Cablecos should invest in FTTP to remain relevant in the long term

Listen to or download the associated podcast

The increase in FTTP coverage is a growing problem for cable operators

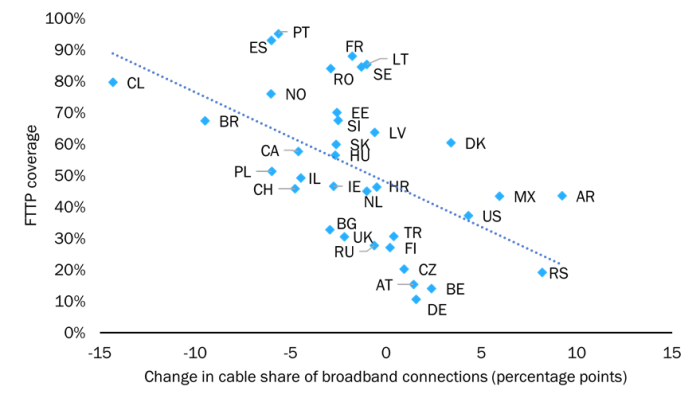

Cablecos have spent years as the fixed broadband market leaders, but their market share is now being squeezed by competition from fibre-to-the-premises (FTTP) players. Indeed, FTTP coverage has empirically been shown to be inversely proportional to cablecos’ market share (Figure 1). This means that there is an imminent threat to cablecos in advanced markets such as that in Spain, where FTTP coverage is well over 80%. However, FTTP coverage in slow-moving markets such as those in Germany and the USA is growing only slowly, and cablecos are still cautious about upgrading. Cablecos that plan to upgrade their networks can take one of two pathways: extend the lifetime of cable assets by continuing along the DOCSIS path or overbuild their own networks with FTTP (typically XGS-PON). A full discussion of this can be found in Analysys Mason’s Cable network strategies in an age of fibre.

Figure 1: Change in cable share of broadband connections, 1Q 2017–3Q 2021, and FTTP coverage, 2021, by country

Source: Analysys Mason, 2022

We believe that cablecos should focus on transforming into efficient and competitive players rather than on addressing the short-term consumer demand for bandwidth. The variants of DOCSIS4.0 will deliver most of the bandwidth that XGS-PON does, and this will be plenty for consumers who generally will not care whether it is on glass or coax. Variants of DOCSIS4.0 may also be cheaper to deploy than FTTP in terms of capex, but they will be expensive to maintain and may lead to stranded assets in the long run. FTTP has significantly lower opex than cable, and these opex savings are likely to offset the additional deployment cost of FTTP. Fiberisation is therefore required to enable cablecos to be competitive in the long run, and they should move quickly.

Cablecos have historically dominated the broadband market in the USA, but FTTP is an emerging threat

Figure 1 shows that the cable share of broadband connections is higher in the USA than in most other countries and that the FTTP coverage is below 40%. Comcast and Charter are the two largest US cablecos: they have long enjoyed utilisation rates of over 50% and superior margins, and are therefore fairly resistant to the expense of upgrading to FTTP.

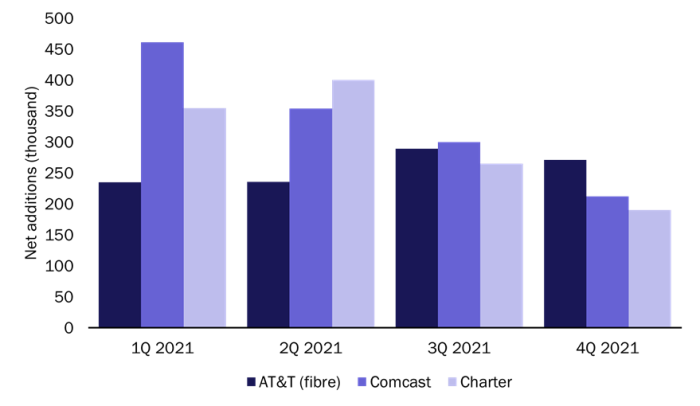

However, there are signs that the cable market share in the USA is peaking due to growing pressure caused by the continual FTTP roll-outs from AT&T, Frontier, Lumen, Windstream and others. Figure 2 shows that AT&T’s FTTP net additions surpassed the net additions of both Comcast and Charter (individually) for the first time in 4Q 2021. If current trends continue, the number of cable customers will start to decrease at some point this year. Indeed, AT&T reported that 70% of its FTTP net additions in 2021 were new customers, which suggests that it is gaining customers from cable operators. Comcast and Charter have acknowledged that cable is being threatened and are looking to upgrade. Comcast is prepping for DOCSIS4.0, but Charter is being more tentative and may see FTTP as a viable alternative.

Figure 2: Total broadband net additions, by provider, USA, 2021

Source: Analysys Mason, 2022

Cablecos should shift to fibre to prevent a long-term revenue decline, and should act sooner rather than later

Cablecos face a tough decision in choosing whether to stick with HFC/DOCSIS or to overbuild FTTP. Our analysis reveals three clear disadvantages of HFC relative to FTTP.

- HFC tends to have higher maintenance costs than FTTP. HFC has far more active components to go wrong than FTTP, and the field-force will need to be retrained to handle variants of DOCSIS4.0.

- HFC consumes more power than FTTP. DOCSIS networks have a greater density of nodes than FTTP networks, so they consume more power.

- HFC has a limited vendor ecosystem. The ecosystem for HFC has fewer equipment and chipset vendors than that for xPON (FTTP). A small number of vendors will upgrade to DOCSIS4.0, but this generation is likely to be the end of the roadmap.

Cablecos may be able to use wholesaling to enter the FTTP market. Wholesaling is always a trade-off between control and cost savings, and competitors’ wholesale tariffs are falling, thereby increasing the risk of cannibalisation and retail price erosion. However, the availability of lower-priced, faster FTTP (often sold without a video service) is a reality that cablecos will sooner or later have to face, and they will need to lower their network costs in order to maintain margins. Wholesaling can provide a much larger customer base for smaller cablecos, particularly those with no mobile assets to keep churn rates low. A netco/serveco split may be necessary, especially if external finance is required for the upgrade.

Overall, cablecos should take a long-term view when deciding their network strategies, rather than trying to address the customer demand for bandwidth or traffic. Competitors are already starting to erode cablecos’ customer bases, thereby undermining the position that they have long enjoyed as the premium supplier in the market. FTTP overbuild will take years to achieve, so cablecos should ignore DOCSIS4.0 and start planning for fiberisation now.

Article (PDF)

DownloadAuthors