How to secure best value from public funds to improve digital infrastructure in local regions

The changing UK market for digital infrastructure

The UK has seen significant investment in its digital infrastructure over the past five years, led by the private sector, across assets such as fibre access networks and data centres (with over GBP17 billion committed to altnet FTTP players alone).1 This has led to FTTP coverage of households rising from <5% in 2018, to over 65% in April 2024,2 with many residential and business customers starting to realise the benefits of ultrafast, gigabit-capable connectivity.

While the private sector has led on most of this digital infrastructure ‘boom’, the public sector (and local authorities specifically) has had a role to play, via its enabling role in authorising wayleaves and permits, or through facilitating deployment using publicly funded investment. There has been a long history of local authority involvement in supporting public-sector investment in fixed networks across the UK, from rural programmes such as the Superfast Broadband Programme (2010–22), to more urban programmes like the Local Full Fibre Network programme (2017–21).3 While these programmes were all initiated by central government, local bodies played an important role in shaping their success at the local level. This is similar with the UK Government’s Project Gigabit (providing gigabit-capable connectivity to rural areas), but with the UK still seeing significant private-sector investment, is there a wider role for local authorities in the telecoms market?

The public-sector opportunity

Despite growing FTTP coverage across the UK, and the establishment of regional data centres, there are likely to be specific local problems to solve. Examples of these local problems include: anomalies in urban areas where there is poorer digital infrastructure than would otherwise be common in similar density areas (for example, uncovered business parks or housing estates), a lack of competition or service choice (for example, if there is no wholesale offer available), and changing requirements (for example, due to adjacent major infrastructure projects like HS2). Local authorities, with their unique knowledge of the local area and economy, are more likely to spot these potential problems, and are often well placed to help solve them.

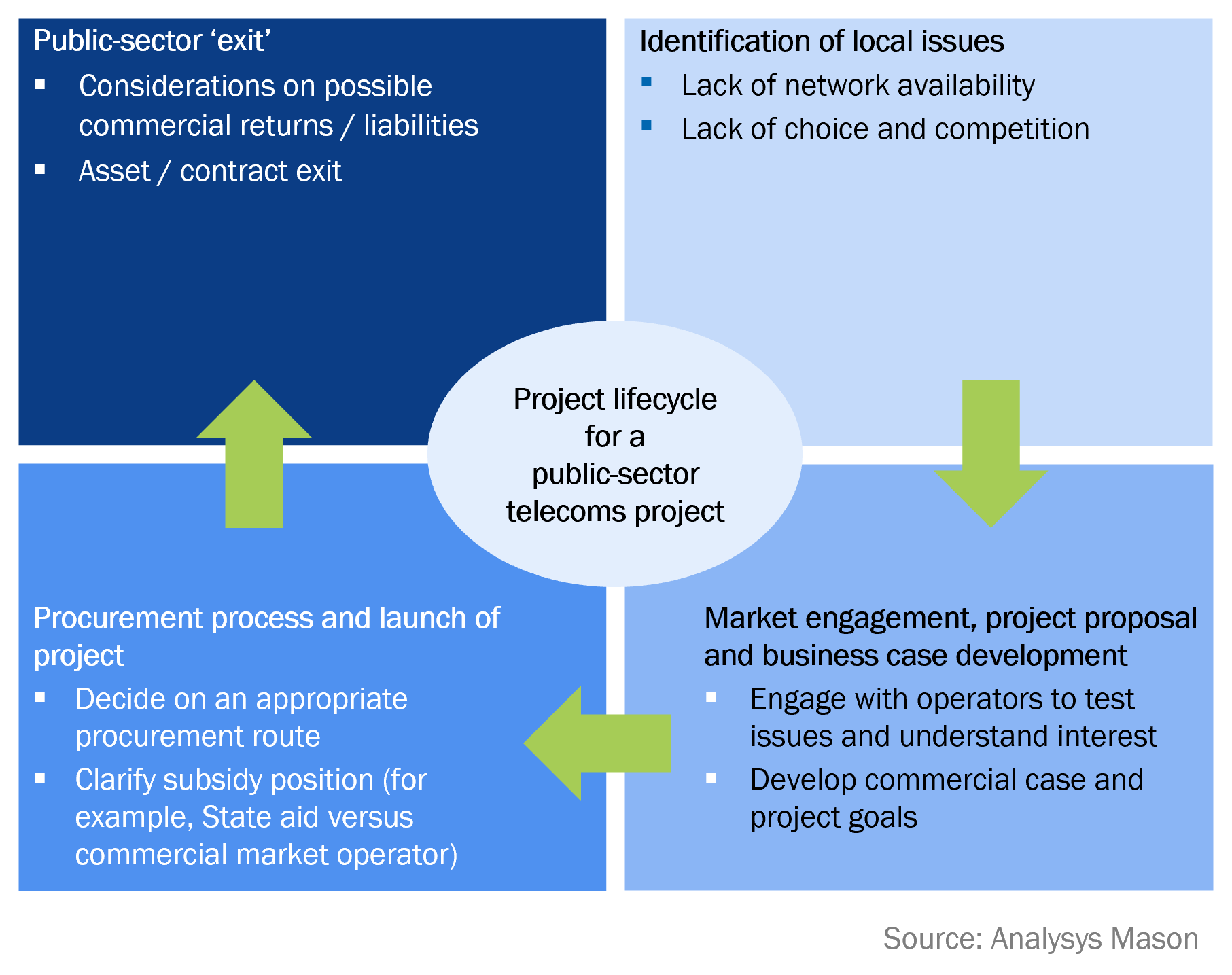

However, in most of these cases, the market situation is complex and it can be difficult to establish that there has been a market failure (i.e., there is no clear route by which State aid could be deployed). It is good practice for local authorities to look to collaborate with market operators and be prepared to invest (either directly or indirectly), while being conscious of the context of the local commercial market. To do this, authorities need to understand not only the local issues, but also the wider market developments and dynamics, as this is critical to ensuring successful engagement with operators. Market engagement is one of the key process steps that local authorities need to consider to run a successful telecoms project. Other key considerations for local authorities are shown in Figure 1, below.

The availability of widespread digital infrastructure can be an enabler for towns, cities and regions to improve opportunities and services for residents and businesses, and in our view, local authorities can play a role in helping to facilitate this, but it needs to be carefully considered.

Figure 1: Typical public-sector telecoms project lifecycle

A recent example of a local authority-led telecoms project is the Liverpool City Region Connect (LCR Connect) project. The Liverpool City Region Combined Authority (LCRCA) wished to stimulate private-sector investment and increase the availabilty of connectivity services across the whole city region. In February 2021, after engaging with the market and running an open procurement process, the LCRCA entered into a joint venture with ITS Technology Group and NGE to build the LCR Connect network, with a joint investment of GBP32 million. The wholesale fibre network of over 200km was formally launched in February 2024, with a solution available to potentially 28 000 businesses, and over 350 businesses have been connected so far.4

Public-sector organisations are not telecoms operators

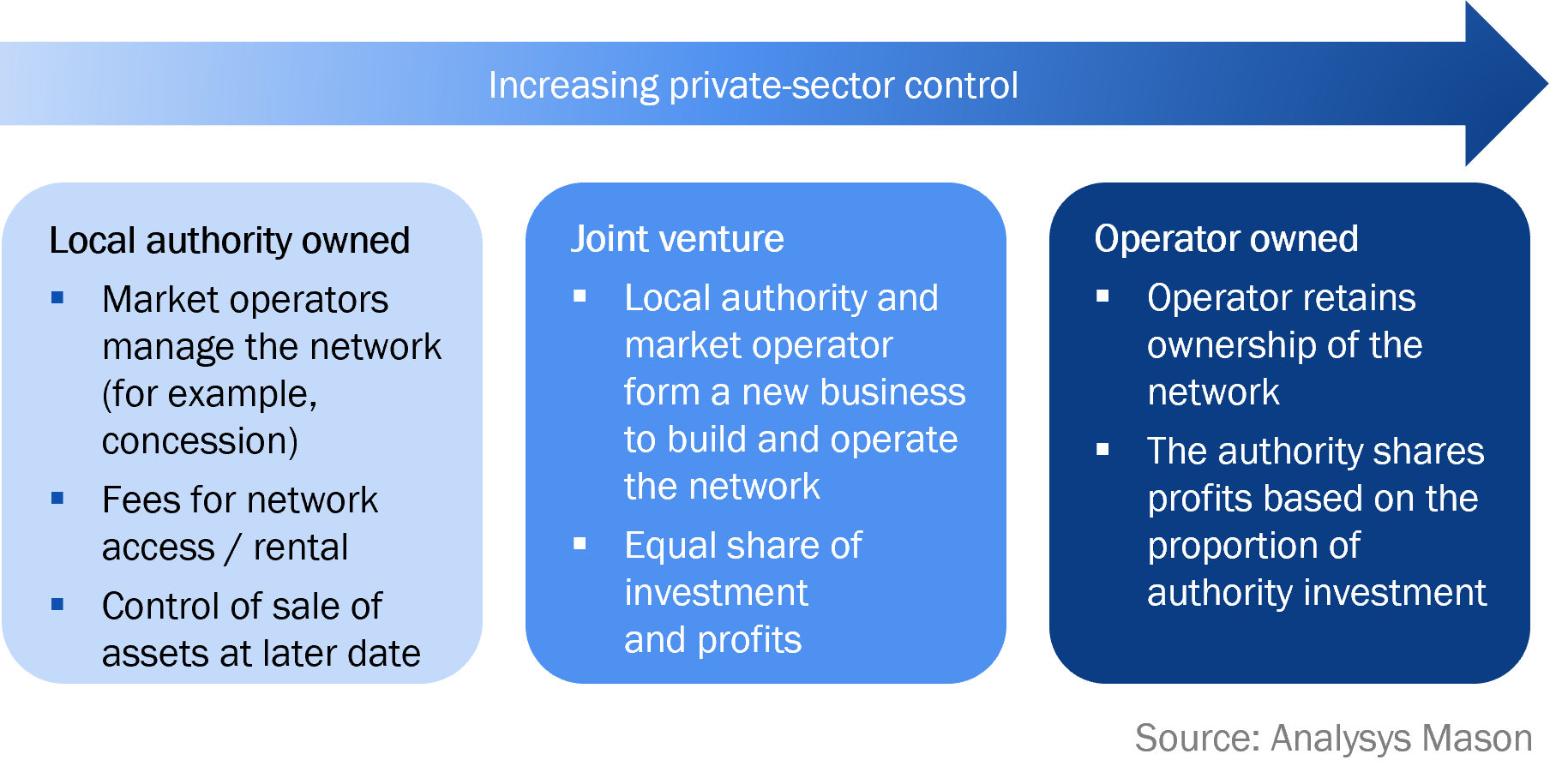

Local authority joint ventures or partnerships are unlikely to solve ‘scale problems’, but they are a possible route to fix local issues, as is the aim for LCR Connect and other similar schemes. However, local authorities need to be careful when participating in the telecoms market, as there are potential risks, which can differ based on the chosen commercial partnership model. Different project goals will require different commercial models – a summary of possible options is presented below.

Figure 2: Summary of potential commercial models

Even after solving the problem, local authorities need to consider, ahead of time, their options for ‘exiting’ the partnership. Private-sector investors typically invest in telecoms infrastructure expecting to make a return over a period of 15 years or more, and this needs to be considered in any arrangement to enable the local authority the flexibility to exit. This is more pressing where local authorities own assets, or are part of a joint venture, where understanding the potential value of those assets (and business) is critical, as infrastructure transactions can be complex.

How Analysys Mason can help

Analysys Mason is able to combine its telecoms knowledge, its private-sector experience and its understanding of investor perspectives (from supporting over 500 digital infrastructure transactions in the last five years) with its deep understanding of local authority issues to provide actionable support to public-sector digital infrastructure projects. We have recently supported local authorities and regional governments by:

- developing project business cases, from both the commercial and the ‘public sector’ positions

- carrying out market engagement exercises in and outside of procurement

- providing procurement support and advice

- conducting valuation of public-sector network assets and associated commercial business.

For further information, please contact Ian Adkins (Partner) and Oliver Loveless (Principal).

1 Financial Times, March 2023.

2 According to the industry tracking website, thinkbroadband.

3 A UK Government-funded programme that allowed councils to bid for funding, with an aim to aggregate public-sector demand, or reuse public-sector assets to help stimulate commercial investment.

4 ITS Technology Group operates the wholesale network and offers services to business-focused internet service providers (ISPs), which then serve the local market. (https://www.liverpoolcityregion-ca.gov.uk/news/liverpool-city-region-one-step-closer-to-becoming-the-most-digitally-connected-area-in-the-uk-as-lcr-connect-network-goes-live).

Article (PDF)

DownloadAuthors

Ian Adkins

Partner, expert in broadband and digital infrastructure

Oliver Loveless

Principal, expert in broadband interventionRelated items

Project experience

Enhancing Microsoft’s product and marketing strategy and strengthening its position as a thought leader in the SMB segment

Project experience

Using segmentation and insights from digital-native businesses to inform a global networking vendor’s sales and marketing strategy in Asia–Pacific

Project experience

Transforming a global financial management software vendor’s go-to-market strategy through advanced customer segmentation