‘Carrot-and-stick’ approaches to nudging the last customers off copper

There is a general agreement that copper networks need to be switched off and, although more incumbent operators globally are planning, or have started the process of, copper withdrawal, full national switch-offs are still rare.

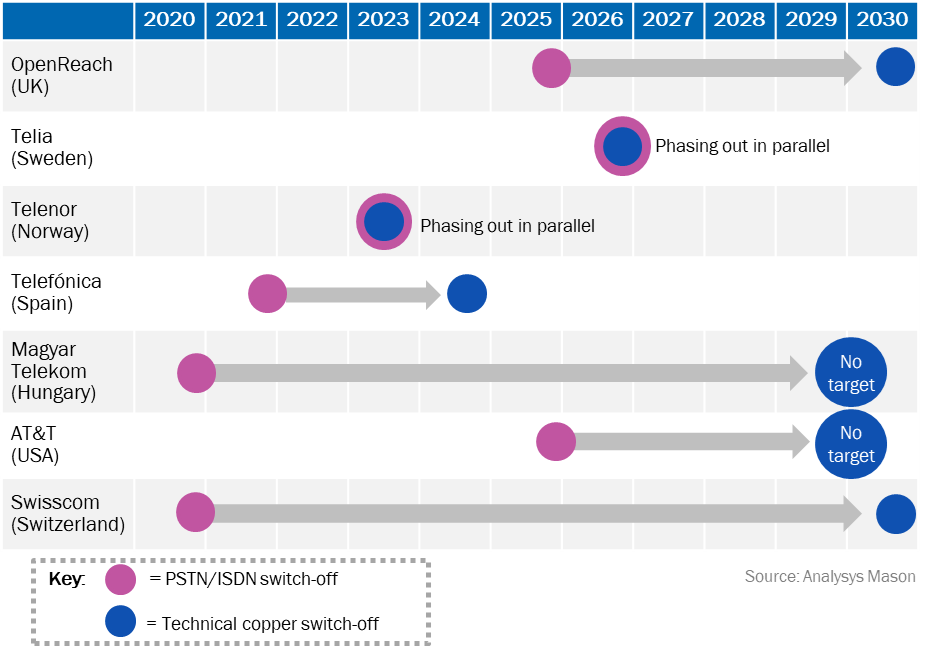

According to Analysys Mason’s Wireline decommissioning tracker, 16 operators worldwide have publicly announced the complete withdrawal of their PSTN/ISDN services and 5 have fully withdrawn their copper services. An additional 33 operators have announced that they are either planning/in the process of shutting down their copper services, with expected dates, if stated, up to 2030. On this basis, we would expect most copper to have been technically decommissioned by 2035.

The move from copper to fibre has three major parts, although the timeline of actions taken can vary (Figure 1).

- The move from voice services (PSTN/ISDN) to all-IP technology and the withdrawal of traditional analogue telephony. This is known as ‘PSTN switch-off’.

- The stop-sell (commercial withdrawal) of copper-based services (PSTN or PSTN-emulation, ADSL, VDSL, including FTTC). The copper network owner may technically withdraw its own copper-based services (based on PSTN switches and DSLAMs/MSANs), while leaving continued use open to third parties if copper unconditioned local loop (ULL) is mandated. In most cases, the legacy copper and the new, mostly fibre, networks will run in parallel for a period, during which customer migration will occur.

- The technical decommissioning of copper at local exchanges, which in some cases will be followed by scrappage.

Figure 1: Examples of operator timelines for switching off PSTN and copper

There are still major barriers to the full technical copper decommissioning which are causing delays for many operators. These can include adhering to, or managing, regulatory constraints and timelines, and ensuring that no customer is left without the possibility of an equivalent service to the one they already have, which takes a large amount of planning and communication. There is a risk of churn, and a responsibility to protect vulnerable customers, emergency services/devices and universal service obligations (USO).

Operators will be looking at strategies other than simple pricing mechanisms to move customers off copper.

Operators are going beyond reducing the price of fibre plans to enable them to move customers from copper to fibre services

When it comes to migrating from copper to fibre, operators can choose several strategies, including decommissioning copper as quickly as possible and accepting the risk of customer churn, or taking a more balanced approach of continuing to serve legacy copper customers while gradually working to reduce the number of users. The second approach is often more common, based on regulatory constraints.

To support/speed up the transition process operators are using ‘carrot-and-stick’ approaches to nudge the last remaining customers from copper/PSTN networks over to fibre. These approaches often go beyond, or are followed in combination with, the use of pricing strategies such as offering fibre at a discounted price (retail and/or wholesale), upgrading services at no added cost or reducing/eliminating connection charges for fibre plans.

A ‘carrot’ approach could involve:

- using regional and national marketing campaigns to notify customers that the sale of copper-based products and services will be stopped, as well as using the campaign as an upselling opportunity

- improving the ease with which customers can instal and upgrade to fibre – this includes reducing the wait times for installation

- providing additional education, technical support and care for hesitant and vulnerable customers – this could include offering free battery back-ups for vulnerable customers (in case of a power cut which would affect the running of fibre telephone lines) or offering priority fault repair, a relay service and working with social care agencies or charities to ensure new systems are fit for purpose.

A ‘stick’ approach may involve:

- reducing or completely stopping the repair and replacement of faults and parts in the copper network

- reducing the speed of the copper network as a way to get customers to transfer to a better-quality fibre service

- increasing the price of copper services (after a regulator’s copper charge control is lifted) – this could involve moving the pricing of PSTN services from call-by-call to minute-by-minute.

Figure 2: Examples of carrot and stick approaches to ’nudging’ used by operators

| Operator | Country | Nudging technique |

| Chorus | New Zealand | Chorus is conducting regional copper shutdown campaigns, sending out a detailed withdrawal brochure and offering back-up batteries for landlines in case of power source emergencies for customers who do not have access to a mobile phone. |

| Openreach (BT) | UK | Openreach has notified customers about the shutdown of the copper network and is also conducting trials that adjust the performance of its analogue services such as blocking outbound calls and broadband ISP speeds to encourage customers to upgrade. |

| Spark | New Zealand | In 2016, Spark started a national ‘Upgrade New Zealand’ campaign to get many broadband customers off the copper network. The campaign aims to make it easier for homeowners to install fibre, which includes giving customers the option to select a specific day for fibre installation (which reduces the wait time and uncertainty around organising a technician). |

| Telenor | Norway | Telenor stopped repairing faults in its copper network during the last 7 months of shutdown. |

| Telus | Canada | Telus has mostly stopped repairing its copper network where its PureFibre service is available. Telus will typically carry out an upgrade to fibre if an engineer is visiting a copper repair request. |

Source: Analysys Mason

Approaching customer migration is about finding a balance between addressing the concerns and needs of hesitant customers while minimising the time and expense of operating two separate networks. To tackle these cross-functional challenges, operators must approach copper decommissioning with a well-planned strategy that helps to reduce disruption for themselves and their customers.

Article (PDF)

DownloadAuthor