Technical due diligence: the growing imperative before investing in new-age businesses

There have been various instances of fraudulent activities/claims relating to new-age companies across verticals including news and entertainment, social media, and over the top (OTT), where metrics were manipulated to portray an inflated user base, user engagement, monetization ability, and technical capabilities of their platforms in order to drive higher valuations of the companies and mislead investors. This highlights an urgent need to conduct detailed technical diligence of companies in these domains prior to decisions being made about investment.

At Analysys Mason, we have helped several investors avoid such pitfalls by conducting technical due diligence that involves the forensics of raw server data and code-level assessment of product and infrastructural capabilities to identify any fraudulent activities or unusual/suspicious trends.

What is a technical due diligence and why is it worth doing?

Over the past couple of years there have been various instances of fraudulent activities where companies across verticals such as news and entertainment, social media, and OTT among others have manipulated metrics to portray an inflated user base, user engagement, monetization ability, and technical capabilities. Such practices are being used to drive higher valuations of these companies and mislead investors. This indicates a critical need for technical due diligence (along with commercial, financial and legal due diligence) while assessing such companies or tracking portfolio progress.

These fraudulent practices are not limited to the initial funding stages of new-age companies but often occur during the higher-ticket-sized growth deals; some of the largest global PE/VC funds have also been victims of such practices within India and globally. Several well-known Indian and global names have allegedly deployed such malpractices to manipulate their scale and growth story.

Technical due diligence can be used to delve into the authenticity and growth patterns of user base (daily active users (DAUs)/monthly active users (MAUs)), scrutinize user engagement and usage behaviour (number of sessions, session duration, etc.), and assess product and infrastructure technological capabilities, among other areas. These factors not only safeguard investors against potential pitfalls but also contribute to a comprehensive understanding of a company’s business proposition.

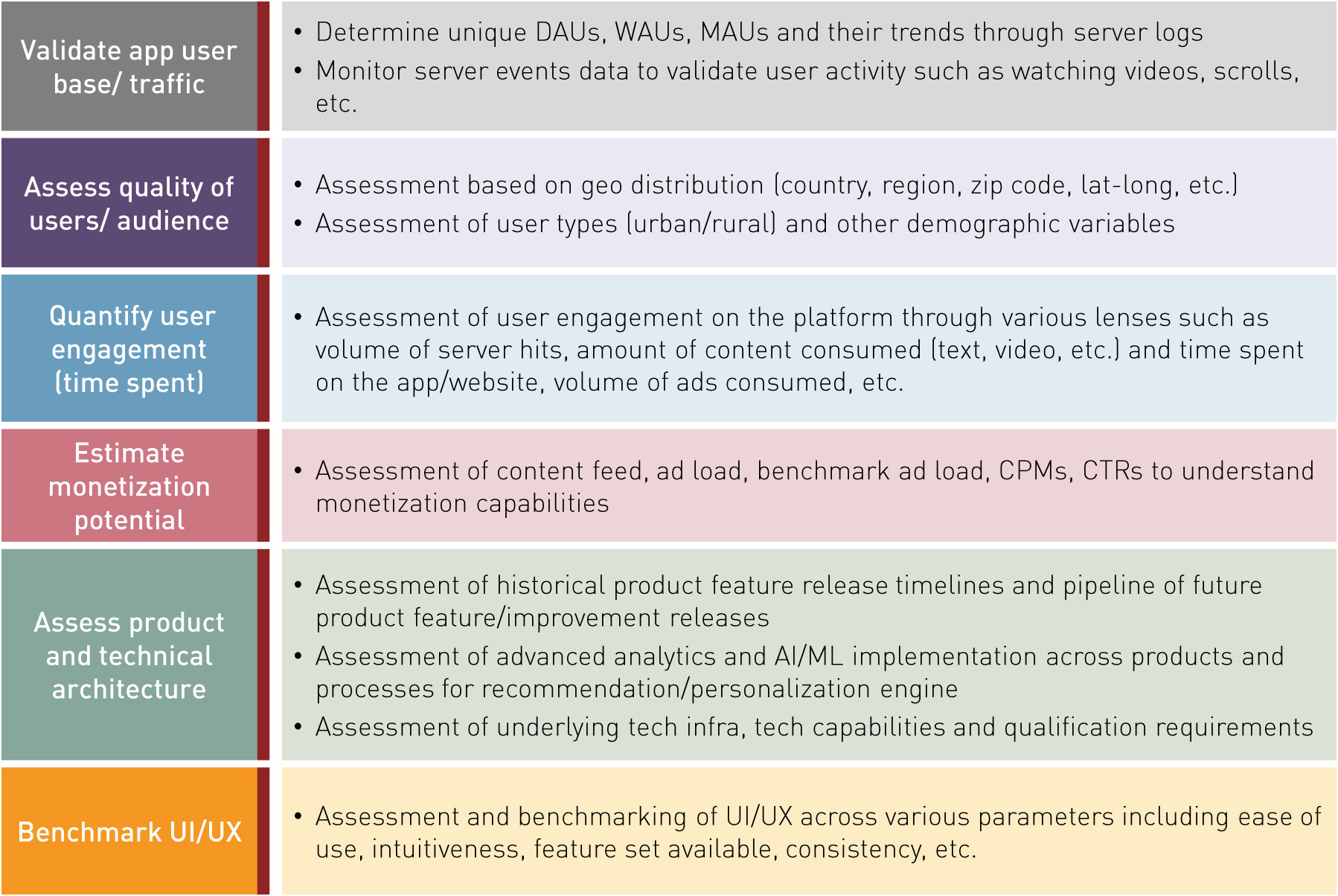

We have developed our own proprietary tools and processes to conduct technical due diligence of assets that involve forensics of raw server data (such as app activity logs) and code-level assessment of product and infrastructural capabilities to help investors identify any fraudulent activities or unusual/suspicious trends. We highlight a few examples of the key elements of analysis we typically conduct in a technical due diligence:

Investors are often misled by companies trying to drive higher valuations; technical due diligence is a must before investing in new-age businesses

Over the past couple of years there have been various instances where companies across verticals such as news and entertainment, social media, and OTT, among others, have manipulated metrics to portray an inflated user base, user engagement, monetization ability, and technical capabilities.

Such practices are being used to drive higher valuations of these companies and mislead investors. This indicates a critical need for technical due diligence while assessing such companies or tracking portfolio progress.

Technical due diligence can be used to delve into the authenticity and growth patterns of the user base (daily active users (DAUs)/monthly active users (MAUs)), scrutinize user engagement and usage behaviour (number of sessions, session duration, etc.), and assess product and infrastructure technological capabilities, among other areas.

Analysys Mason recently conducted the technical due diligence of a leading South Asian news and entertainment app for a global PE investor

We accessed and queried the Target’s raw user-activity logs and conducted numerous sanity checks to verify the legitimacy of its user base and user engagement.

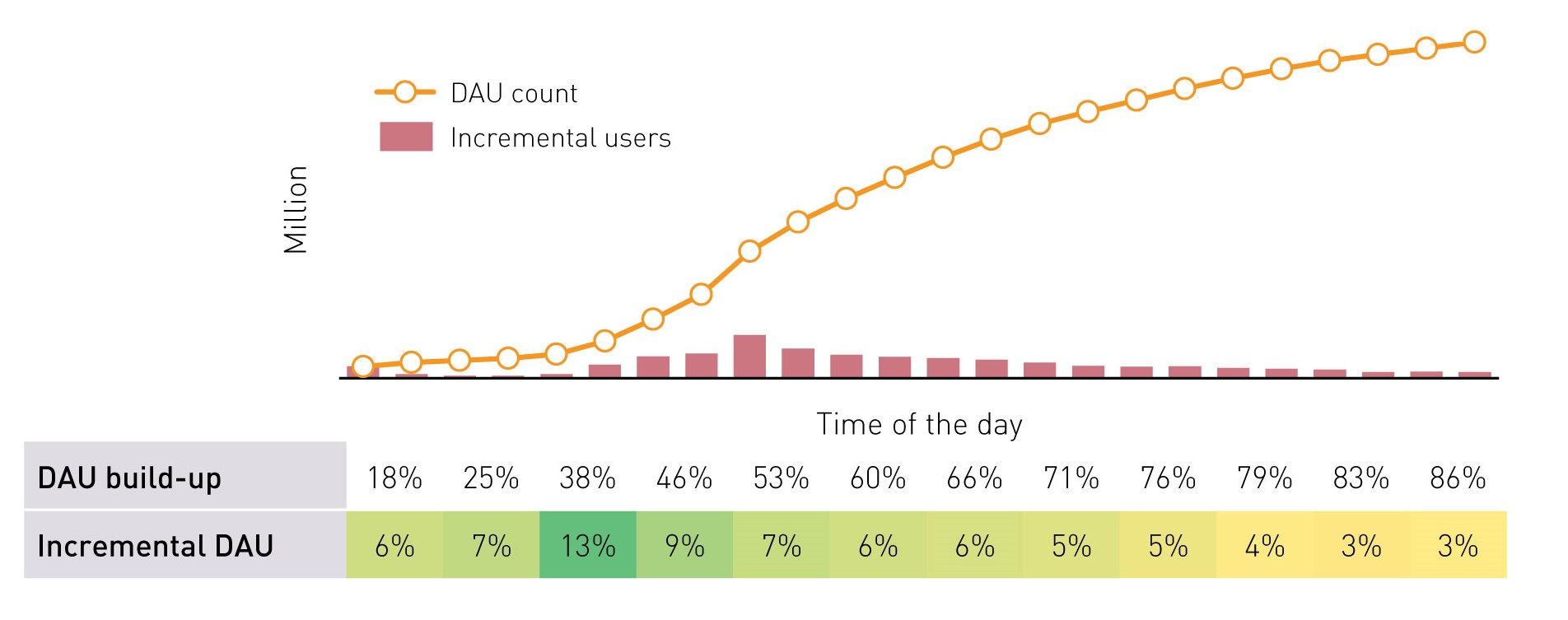

In the context of our analysis of the news and entertainment platform, it was observed that the number of concurrent active users pick up during the morning hours (6:00–10:00), which was in line with real-world news readers’ behaviour.

In the context of our analysis of the news and entertainment platform, it was observed that the number of concurrent active users pick up during the morning hours (6:00–10:00), which was in line with real-world news readers’ behaviour.

Another method that was leveraged to validate the user base of the platform was to analyse the user base distribution across aspects like geography, OEM, etc. We observed that the top 15 urban cities formed ~65% of the user base, and was aligned with India’s internet user distribution. Similarly, Samsung and Xiaomi were the leading OEMs amongst the user base, which was in line with smartphone market shares in India.

To download the full newsletter, click here.

Authors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)

Ashwinder Sethi

Partner