5: Type of spectrum used in private LTE/5G networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

The bands that are typically used vary depending on the market in question. The most commonly used bands for LTE-based and 5G-based private networks are shown in Figure 6.

Figure 6: Most commonly used frequency bands for private LTE and 5G networks, by region, worldwide, from data published in June 2021

| Region | LTE | 5G |

|---|---|---|

| Europe | 2.6 GHz and 3.5 GHz | 3.7–3.8 GHz and 3.8–4.2 GHz |

| Americas | 3.5 GHz (CBRS) | 3.5 GHz and mmWave |

| Asia–Pacific | 1800 MHz | 28 GHz |

Source: Analysys Mason, 2021

One benefit of the new 5G spectrum is that it is better-suited to low-latency applications that need wider channels. This means that more-demanding factory-based applications could be delivered over wireless 5G links instead of fixed cabling. The use of wireless technology may provide a range of benefits to users, such as greater scalability and flexibility to move or reconfigure machinery without the constraints of wired connections. These wider channels are principally available in spectrum bands in the 3.4–4.2 GHz frequency range, and are not available within the bands most commonly used for private LTE networks, such as 1800 MHz and 2.6 GHz.

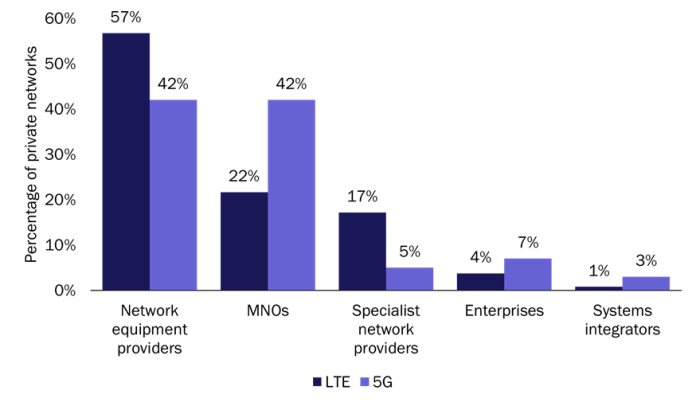

MNOs are increasingly getting involved with private network deployments

MNOs are increasingly getting involved with the deployment of private 5G networks (either as network providers or delivery partners) due to the complexity of 5G technology and the demanding factory and industrial applications that 5G is being used to support. Indeed, for private LTE networks, the majority of systems are managed by network equipment providers (NEPs), whereas there is an equal split between the share of systems managed by NEPs and those managed by MNOs for private 5G networks (Figure 7).

Figure 7: Providers for private LTE and 5G networks, worldwide, from data published in June 2021

Source: Analysys Mason, 2021

Analysys Mason’s consulting team provides strategy, technology, regulatory and spectrum advice in relation to private networks. This article is based on Analysys Mason’s Private LTE/5G networks tracker. For more information on private networks, see Analysys Mason’s What are private LTE/5G networks and why are they important?

1 The European 5G Observatory provides further details on the various approaches to private 5G network spectrum in Europe. European 5G Observatory (2020), 5G private licences spectrum in Europe. Available at: https://5gobservatory.eu/5g-private-licences-spectrum-in-europe/.

Private networks: trends and analysis of LTE-based and 5G-based networks

Download (PDF)Authors

Janette Stewart

Partner, expert in spectrum policy, pricing and valuation

Ibraheem Kasujee

Senior AnalystRelated items

Case studies report

Private LTE/5G network vendors: case studies and analysis

Article

Hyperscalers’ retreat from the private networks market reflects its slow progress, but not its failure

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies