Analysys Mason’s survey findings: CSPs’ B2B success will be defined by the flexibility of their commercial models

The enterprise segment has emerged as a beacon for new revenue growth and differentiation as communications service providers (CSPs) confront the challenges of declining revenue from traditional sources, continued investment and investor pressure on margins and profitability. Indeed, emerging enterprise opportunities are expected to provide CSPs one of the largest windows for new revenue generation and margin expansion in the medium-to-long term. CSPs that successfully deepen their relationships with enterprises in the long term also stand to gain from substantially improved valuations and public market recognition. CSPs are therefore driven to expand their systemic capabilities in order to better engage with small and medium-sized businesses (SMBs) and large enterprises and to monetise the related opportunities.

5G remains a key driver of new opportunities, but CSPs are also exploring other enterprise-focused topics such as network-as-a-service (NaaS), edge computing and SD-WAN. However, the lack of clarity on the nature of emerging enterprise use cases remains a cause for concern for CSPs. It means that there will have to be a paradigm shift in how CSPs define and procure their support systems because this will now need to be done without detailed specifications of the use cases that will be supported, as has historically been the case. Instead, CSPs will need to embrace an agile architecture-centric design for future systems that emphasises flexible, scalable, configurable and extendable frameworks to support dynamic commercial models and as yet unseen use cases.

Key findings: CSPs remain a favoured supplier, but need to improve their capabilities to stay relevant to enterprises

Analysys Mason conducted a survey of, and interviews with, over 350 CSPs and enterprises worldwide in November and December 2021 to assess the commercial models that are being considered and deployed for enterprise services. The results highlight the need for CSPs to urgently transform their enterprise commercial models because only 21% are currently ready to support new enterprise commercial models. The key findings of the report are as follows.

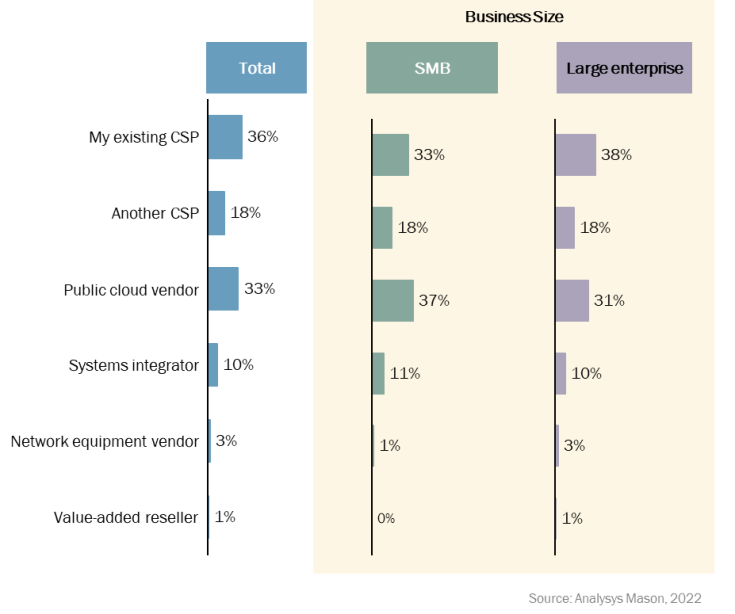

- Enterprises prefer partnering with CSPs over public cloud providers (see Figure 1 below), even though they acknowledge that the latter have a more-attractive commercial model. Flexible commercial models and seamless onboarding are the two main factors that make CSPs more-attractive partners.

- Enterprises reported that the ability to track spending and usage in real-time, the ability to configure new products and services in real-time and pay-as-you-use commercial models that do not have major set-up costs are the most-important factors in new commercial engagements. There is an acute need for such capabilities, especially in the SMB) space.

- Enterprises plan to launch between 6 and 25 new offerings that require agile commercial models in the next 2 years. Enterprises also plan to increase their spending with CSPs during this time, provided that CSPs are prepared to offer flexible commercial models.

- CSPs are planning to transform their enterprise-focused systems within the next 2 years. The key outcomes that are expected from the transformation are an improved time to market, support for flexible commercial models, lower commercial risk and a reduction in operational costs.

- CSPs consider digital marketplaces and advanced partner settlement models to be strategically crucial to their participation in the B2B2X value chain and are prioritising their development.

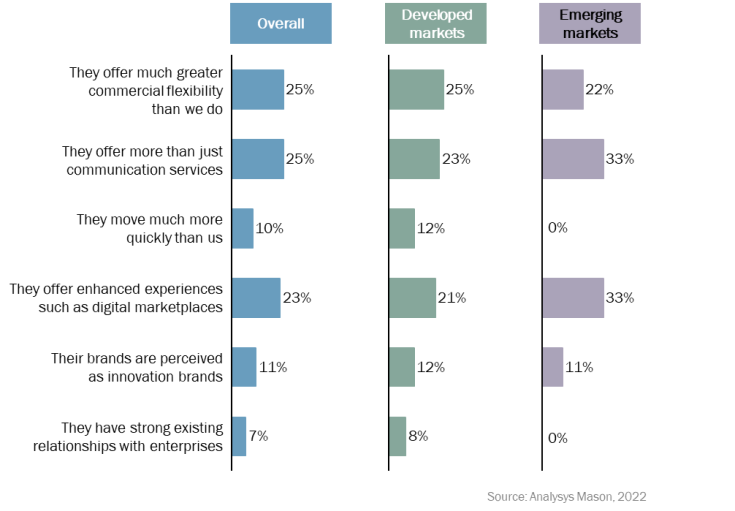

- CSPs consider cloud players to be more of a competitive threat for enterprise services than other CSPs. CSPs reported that platform flexibility, enhanced experience and a broad portfolio of enterprise applications are the key factors that make cloud players a competitive concern (see Figure 2).

Figure 1: Enterprises’ preferred suppliers for current and planned ICT services, worldwide, December 20211

Figure 2: Advantages of CSPs’ competitors, worldwide, December 20212

CSPs need to significantly increase investment in their enterprise monetisation systems to avoid falling behind their competitors

The modern enterprise offers most CSPs a unique opportunity to use their expertise, relationships and expansive network assets to build a multi-dimensional value chain across multiple industry verticals. This is easier said than done thanks to the intense competition in the segment and most CSPs’ inability to offer a comparable experience to that of digital natives. However, our research shows that CSPs remain enterprises’ preferred partners, despite their shortcomings. CSPs must therefore ensure that they are able to offer configurable solutions, flexible commercial models and transparent and trackable transactions as enterprises prepare to launch multiple new offerings in the short-to-medium term. If CSPs do not invest in their enterprise monetisation systems, they risk being overtaken by their competitors in the medium term.3

1 Question: “Looking ahead and thinking about current and planned ICT services, who will be your preferred main supplier? (CHECK ONE)”; n = 309.

2Question: “When thinking about your competitors, what is your main concern? (CHECK ONE)”; n = 61.

3 For more information, see Analysys Mason’s complete report CSPs’ B2B success will be defined by the flexibility of their commercial models.

Article (PDF)

DownloadRelated items

Article

GenAI can help cut the cost of software creation, boosting the potential of free applications to transform the market

Article

Low-code and no-code platforms are a powerful tool for telecoms operators and application vendors

Strategy report

Monetising 5G and next-generation services: operational impact and implications for telecoms networks