Asia–Pacific telecoms market update 1Q 2024: 5G is spreading rapidly in India

02 July 2024 | Research

Article | PDF (4 pages) | Developed Asia–Pacific Metrics and Forecasts| Emerging Asia–Pacific Metrics and Forecasts

This article highlights major telecoms market developments in Asia–Pacific (APAC), and includes data from Analysys Mason’s 1Q 2024 update. The full dataset is available in Analysys Mason’s DataHub.

Recent telecoms market developments in APAC include:

- NBN co’s increased investments in infrastructure to expand FTTP coverage in Australia

- the rapid deployment of 5G networks by Indian mobile network operators (MNOs) since the technology’s launch in 4Q 2022

- an ongoing SIM registration scheme in Thailand

- rumoured mergers in Sri Lanka and Indonesia.

Quarterly net additions of FTTP connections in Australia have more than doubled since 1Q 2023

Fixed network operator, NBN co, has accelerated the build-out of its fibre network in the past 2 years to address the strong demand for gigabit-capable broadband. Analysys Mason’s latest data shows that NBN co’s investment has resulted in an increase in the pace of migration to FTTP (Figure 1).

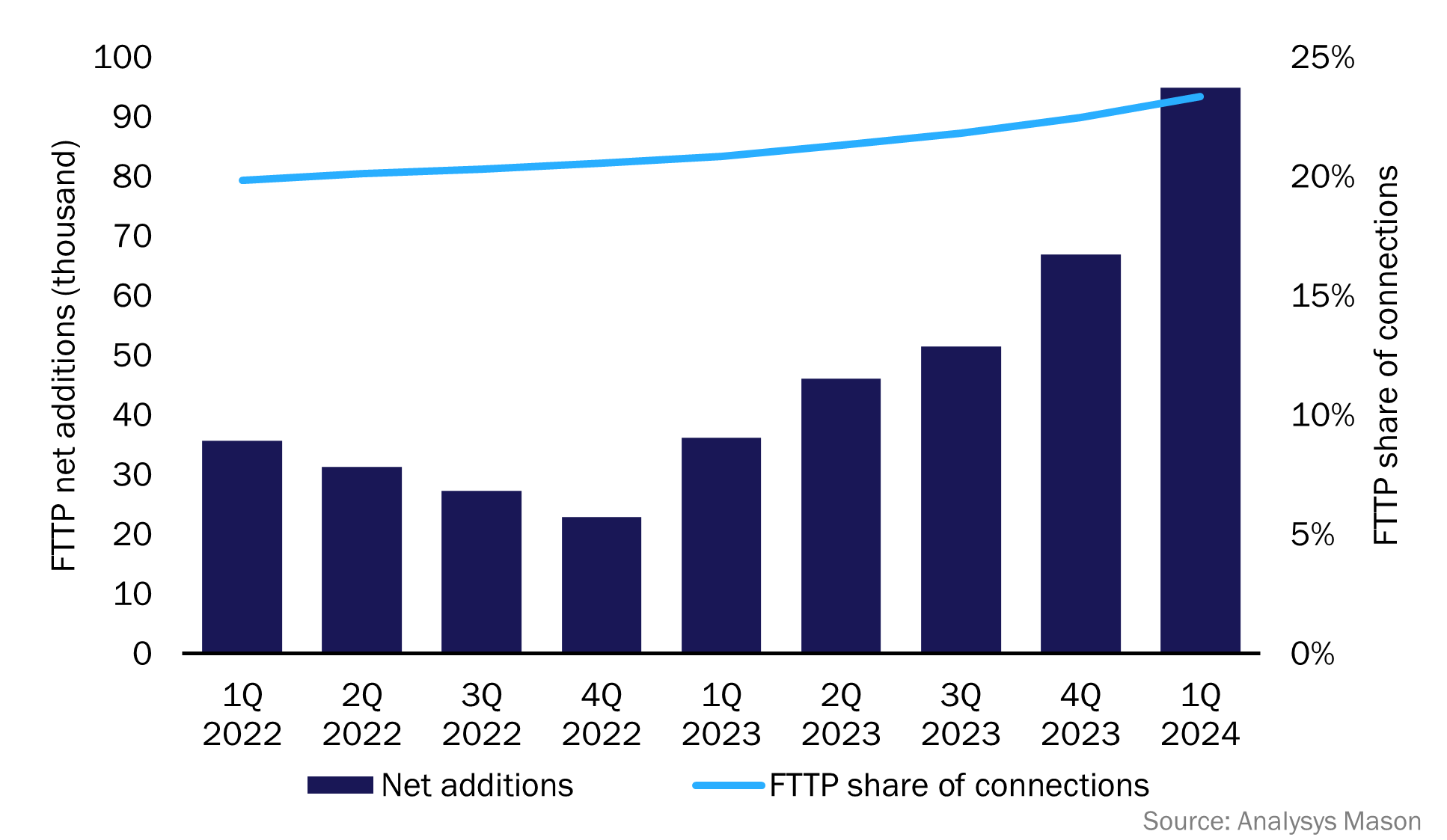

Figure 1: FTTP net additions and FTTP share of fixed broadband connections, Australia, 1Q 2022–1Q 2024

FTTP adoption in Australia is increasing, and at a faster pace in the last few quarters than in previous quarters. FTTP overtook cable as the second-most used technology in 2Q 2023, but DSL remains the most used technology in the country. The number of FTTP connections grew by 95 000 quarter-on-quarter in 1Q 2024, and FTTP accounted for 23% of all fixed broadband connections.

Major mobile market developments in APAC include a SIM registration scheme in Thailand and a 5G launch in India

The introduction of a SIM registration scheme in Thailand caused the number of prepaid subscribers to decline in 2023

AIS, the second-biggest MNO in Thailand in terms of the number of subscribers, reported a decrease of 1.5 million prepaid subscribers (–4.6% year-on-year) in 2023. This was the result of the regulator requesting holders of over five SIM cards to re-register their IDs in November 2023. There will be further re-registrations in 2024.

However, AIS’s number of prepaid customers has since returned to growth, fuelling by a rising number of foreign tourists in Thailand. Indeed, 69% of all mobile connections in Thailand are prepaid as of 1Q 2024.

LG Uplus is gaining subscriber market share by hosting MVNOs

Growth in the number of mobile connections has accelerated for South Korean MNO, LG Uplus, since the start of 2023. LG Uplus gained 1.25 million subscribers during 2023, compared to 558 000 in 2022. It added a further 292 000 connections in 1Q 2024 to reach a total of 16.2 million subscribers. This translates to a 26% subscriber market share.

This growth can mainly be attributed to the increase in the number of MVNO connections hosted on LG Uplus’s network. Indeed, part of LG Uplus’s wireless network expansion strategy is to allow MVNOs to use its retail platforms, including physical stores and a dedicated MVNO website. Two recently launched MVNOs, KG Mobile and GME Mobile, are using LG Uplus as their exclusive host.

5G is still rare in emerging Asia–Pacific, but Indian MNOs have proven that rapid migration from 4G to 5G is possible

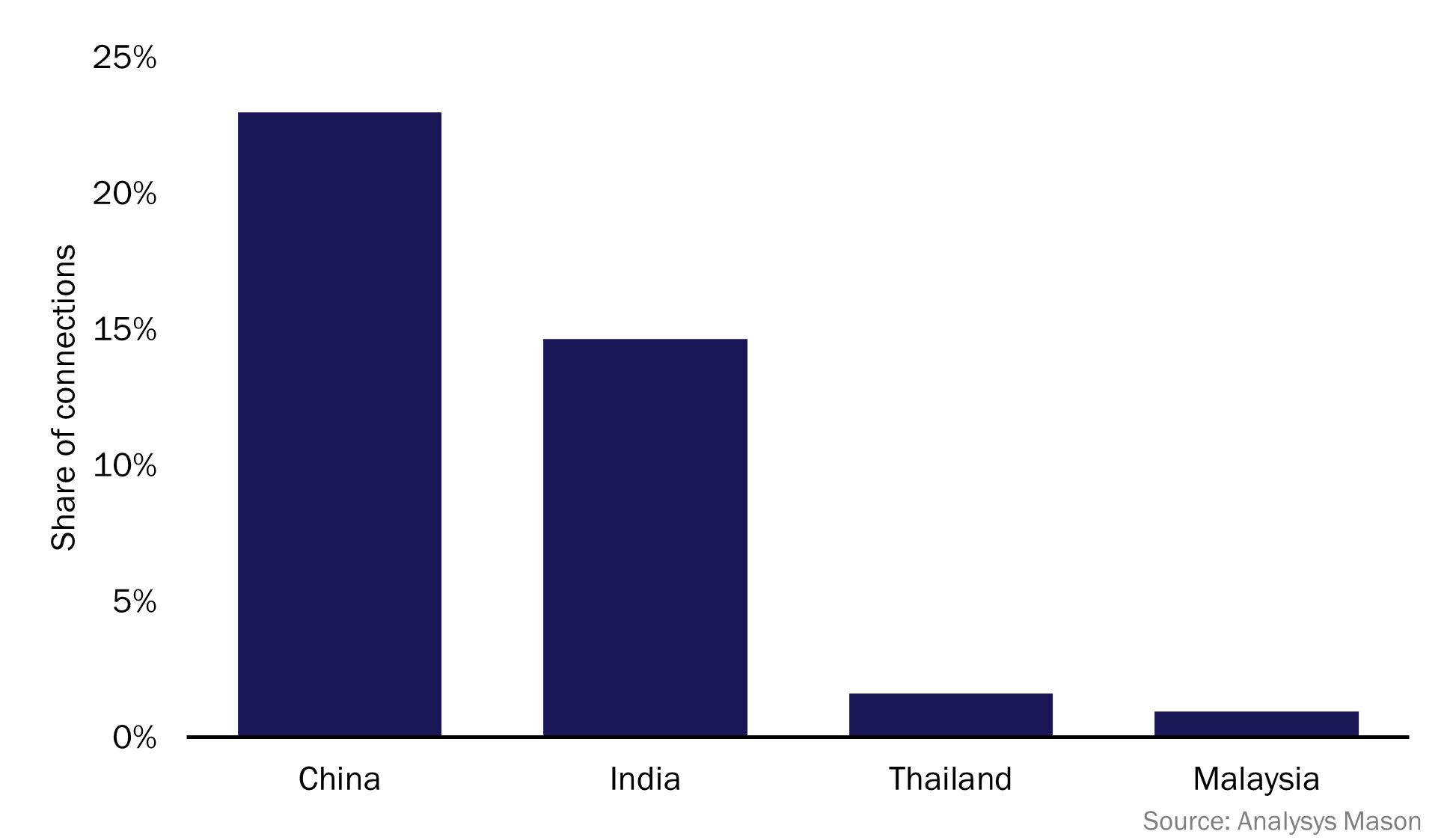

Indian MNOs Jio and Airtel launched 5G in 4Q 2022 and have been successful in quickly migrating customers to 5G plans. Indeed, 5G accounted for 14.6% of mobile connections in India 1 year after the service was launched. This share increased further to 20.8% in 1Q 2024. MNOs in other emerging markets in APAC have had more difficulty in migrating customers to 5G (Figure 2).

Figure 2: 5G share of mobile connections 1 year after launch, selected countries in APAC

There are several reasons for Indian MNOs’ success, including investing in the infrastructure to cover all major towns and cities and the availability of affordable 5G devices and 5G plans. For example, Jio’s cheapest 5G postpaid plan retails at INR299 (USD3.6) per month, while a similar plan in Thailand retails at THB449 (USD12.2). It is clear that the plans in India are cheaper, even when accounting for differences in GDP per capita on a purchasing power parity (PPP) basis.

There will be further mobile market consolidation in emerging Asia–Pacific

The owners of XL Axiata and Smartfren have reportedly sought regulatory approval for a proposed merger

The Indonesian Ministry of Communication and Informatics confirmed that XL Axiata and Smartfren were discussing a merger in 2023. This news came only a year after the merger of Ooredoo (Indosat) and Hutchison Asia Telecommunications (Tri) was finalised. This means that the Indonesian telecoms market will have gone from five MNOs to three in under 3 years, assuming that the merger between XL Axiata and Smartfren is finalised in the coming year.

1Q 2024 data shows that the proposed new entity would have a 27% subscriber market share. Telkomsel (41%) would continue to be the market leader and IOH (32%) will remain the second-largest MNO.

Sri Lankan MNOs Dialog and Airtel have signed an agreement to merge their mobile operations

Dialog and Airtel announced their intentions to merge their mobile operations in April 2024. The merger has been approved by the Telecommunications Regulatory Commission of Sri Lanka (TRCSL), but remains subject to the approval of Dialog’s subscribers.

The new entity would account for 69% of mobile subscribers and would further cement Dialog’s dominance in the Sri Lankan mobile market.

Article (PDF)

DownloadAuthor