Impact of taxation on social media in Africa

The Internet has had significant economic impacts, as an increasing amount of activity moves online. Like every other economic activity, taxation is an area that has been affected by the Internet and the move to a digital economy. In response, there is a recent trend towards taxation of over-the-top (OTT) services and social media, notably in sub-Saharan Africa (SSA), given the growth in size and popularity of the services. In this paper, we examine the impact of taxation on social media in five countries in SSA: Benin, Cameroon, Kenya, Uganda and Zambia.

The Internet has had significant economic impacts, as an increasing amount of activity moves online. Like every other economic activity, taxation is an area that has been affected by the Internet and the move to a digital economy. In response, there is a recent trend towards taxation of over-the-top (OTT) services and social media, notably in sub-Saharan Africa (SSA), given the growth in size and popularity of the services. In this paper, we examine the impact of taxation on social media in five countries in SSA: Benin, Cameroon, Kenya, Uganda and Zambia.

Each of the countries has a digital development plan to increase Internet adoption, with a broader objective of improving ICT as a source of economic growth. We show how the proposed or already-imposed social media taxes are likely to run counter to the identified need to generate more locally relevant content to increase demand for Internet. Social media is a significant source of relevant local content, allowing access to family, friends, businesses, and government.

Taxation is of course a well-recognised and long-standing necessity for every government. However, how taxes are structured, imposed and levied is critical. We show that the social media taxes considered fall short of internationally accepted digital taxation principles. This is particularly true as social media is typically free for users, and a tax imposes challenges both in terms of significantly distorting demand and in terms of tax collection.

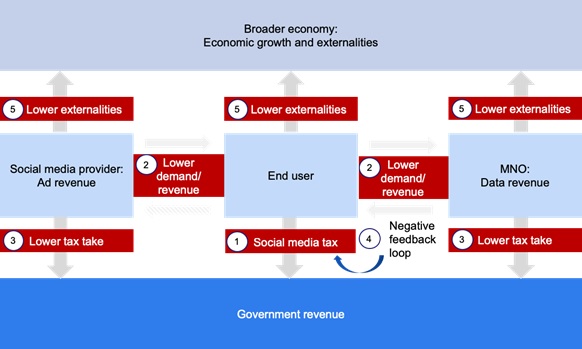

Imposing a tax on a free service can thus have a big impact, as shown in Figure 1 below.

Figure 1: Impact of taxation on social media [Source: Analysys Mason, 2019]

- Since no revenue was gathered from users before, the provider will have to develop a means of charging, or pass the responsibility to a third party, such as the mobile network operator (MNO).

- This will potentially have a significant impact on demand, beyond what one might expect from a small price increase, because there is a step jump in demand between a free service and charging for a service.

- This in turn will lower revenue and taxes. For instance, according to the Uganda Communications Commission (UCC), the number of Internet users declined by 15.7% in the first three months after the social media tax was implemented in July 2018, alongside lower usage of social media. This negatively affects tax revenue from services that are supported by social media, such as sales of data or advertising (which are already taxed via corporate taxation).1

- The lower usage of social media will also lower the returns from the social media tax. The UCC showed a 29.1% decrease in OTT tax revenue in the three months following the implementation of the tax.2

- Finally, the lower usage of the Internet and social media will lower the economic benefits of Internet access.

Based on our assessment of the social media taxes proposed or already imposed in the five countries under consideration, the tax legislation can be expected to have predominately negative implications on all market stakeholders directly or through spill-over effects and externalities. Instead, we outline potential next steps towards a more detailed, longer-term study on social media taxation, to assist governments in balancing their need for revenue with the needs of developing the ICT sector in their countries.

The full report is available to download here.

This report was commissioned and sponsored by Facebook, and researched and prepared independently by Analysys Mason, a global consultancy specialising in telecoms, media and technology. The analysis contained in this document is the sole responsibility of Analysys Mason and does not necessarily reflect the views of Facebook or other contributors to the research.

1 Source: RIS (2019), OTT tax causes massive decline in estimated internet users in Uganda. Available at: https://researchictsolutions.com/home/ott-tax-causes-massive-decline-in-internet-subscriptions-in-uganda/?fbclid=IwAR0g1-LGuZQUOMxuLkv7g%E2%80%A6. See also Box Error! Reference source not found. for more details.

2 Ibid

Download report

The report examines the impact of taxation on social media in five countries in SSA: Benin, Cameroon, Kenya, Uganda and Zambia.

Download your free copyAuthors

David Abecassis

Managing Partner, expert in strategy, regulation and policy