A re-think on ESG for the space sector

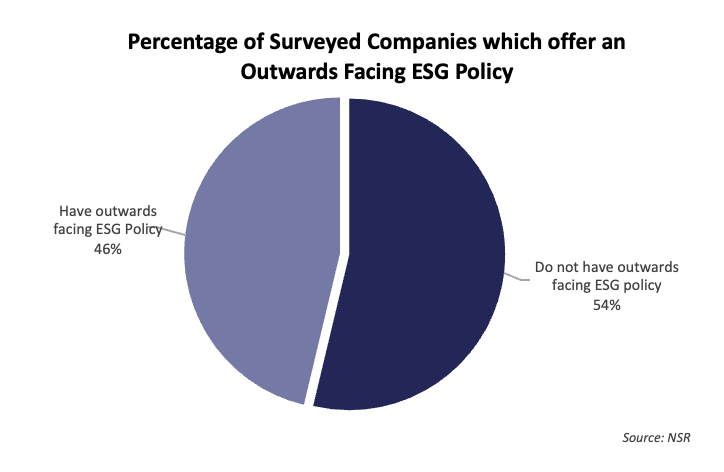

Talk of ESG seems to be everywhere from increasing regulatory requirements, stakeholder interest, to social pressures. However, not everyone is on board the ESG train. In NSR’s Space ESG Assessment (Jan, 2023) only 46% of surveyed entities currently offer an outward facing ESG policy. With more than half of the surveyed space companies lacking an outward facing ESG strategy – who is involved, and why should the others reconsider?

While the benefits for a comprehensive ESG strategy are increasing - be it aiding in a softer transition into new regulations, attracting talent, or winning business from ESG-focused clients – there are still companies not fully onboard with an ESG position. Clearly, the potential negative impacts to companies associated with poor ESG engagement could be high and unwanted so why wouldn’t ESG be on your radar?

Who Isn’t Involved in Space ESG Strategies?

Space ESG Strategies are for the “Big Companies”

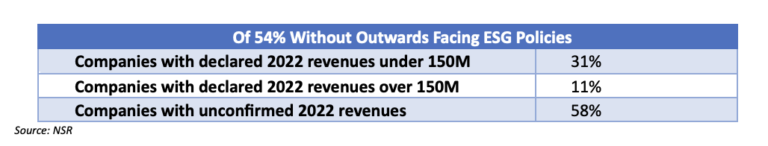

Within NSR's surveyed companies, those without an ESG policy tend to be private and smaller (by revenue size) than ESG engaged companies.

ESG engagement costs can be challenging. Start-up cash must be carefully targeted to core needs, and the near-term ‘returns on ESG’ are at-best murky. With much of the media ESG focus sitting solely in environmental activity (E), i.e. the expensive goals, attainable lower cost social (S) and governance (G) goals can be forgotten.

ESG strategies can scale across revenue status through a diverse focus on E, S, and G metrics.

My Product is an “ESG Objective”

Business ESG related activity may also be a contributing factor. It is easy to dismiss assessing company ESG needs when output already contributes to "ESG goals" such as within space sustainability work. This does not mean that regulatory needs have been addressed, the requirements do still stand for companies meeting regulatory standards.

Simply, meeting someone else’s ESG requirements does not mean your company has an ESG Strategy.

No Clear Stakeholder Requirements

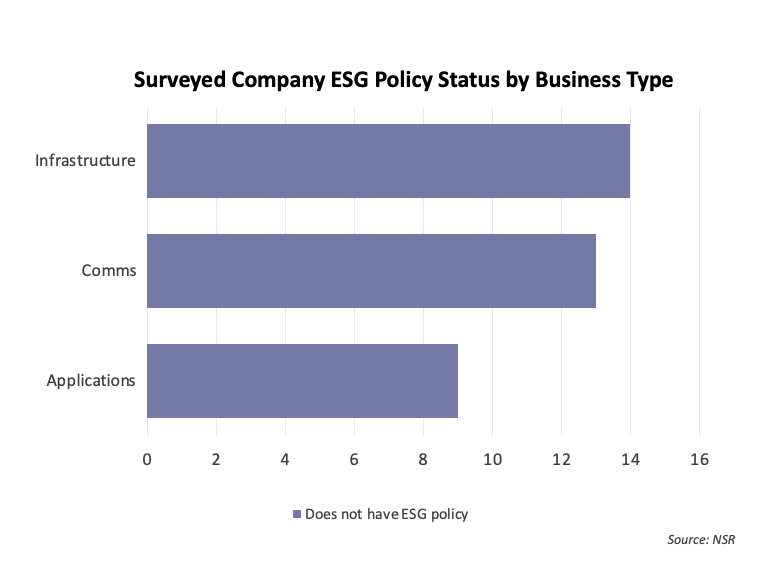

When looking at engagement and business type (communications, infrastructure or applications focused)- Space & Satellite Applications entities are least likely to engage in ESG policy development. This may relate to the innate number of downstream stakeholders these company types tend to have. Stakeholders are the driving force for company ESG involvement. Lower numbers of stakeholders can decrease the motivation to engage.

Note: Regional location of company head offices had no notable impact on company engagement or lack thereof within this group.

An ESG Re-Think for Space Players:

Industry Action Can Avoid (costly and unfavorable) Regulation

Companies must distinguish between ESG activity and being active in ESG before regulations such as the upcoming EU Corporate Sustainability Reporting Directive (CSRD) force their hand. Many who actively promote the ESG impacts of their business do not offer an outward facing ESG policy of their own. Business activity alone will not address regulatory requirements and many within the Space & Satellite industry will find themselves facing-down CSRD or similar standards soon.

In macro-market conversations such as space sustainability, interested stakeholders are asking questions and established players such as Viasat and SES are actively working to address this. They are making waves in the media campaigning for stronger standards, regulations and practices within the industry to protect space sustainability. Such actions not only showcase company ESG strengths for stakeholders but also aid in shaping what standards could look like in the long-term, potentially to company advantage. Current actions do and will serve to enhance opportunity potential going forward.

Already commercial plans, such as the recently announced SES and NorthStar Earth & Space’s SSA services implementation collaboration, are being built on the backs of past sustainability agreements. This type of industry action is key to getting ahead of any regulatory frameworks, and ensuring if/when regulations do start that industry has a series of best practices to work against.

Stakeholders are Not Only Shareholders

While smaller companies may consider ESG as a requirement only when they have stockholders to answer to, there are more than stockholders in your stakeholders. From investors through to customers, in markets such as the terrestrial cell tower markets our colleagues at Analysys Mason found ESG activity offers the best impact for companies when optimized to specific stakeholder needs and can offer significant opportunities to aid positive engagement with potential partners such as interested nation-states. As the lines blur between terrestrial and space technologies, ESG standards and practices from terrestrial sectors will find their way to space as well.

Sustainability discussions are continuing to develop through governments globally. Messaging is clear from organizations such as the UK Space Agency during the recent Secure World Foundation, Space Sustainability Summit- ESG is now a priority and opportunity is growing.

ESG is also beneficial in its ability to draw both financial and human capital investment. Space Companies with positive ESG impact are noted as increasingly attractive prospects to potential staff as businesses battle for high skills employees. Furthermore, it can be of use in representing companies well in funding rounds, as demonstrated by the recent success of ESG associated Satellite start-ups such as Vyoma and Airmo. In a tighter environment for funding, ESG approaches can provide a key differentiation for cash-hungry space start-ups.

Planning Key to Unlocking the Returns on ESG Strategies

Short-term planning can decrease long-term needs for space players when it comes to unlocking the upside of an ESG strategy. Activity in this area is continuing to gain new interest with countries such as Brazil, Japan and South Africa who are pushing forward new regulatory action plans to promote and support ESG development within their borders.

At the same time, significant economies such as the United States, European Union, and China are working towards developing space-based infrastructure to measure and monitor greenhouse gases. The foundations are being laid, ESG standardization is on its way. Companies can benefit from planning towards meeting these requirements. Starting early allows you to build to future needs and developments such as India’s upcoming ESG disclosure mandate instead of restructuring later, most likely at an additional cost.

At contract level, governments are increasingly requiring companies to demonstrate how they address ESG goals, as seen recently with the EU’s IRIS2 sustainability contract requirements. Smaller companies looking to join consortia should prepare to address this. Terrestrial activity, which generally offers a solid preview of coming attractions in the Space & Satellite sector now sees upwards of 15% of RFP award scoring linked back to ESG criteria. Being prepared to provide a strong showing here will improve the odds of bidding success.

ESG engagement will cost, however with long-term planning the benefits from an ESG strategy could be vast.

The Bottom Line

With less than half of surveyed companies currently offering an outward-facing ESG policy, significant activity will be needed across the Space & Satellite sector. Structured long-term planning will be key if Space players want to participate in the ESG conversation.

Space sector players should:

- Build a strategy to address all stakeholder interests. For players in the UK, partners such as the UK Space Agency should be aware of your ESG objectives.

- Identify regulations which may impact your goals. SES and Northstar announcement around SSA data is only one example of being proactive in having a proactive ESG strategy.

- Communicate the outcome of your work. The inclusion of ESG in IRIS2 contract demonstrates there is money on the line, now.

Bottom Line, an “ESG rethink” can aid in decreasing ESG regulatory pressure, boost financial gains and improve stakeholder engagement. However, this must happen soon as engagement takes time and those unprepared will miss out.

Author

Sarah Halpin

Analyst, space and satellite, expert in government and military spaceRelated items

Forecast report

Consumer and enterprise broadband via satellite: trends and forecasts 2023–2033

Report

Satellite operators’ financial KPIs 2024

Strategy report

Earth observation emerging sensors: strategies for satellite operators