What are private LTE/5G networks and why are they important?

16 February 2021 | Research

Article | PDF (6 pages) | IoT Services| Private Networks| Wireless Technologies

Listen to or download the associated podcast

The private LTE/5G network opportunity is generating considerable interest from suppliers such as infrastructure vendors and mobile operators, as well as from enterprise buyers in a range of sectors. Private LTE/5G networks can complement or replace existing network technologies and enable a wide range of applications and use cases. However, the requirements for private LTE/5G networks are complex and highly bespoke, and as such, the market is difficult to scale. This article examines the market drivers and challenges for suppliers and buyers of private LTE/5G networks.

What is a private LTE/5G network?

A private LTE/5G network is a cellular network that is built specifically for an individual enterprise. Such networks are most commonly deployed on a single site (for example, in a factory or a mine). Private LTE/5G networks can also be deployed to address wide-area network requirements such as a utility’s need to monitor a transmission network. Private LTE/5G networks differ from public mobile networks; the latter are designed to support the wide-area network requirements of the consumer smartphone market.

How are private LTE/5G networks deployed?

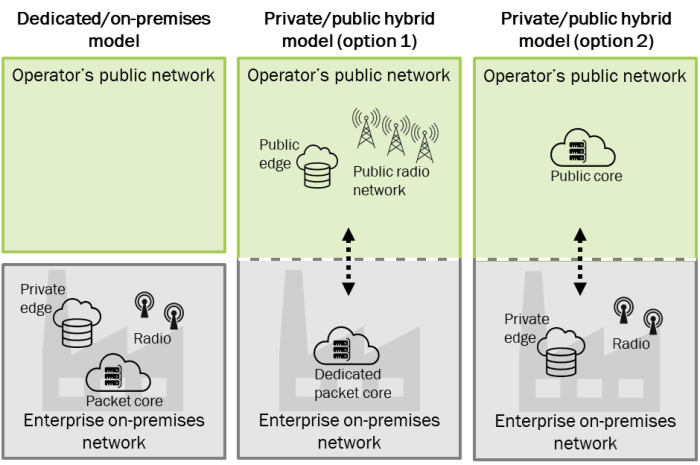

There are two main network deployment models for private LTE/5G networks.

- Dedicated, on-premises networks. An enterprise deploys a dedicated, on-premises network (radio access network and core) that is purpose-built for the sole use of a single enterprise. The enterprise deploys its own edge computing assets. It can use any of the spectrum options mentioned in the next section.

- Hybrid networks. The network is based on a combination of public mobile network components and dedicated on-premises elements. For example, a slice of the public radio network may be combined with a dedicated on-premises core network. 5G enables various deployment combinations such as control and user plane separation (CUPS) of the core network.

Other models may evolve based on public network slicing or dedicated enterprise networks (for example, a specific network for utilities).

What are the components of private LTE/5G networks?

A private LTE/5G network is formed of several network components, as shown in Figure 1 and discussed below.

Figure 1: Private LTE/5G network deployment models1

Source: Analysys Mason, 2021

Spectrum. There are four main types of spectrum, the first three of which are primarily licensed.

- Industrial spectrum. Regulators in some countries (for example, Germany and Japan) allocate spectrum specifically for industrial use. This approach diversifies spectrum ownership, facilitates market entry for alternative providers and consequently provides a greater choice of network suppliers.

- Shared spectrum. Regulators allocate spectrum that is shared by a number of stakeholders. Access to the spectrum can be administered either by the regulator (Ofcom administers access in the UK) or by a certified spectrum access system provider (for example, Federated Wireless is one of the companies certified to administer access for CBRS spectrum in the USA). For CBRS (USA), a block of licence-exempt spectrum is also available for general availability access (GAA). Shared spectrum, like industrial spectrum, lowers the barriers to the deployment of private 5G networks.

- Public spectrum. This approach uses a mobile network operator’s public network spectrum to support enterprises. Operators lease their spectrum to enterprises for a fee.

- Unlicensed spectrum. Unlicensed spectrum bands are designated by regulators, are non-exclusive and free-to-use, but are still subject to the rules of use established by the regulatory body. Examples of unlicensed spectrum solutions for private LTE/5G networks include the Multefire LTE-based technology, which can operate using unlicensed 5GHz spectrum. Regulators are making 6GHz licence-exempt spectrum available for 5G and Wi-Fi use in some countries (such as the USA).

Radio access network. The radio access network is typically a small cell (or small cells) deployed on the customer’s premises. However, customers can have a dedicated slice of the public radio access network in some deployment models, such as the hybrid model shown in Figure 1. This model is not yet common, but some operators (such as Deutsche Telekom) do already offer this approach to some of its customers. We expect this model to become more common over time.

Core network. A dedicated core network can be deployed on-premises or a private slice of the public network core can be used.

Compute platforms. Private networks will need cloud computing platforms to run LTE/5G network functions, such as the mobile core, which are typically virtualised in this context. There are a number of options for these platforms.

- Private on-premises platforms. Enterprises can deploy a private, on-premises cloud that is dedicated to running the network functions or the network functions can run alongside the enterprise’s IT and/or operational technology (OT) applications. This private cloud may run in the enterprise’s central data centre or be distributed across an enterprise site in edge locations (‘micro’ data centres), depending on the required latency.

- Public edge cloud. The virtualised network functions (VNFs) are hosted in a public edge cloud, close to an enterprise location.

- Public cloud. The VNFs are hosted in a public cloud.

Applications and devices. Enterprises often deploy a private LTE/5G network for a single application, but will add different devices and use cases over time. The networks are flexible and can support many different types of devices and applications. Typical early devices include automated guided vehicles (AGVs), surveillance cameras and voice and video communication devices. The LTE and 5G standardisation effort driven by the 3GPP has resulted in a large ecosystem of LTE and 5G device manufacturers that offer affordable devices. This ecosystem is set to grow as industrial device manufacturers start to support LTE and 5G technologies.

Who is deploying private LTE/5G networks?

There are around 1000 private LTE/5G network deployments worldwide. Figure 2 shows selected examples.

Figure 2: Selected private LTE/5G deployments, by vertical

| Sector | Network | Enterprise | Supplier | Site | Primary use cases |

|---|---|---|---|---|---|

| Manufacturing | 5G | Ford UK | Vodafone | Factory | Real-time monitoring and control of industrial equipment (for example, welding machines) |

| Manufacturing | LTE | Osram | Deutsche Telekom | Factory | AGVs |

| Transport | 5G | Ningbo Zhoushan Port Authority | Huawei | Port | Remote monitoring, control and video surveillance of gantry cranes |

| Transport | LTE | Groupe ADP (HubOne) | Ericsson | Airports | Push-to-talk communications and asset tracking |

| Mining | 5G | Sandvik | Nokia | Mine | Support for AGVs |

| Retail | LTE | Ocado | Cambridge Consultants | Warehouse | Remote control of semi-autonomous warehouse vehicles |

| Oil and gas | LTE | Phillips66 | Accenture/AT&T | Oil refinery | Safety applications and capacity monitoring |

Source: Analysys Mason, 2021

The manufacturing and transport sectors have been among the early adopters of private LTE/5G networks. Manufacturers such as Hitachi and Toyota have deployed private LTE/5G networks in factories to support mobile assets such AGVs, as well as applications that drive productivity gains and health and safety, such as video surveillance.

Transport hubs have been the early beneficiaries of private LTE/5G networks. Networks in this sector are supporting push-to-talk, voice and video applications, as well as the remote monitoring and control of heavy equipment.

Why are organisations using private LTE/5G networks?

The demand-side factors for private LTE/5G networks include the following.

- Operational efficiency. The demand for private LTE/5G networks is growing because large organisations’ digital transformation programmes are underway. Enterprises are in the process of digitising their data and using it to drive processes and create new digital products and services.

- IT and OT convergence. The convergence of IT and OT is also a key consideration. Ultimately, the need for high-bandwidth, low-latency networks to support increased automation will grow as enterprise data processing requirements increase.

- Data privacy. Enterprises deploy private networks because data privacy is a key concern. They require more control and visibility of their data.

- Cable substitution. Enterprises deploy private LTE/5G networks to support new applications as a more cost-effective alternative to extending their fixed networks.

- Replacing legacy networks. Existing networks such as TETRA are reaching the end of their life and cellular technologies offer viable alternatives.

- Wi-Fi limitations. Enterprises have used Wi-Fi successfully but have found that it has limitations in terms of supporting mobility and/or other factors such as reliability.

Why are suppliers offering private LTE/5G networks?

The supply-side factors for private LTE/5G networks include the following.

- New growth markets. Suppliers are looking for new growth markets, and private LTE/5G networks present an opportunity. Suppliers are targeting organisations either directly or through partnerships.

- Industrial spectrum. Some governments have made industrial spectrum available (for example, in Germany and Japan), while others use shared spectrum (the USA). This has lowered the barriers for new suppliers to target the private LTE/5G network opportunity.

- Standards. 3GPP 5G standards are now designed to accommodate enterprises’ needs, thereby making it easier for suppliers to demonstrate the suitability of cellular networks. Standards are instrumental in driving down costs and increasing the range of available devices and applications.

What is hindering private LTE/5G network adoption?

There are also demand-side and supply-side challenges for the adoption of private LTE/5G networks. Demand-side factors include the following.

- Cost. Private LTE/5G networks can be more costly to deploy than Wi-Fi networks. LTE/5G network components have traditionally been designed to cater for public networks and business and pricing models are designed as such. Prices will need to decline to match those of Wi-Fi to enable private LTE/5G networks to reach a broader audience; only a few large enterprises can currently deploy commercially. Small and medium-sized enterprises (SMEs) and certain verticals are largely excluded from the market. The hybrid network model is expected to come with lower price points than those for the dedicated, on-premises model, but hybrid deployments are only just emerging.

- Complexity. Private LTE/5G networks are complex to deploy and manage. This may deter some enterprises from adopting the technology.

- Slow pace of change. The private LTE/5G network opportunity is slow to materialise because the pace of change is sluggish in many industries. For example, the estimated life of a factory is 20 years; this could limit the speed at which private LTE/5G and other new technologies can be deployed.

- Immature business models. Current business models are based on traditional capex/opex models. Market evolution to opex-based or SaaS-based models is likely to increase the addressable market for private LTE/5G networks to new enterprise segments and verticals.

The main supply-side factors are as follows.

- Market fragmentation. Enterprise requirements differ by industry vertical and by enterprise size, and many businesses need bespoke solutions. It is difficult for suppliers to address all requirements. Developing scalable solutions is a challenge.

- Skills. Suppliers require network design and deployment skills, as well as systems integration skills.

How big is the private LTE/5G network opportunity?

The cumulative revenue for private LTE/5G networks will grow to USD9 billion between 2020 and 2025, excluding spending on spectrum, devices and applications. The number of private LTE/5G networks will grow from around 500 in 2020 to 14 000 in 2025. Our predicted revenue growth is a conservative estimate because there are multiple challenges, as outlined above.

Who is supplying private LTE/5G networks?

Traditional and specialist network equipment providers (NEPs), cloud providers, systems integrators and operators are all building propositions for private LTE/5G networks, meaning that customers have a broad choice of suppliers. However, no single supplier can deliver an entire solution; suppliers will need to partner with other players in the ecosystem to deliver their networks. The following categories of supplier are looking to take a key role in private LTE/5G network market.

- NEPs have been at the forefront of delivering private LTE/5G networks so far. They provide network infrastructure equipment such as small cells and the core network. The main challenge for these vendors is to scale down their solutions to meet enterprises’ requirements. Ericsson, Huawei and Nokia all provide network components for private LTE/5G networks. NEPs often work in partnership with their traditional mobile network operator (MNO) customers to deliver private LTE/5G networks, but may also serve the enterprise market directly. Nokia has taken this approach, for example.

- Challenger vendors such as Athonet and Mavenir are pioneering using cloud-based architecture to deliver private LTE/5G core networks. Their solutions are often designed for enterprises rather than large public mobile networks. The 5G RAN is a harder network domain to put in the cloud than the 5G mobile core. New initiatives such as Open RAN are expected to lower the barriers to entry for new vendors and operators, thereby making private LTE/5G networks more affordable.

- Public cloud providers such as AWS, Google and Microsoft are extending their edge networking solutions to support some components of private LTE/5G network deployment. Microsoft has taken this a step further and has acquired two challenger vendors, Affirmed Networks and Metaswitch, to extend its offer to the core network. Public cloud providers have established relationships with enterprises but will partner to deliver the radio access network and other components.

- MNOs are also developing private LTE/5G network propositions. AT&T, China Mobile, Deutsche Telekom, Orange, Telefónica, Verizon and Vodafone have all launched propositions, often aligned closely with their IoT and edge computing approaches. MNOs provide dedicated, on-premises networks, but are also exploring hybrid deployment models that use 'slices' of their public network assets.

- Systems integrators are well-placed to deliver private LTE/5G networks. They already work closely with enterprises and have the capabilities to integrate network infrastructure from different suppliers. They regard cellular technology as another network technology to add to their portfolio.

We also expect to see other players, such as neutral hosts and infrastructure owners, enter this market. For example, the tower company, Cellnex, has acquired the private network specialist, Edzcom, to address this opportunity.

1 Figure 1 shows two versions of the hybrid model; other variations are possible, but are not shown here.

Article (PDF)

DownloadIoT and next-generation networks research

IoT and M2M Services IoT Platforms and Technology Next-Generation Wireless NetworksAuthor