Challenger operators in Europe have gained subscriber market share by keeping prices flat

Listen to or download the associated podcast

Challenger operators in Europe have been commonly maintaining or cutting prices. This gives them a clear advantage over established operators, most of which have raised prices to mitigate inflationary pressure.

Challengers were hoping that their strategy would lead to increased subscriber market share and are now starting to see the results. Three challenger operators in three countries (France, Italy and Spain) each increased their number of subscribers by up to 300 000 in 1Q 2023 while churn increased in the rest of the market and the number of subscribers decreased.

This article is based on 1Q 2023 data that is available in Analysys Mason’s DataHub.

Many challenger operators announced that they will not increase prices, despite high inflation

Amid inflationary pressure, including rising energy costs, many European operators have decided to increase their prices. This allows market challengers to gain market share by delaying price rises or promising no mid-contract price rises. As stated in Analysys Mason’s article, Price rises in Western Europe are giving challengers an opportunity to boost their mobile and fixed market share, examples of such challenger operators exist in France, Italy and Spain.

Iliad, operating under the name Free in France, has stated that it will not increase its prices in France before 2027 and that it does not plan any price increases related to inflation in Italy. Similarly, Digi, in Spain, has announced that it has no intention of increasing its prices. Meanwhile, other operators in France, Italy and Spain have increased or will increase prices by up to EUR5 per month.

The results of different price strategies are evident in the mobile market

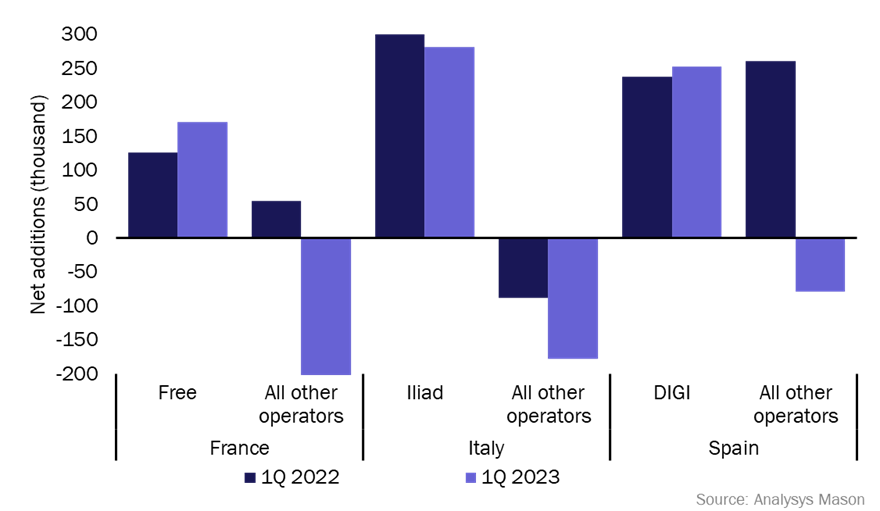

Figure 1 shows the challenging operators’ net additions in mobile subscribers between 4Q 2021 and 1Q 2022, as well as between 4Q 2022 and 1Q 2023 compared to other operators’ net additions. Challenger operators Digi, Free and Iliad have been more successful than their competitors in gaining subscribers in their respective countries.

Figure 1: Mobile subscriber growth by country and operator, 1Q 2023

The data suggests that pricing strategies have played a part in churn and customer acquisition. Challenger operators, Free in France and Digi in Spain, increased their net additions in 1Q 2023 compared to 1Q 2022, while subscriber numbers for other operators, as a whole, decreased in 1Q 2023.

Subsequently, Free and DIGI have continued to increase their market shares and now account for 18.5% and 6.7% of subscribers respectively. Iliad in Italy did not quite manage to match its subscriber growth in 1Q 2023 with that of 1Q 2022, but churn increased for its competitors during that time. Iliad’s addition of 282 000 subscribers in the first quarter of this year means that it now accounts for 13.5% of subscribers.

Some of the European operators announced that they would increase prices in March 2023. Therefore, it is likely that we are yet to see the full extent of how different strategies will affect the mobile market. However, it is already clear that challengers are taking a bigger share of new and churning subscribers.

Price increases are not paying off for operators in the short term

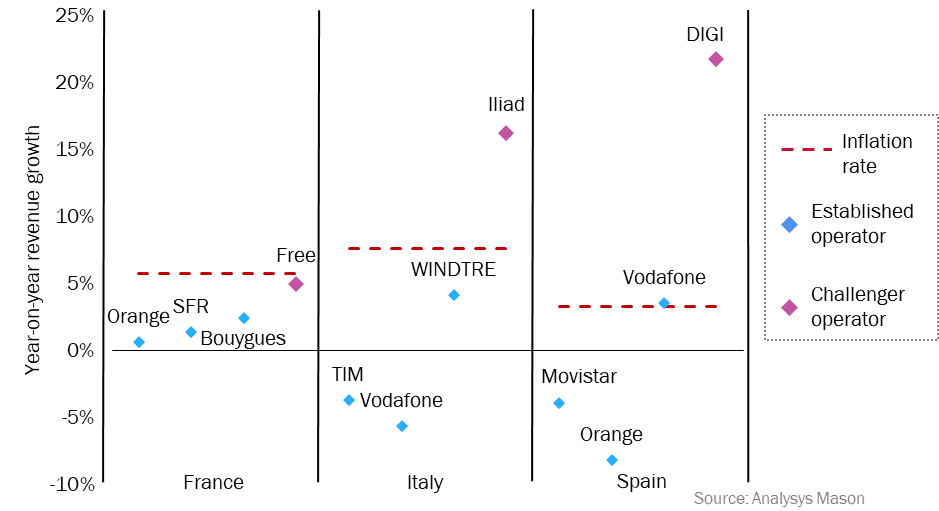

Figure 2 shows year-on-year growth in mobile service revenue and annual inflation rates in the first quarter of 2023. Challenger operators are generating less revenue than their competitors, but they are seeing faster relative growth. Digi’s revenue increased the most year-on-year (21.7%), followed by Iliad (16.2%) and Free (4.9%).

The operators that increased prices were hoping that it would mitigate inflationary pressure. However, the data shows that for some operators in Italy and Spain, it has resulted in decreasing revenue. Orange’s mobile revenue decreased the most year-on-year (8.2%), but Movistar, Vodafone (Italy) and TIM also recorded falling revenue.

Figure 2: Mobile service revenue and revenue growth by country and operator, 1Q 2023

Challenger operators saw their competitors’ price increases as an opportunity to disrupt the market and continue their fast growth by keeping prices unchanged. Seemingly, their strategies have paid off; their subscriber numbers are growing while those of their competitors are increasingly churning. Conversely, the attempt of operators to increase revenue by increasing prices has not paid off; for some, revenue is decreasing year-on-year and others are only seeing slight growth, below current inflation rates.

The impact of the price strategies is yet to be fully understood. The data suggests that keeping prices flat is paying off for the challengers in the short term, but it remains to be seen how sustainable the strategy is.

Article (PDF)

DownloadAuthor

Erik Ottosson

AnalystRelated items

Tracker

European quarterly metrics: Western Europe 1Q 2025

Tracker

European quarterly metrics: Central and Eastern Europe 1Q 2025

Article

Telecoms operators are hoping to defend ASPU by bundling in AI products such as ChatGPT and Perplexity