Operators must leverage multiple applications to maximise a first-mover strategy in 5G mmWave

Millimetre wave (mmWave) spectrum, which is above 24GHz for 5G, continues to be allocated for 5G radio access in many countries. For instance, Spain auctioned 26GHz spectrum in December 2022. At Mobile World Congress 2023, Telefónica, Ericsson and Qualcomm demonstrated a mmWave commercial network using the freshly acquired spectrum. However, despite its increasing availability and some early commercialisation, there remain many conflicting perspectives around the economic viability of mmWave and its benefit to 5G.

mmWave spectrum offers high capacity and low cost per MHz/pop, but faces severe propagation challenges

Compared with mid-band and low-band alternatives, mmWave spectrum can offer a range of benefits for mobile network operators (MNOs), including relative abundance, high bandwidth and low cost per MHz. The typical Mbit/s/m2 capacity of mmWave can reach over four times that of mid-band, although the figure depends on the amount of spectrum used in each band and the infrastructure deployed. Its typical cost per MHz/pop can be as much as fifty times less than that of mid-band, making it a potentially cost-effective solution to increase network capacity.

On the other hand, mmWave also faces many challenges when compared to mid-band spectrum. Primarily, these relate to propagation, user equipment (UE) availability and the difficulty of charging more for quality of experience (QoE) improvements. In terms of propagation, mmWave’s line of sight (LOS) range is typically less than half of that of mid-band alternatives. Its high absorption also means it struggles to penetrate buildings and can be impacted significantly by foliage and atmospheric changes. This drastically increases the amount of infrastructure investment needed for coverage scenarios when compared with mid-band.

Even if traffic density is high enough to require mmWave’s additional capacity, the relatively low penetration of compatible devices, and the difficulty in monetising the improved service performance it brings, present further challenges for MNOs. Combined, these factors have created difficulties for operators in justifying the business case for mmWave in the public mobile network, especially at this early stage.

Mid-band improvements limit mmWave’s near-term value, but some operators want to adopt a first-mover strategy

Due to its inherent challenges, the commercialisation of mmWave in the macro network has been limited over recent years. There have been positive case studies, such as the roll-out of over 30 000 mmWave base stations across urban locations in Japan, or Verizon’s deployments in the USA. However, examples of significant deployments have been relatively sparse and inconsistent. In South Korea, mmWave licences were recalled when operators failed to meet roll-out deadlines, demonstrating that MNOs, even in nations with some of the highest mobile traffic, have had difficulty in justifying the business case for mmWave.

MNOs have instead focused recent investments on mid-band spectrum, and many feel this is sufficient for most current high-capacity public network scenarios. Since the initial roll-outs of 5G, innovation in massive MIMO antennas, gallium nitride (GaN) processors and carrier aggregation have significantly improved the capacity that MNOs can achieve with mid-band assets. This has reduced the need for an additional high-band capacity layer in macro networks, and while there remains potential value for mmWave in public networks in the long-term, its viability point has shifted, both in terms of capacity and timescale.

Despite its current challenges, mmWave is expected to become more valuable in the long term, as network traffic continues to climb, advanced 5G use cases mature and end-user devices become more available. At the same time, emerging technologies such as integrated access and backhaul (IAB), smart repeaters and reconfigurable/intelligent surfaces (RIS) are expected to continue improving its propagation characteristics. However, these are long-term factors which will take time to evolve.

For many MNOs, the current opportunity for mmWave, in public networks alone, will not justify early investment in the spectrum. Therefore, MNOs that want to be early adopters should turn to other applications/use cases for mmWave in the medium term, to maximise the business case for an early investor strategy.

Operators targeting early mmWave investment should develop a roadmap which considers application suitability and timescale

To maximise the business case for early investment in mmWave, operators should consider developing a multi-application roadmap which prioritises core use cases and their suitability to the spectrum. Operators that can leverage all applications effectively within their markets will have the strongest business case, although there may be regional and operator-specific factors which impact this.

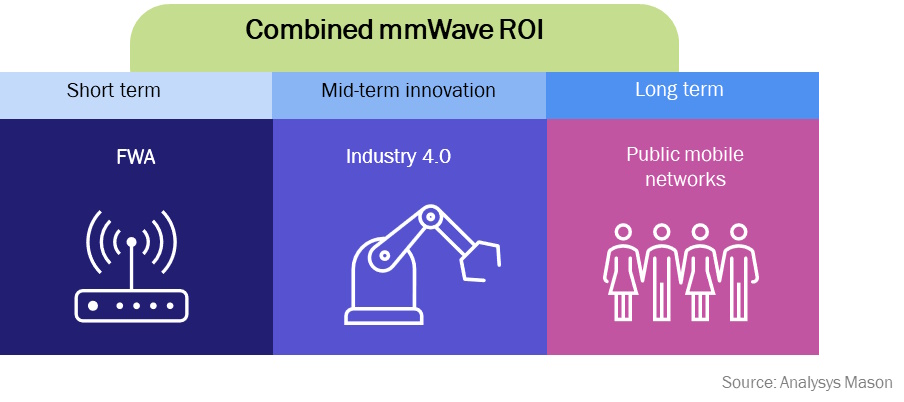

Figure 1: The multi-application roadmap for mmWave

Fixed–wireless access (FWA) offers the most immediate opportunity for mmWave implementation and innovation. Unlike in mobile broadband (MBB) applications, FWA transceivers are in fixed locations, meaning signals can be amplified and more effectively targeted. This reduces the impact of mmWave’s LOS and coverage issues, with FWA tests demonstrating over 1Gbit/s download speeds over distances of over 10km. FWA has other advantages, such as its use of customer premise equipment (CPE) so there is no reliance on support from handset makers. There is also a clear monetisation opportunity based on performance gains where there is demand for premium services.

Operators hoping to invest in mmWave should also consider enterprise and private networks, as they are high growth markets that can often require significant network capacity within a limited geographical area. As use cases mature, mmWave will allow some operators to provide a premium service offering to enterprises. This can be effectively monetised based on the individual enterprise’s requirements. Although there is still some time before use cases mature, operators should see enterprise as a key mid-term opportunity to support the business case for mmWave.

Lastly, mmWave should be considered as a long-term asset for public mobile networks, even if these do not, alone, justify the immediate investment in licences. To ensure the best return on investment (ROI) for a national or regional licence, all three applications – FWA, enterprise/private and public networks – should be leveraged. In addition to maximising revenue and ROI, this multi-application strategy will also drive cost savings through infrastructure reuse and allow operators to build the business case for early innovation in mmWave.

For more information, please see Analysys Mason’s recent report covering 5G mmWave.

Article (PDF)

DownloadAuthor