Mobile operators seeking to boost prepaid users’ spend can learn from a new plan in Azerbaijan

26 November 2025 | Research and Insights

Article | PDF (5 pages) | Mobile Services

Azerconnect Group has introduced a new prepaid tariff in Azerbaijan that blends the flexibility of prepaid plans with the recurring revenue characteristics typically associated with contract models.

This approach tries to address a typical challenge of prepaid-dominant markets – SIM cards that generate little usage or are topped up with minimal amounts – with a solution that goes beyond loyalty programmes or usage-based bonuses.

Azerconnect Group has changed the way its prepaid customers keep a SIM active and access connectivity services: it requires customers to buy a bundle of voice, text and data rather than just adding credit.

Azerconnect Group has reported that the number of customers subscribing to mid-tier bundles has doubled and the volume of inactive SIM cards has declined since the tariff launched in Azerbaijan in June 2025.1

This scheme could serve as a blueprint for other mobile network operators (MNOs) seeking to build customer loyalty and engagement without long-term contracts.

Many customers contribute little to MNOs’ revenue, even if they regularly use their mobile network

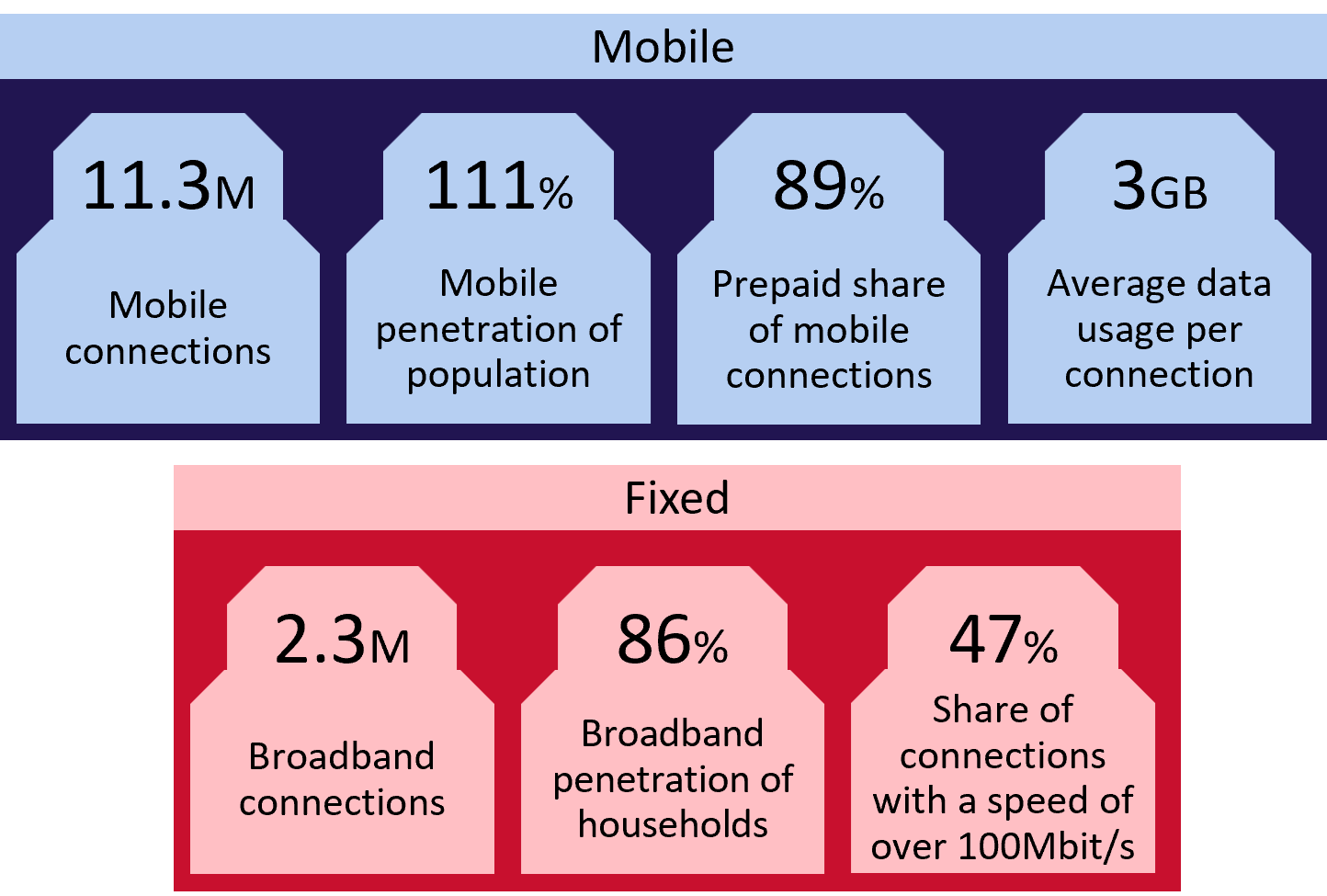

Azerbaijan is a prepaid-dominant market with high mobile penetration (Figure 1). Prepaid tariffs typically include voice, messaging and data (often with a set amount of data for communication platforms or social media).

Figure 1: Key indicators for Azerbaijan’s fixed and mobile telecoms market, 2024

Source: Analysys Mason based on data from the Azerbaijan Statistical Information Service

In this context, Azerconnect Group and its competitors in Azerbaijan face challenges common to prepaid-heavy markets:

- many customers rely on low-value top-ups to keep their mobile service active

- some customers are unsure whether their SIM is active, even after adding credit

- customers can easily switch between MNOs to take advantage of the best offers

- many customers have several inactive SIMs.

A large share of mobile customers maintain an active SIM to retain their number for WhatsApp, rely on Wi-Fi for connectivity and make only minimal top-ups. This behaviour is common globally, driven by the widespread use of communication apps.2

Azerconnect Group’s new tariff offers prepaid customers a novel way to keep their SIM active

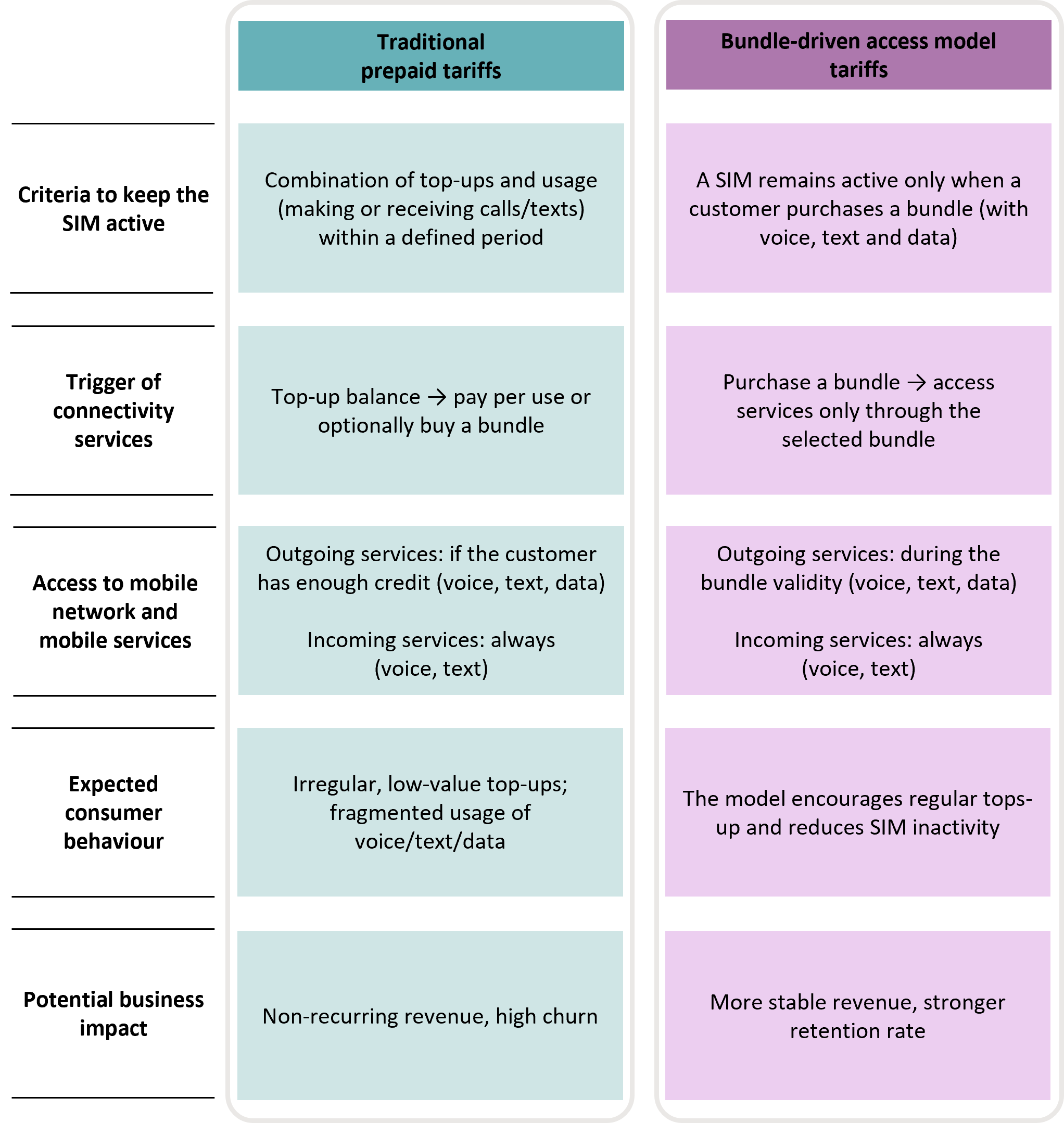

Azerconnect Group has introduced a new way for its customers to keep their SIM cards active and access mobile services by shifting from a “balance-driven access model”, where it is enough to add credit, to what the operator calls a “bundle-driven access model”, where the purchase of a bundle of voice, text and data is the trigger for connectivity services (Figure 2). Other MNOs in the country have moved towards a similar approach.

Figure 2: Comparison between traditional prepaid tariffs and bundle-driven access model tariffs

Source: Analysys Mason

The main features of the new prepaid offering, which includes the standard mix of voice, messaging and data, are as follows.

- Minimum access fee: customers must pay AZN4 (USD2.3) to keep their SIM active and retain their number, if they do not select a bundle. This fee provides 400MB of data or 40 minutes of national calls, valid for 30 days.

- Inactivity policy: SIM cards may be permanently deactivated if customers do not purchase a bundle or pay the minimum access fee during a period of 90 days.

- Loyalty incentives: customers who renew their bundles or pay the minimum access fee for three consecutive months receive benefits. These benefits depend on the bundle’s validity period. Customers who choose bundles with a 7-day validity receive temporary bonuses or add-ons (to drive immediate engagement). Customers who choose 30-day bundles receive promotions designed to encourage upgrades to higher-volume packs.

- Differentiated data rounding: data usage is rounded differently depending on the service type (text, voice or file sharing) to better monetise data used for services such as voice calls via communication platforms.

This model encourages regular bundle renewals and helps customers retain their number (which is especially important for WhatsApp users). It also increases interaction with the operator’s app, creating more upselling opportunities.

Azerconnect Group has introduced a lending feature to support regular bundle renewals; it offers short-term credit for customers seeking flexibility. This feature helps accommodate customers who follow short, non-monthly payment cycles, as is typical in many markets worldwide.

The new prepaid plan can provide lessons for operators seeking to increase customer loyalty and spend

Other operators in prepaid-dominant markets could replicate Azerconnect Group’s tariff and complement their existing strategies aimed at driving regular plan renewals.

These operators typically incentivise customers through loyalty programmes, such as those offered by MTN Ghana or DITO in the Philippines. These programmes enable customers to earn points with each top-up (the points can be redeemed for benefits such as discounts) or gain additional voice, text or data as a bonus after a set number of top-ups.

The bundle-driven access model also presents an opportunity for operators in markets with a high share of contract plans. These operators could encourage more frequent app usage (to create upselling opportunities) by following the same principles the model is based on. For example, operators could prompt customers each month via their app to activate a specific bundle feature (such as roaming or high-speed data) included in their standard monthly fee. This would help address the challenges of limited engagement with operator apps. In our consumer survey, only slightly more than 40% of respondents reported using their operator’s app.

Operators across markets should explore strategies that encourage prepaid customers to adopt spending and loyalty behaviours more akin to those of contract subscribers, who constitute a more profitable and reliable consumer base.

Analysys Mason’s Mobile Services programme examines mobile service providers’ core strategies, with a particular focus on the monetisation of mobile connectivity services, customer satisfaction and churn reduction. To find out more about our expertise in this area, contact Stefano Porto Bonacci.

Azerconnect Group recently invited Analysys Mason to interview its Chief Commercial Officer, Mushfig Aliyev, about the new prepaid tariff that Azerconnect Group launched in Azerbaijan in June 2025. This article is based on the interview. Usage is subject to our disclaimer and copyright notice. Analysys Mason does not endorse any of Azerconnect Group’s products or services.

1 Bakcell’s mid-tier bundles, valid for 28 days, range from AZN10 (USD5.9) to AZN20 (USD11.8).

2 For example, WhatsApp was used by at least 70% of consumers in 18 countries in 2024, according to Analysys Mason’s consumer survey. For more information, see Analysys Mason’s Communication platforms: consumer survey.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Survey report

Retail store visits: consumer survey

Survey report

Awareness and usage of eSIMs, and their impact on churn: consumer survey

Tracker report

Mobile pricing (SIM-only plans): trends and analysis 1Q 2026