Few operators meet the current demand for supporting their business customers’ ESG goals

Listen to or download the associated podcast

Environmental, social and governance (ESG) considerations have become increasingly important for businesses recently and have become a major component of the request for proposal (RFP) scorecard. However, a few operators have yet to employ effective strategies to support businesses with their ESG goals and risk losing out to operators with more developed plans.

Some larger enterprises will want more quantitative support for their ESG goals, and operators should look at offering carbon monitoring services. Operators that do, position themselves well and may be able to secure future revenue growth with ESG value-added services.

This article is based on Analysys Mason’s Operator approaches for supporting business customers with their ESG goals: case studies and analysis.

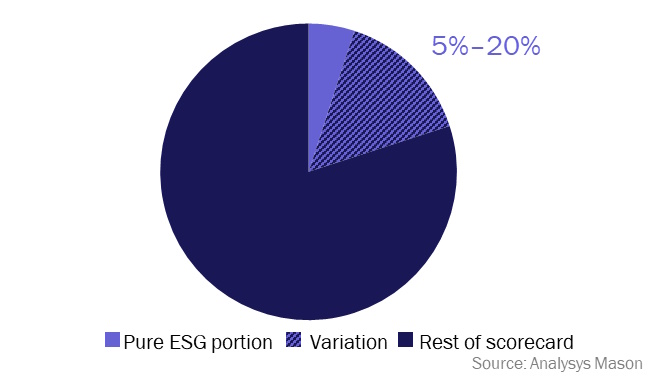

Enterprises are seeking more support with their ESG goals, with ESG typically accounting for 5–20% of RFP scorecards

The importance of ESG has increased dramatically in recent years. Regulatory and investor pressure has led large businesses (especially multi-national and public sector businesses) to develop ESG strategies and targets.1 Most often these strategies are focused on the sustainability aspects of ESG, such as increased renewable energy usage and carbon footprint reduction, though diversity goals are also important in some markets, notably the USA. As such, businesses are increasingly asking for more support with their ESG goals from their suppliers, including telecoms operators.

Analysys Mason’s conversations with operators on this topic highlight that ESG criteria now accounts for a significant share of RFP scorecards. The exact portion varies with geography and industry vertical, but on average it is around 5–20% (Figure 1). One operator commented that virtually every enterprise includes ESG criteria in their RFPs in some form. Our surveys indicate that ESG credentials also influence supplier choice for smaller businesses. Operators will need to be able to deal with this demand effectively and efficiently to not lose out on business.

Figure 1: Typical contribution of ESG to an enterprise RFP scorecard

Almost all operators have developed their own ESG strategies and provide detailed reporting on their progress, often around the sustainability aspects of ESG. Additionally, they work with external providers (for example CDP or EcoVadis) to achieve accreditations that provide valuable marketing collateral. However, their strategies to directly support their enterprise customers with their own ESG goals are at a much earlier stage of development.

Operators should be doing more to implement strategies to support business customers with their ESG goals

Despite the increased importance of ESG in supplier selection, and operators having their own internal ESG goals and teams, few have yet developed effective strategies to support their business customers with their ESG goals. This includes how they respond to ESG portions of RFPs and any solutions they have around the carbon monitoring of network usage.

One of the more advanced operators in this space, Orange Business, has implemented approaches to enable it to effectively and efficiently respond to ESG criteria in RFPs. First, it organised all of its ESG collateral into a central repository so it is easily accessible to all areas of the business, including the pre-sales teams. Additionally, it has embedded a small team within pre-sales that are ESG ‘champions’ to help respond to more difficult questions relating to ESG. Orange stated it aims to use this strategy as a differentiator against operators that are slower to integrate ESG into aspects of its business offerings.

Another strategy operators should take is to highlight more clearly the carbon emissions savings or emissions avoidance that businesses can benefit from when adopting new IT or telecoms solutions. Vodafone is one operator that is making a large play on this strategy, especially for its IoT solutions. For example, it highlights how its connected fleet solutions can help reduce fuel consumption. Strong ESG-focused marketing of existing solutions can help improve the perception of operators by businesses which can act as a differentiator in the space.

The advantages of enacting these strategies are clear – they enable operators to respond to growing ESG portions of RFPs and improve their businesses’ perceptions of them, more easily. However, operators will need to continue to develop their response as requirements by businesses change due to changing regulation.

Offering carbon monitoring solutions can allow operators to differentiate more in the large enterprise space

Some verticals, such as oil and gas or banking and financial, often come under more scrutiny for their ESG practices or are more affected by regulation, especially for large multi-national companies in these verticals. These industries may require more quantitative answers, for which operators can then help supply carbon monitoring tools.

BT and Orange Business have both launched solutions (or have solutions in development) that enable business customers to view the carbon impact of solutions they take from them. BT’s Carbon Network Dashboard provides users with real-time carbon footprint data of network and end-user devices. Enterprises that wish to understand and measure the carbon impact of their networks will find this useful, especially as the data can be exported to businesses’ own internal platforms using APIs. Orange Business is planning to launch a similar service. Both operators are initially including a restricted set of vendors and services within their tools but plan to extend this over time.

While demand for these types of services will mostly be limited to certain verticals and large multi-national corporations (MNCs), they can act as key differentiators for the large enterprise space, especially in the future. The development costs for these solutions may not be viable for smaller operators, but some may be able to partner with specialist providers to offer similar solutions.

If operators can position themselves with strong credentials in the ESG space they may also have the opportunity to develop value-added ESG-related services, such as ESG consulting or providing connectivity for sustainability projects outside of operators’ specialties, such as building decarbonisation. This could be an area to deliver future revenue growth as demand for ESG support increases.

For more articles on the topic of sustainability, see our dedicated sustainability page.

1 For more information see New ESG reporting requirements impact all EU companies.

Article (PDF)

DownloadAuthor