Will the merger between cablecos Charter and Cox change the dynamics of the US fixed broadband market?

21 May 2025 | Research and Insights

Article | PDF (3 pages) | Fixed Services| Fibre Infrastructure

The proposed merger between Charter and Cox Communications (part of the Cox Enterprises conglomerate), announced on 16 May 2025, will create the largest company in the US fixed broadband market. In this sense, it is a big deal. The merger is also a big deal in financial terms: Cox is valued at USD34.5 billion (broken down into USD21.9 billion of cash and equity and the acquisition of around USD12.6 billion of debt). The merger is also expected to deliver big savings. According to the companies’ public announcement, these savings should amount to around USD500 million of annualised cost reductions within 3 years of the transaction’s closure. However, for all its scale, the benefits of the merger do not appear to be sufficient to solve the cablecos’ long-term technology cost challenge.

A big merger, but not big enough to raise regulatory concerns

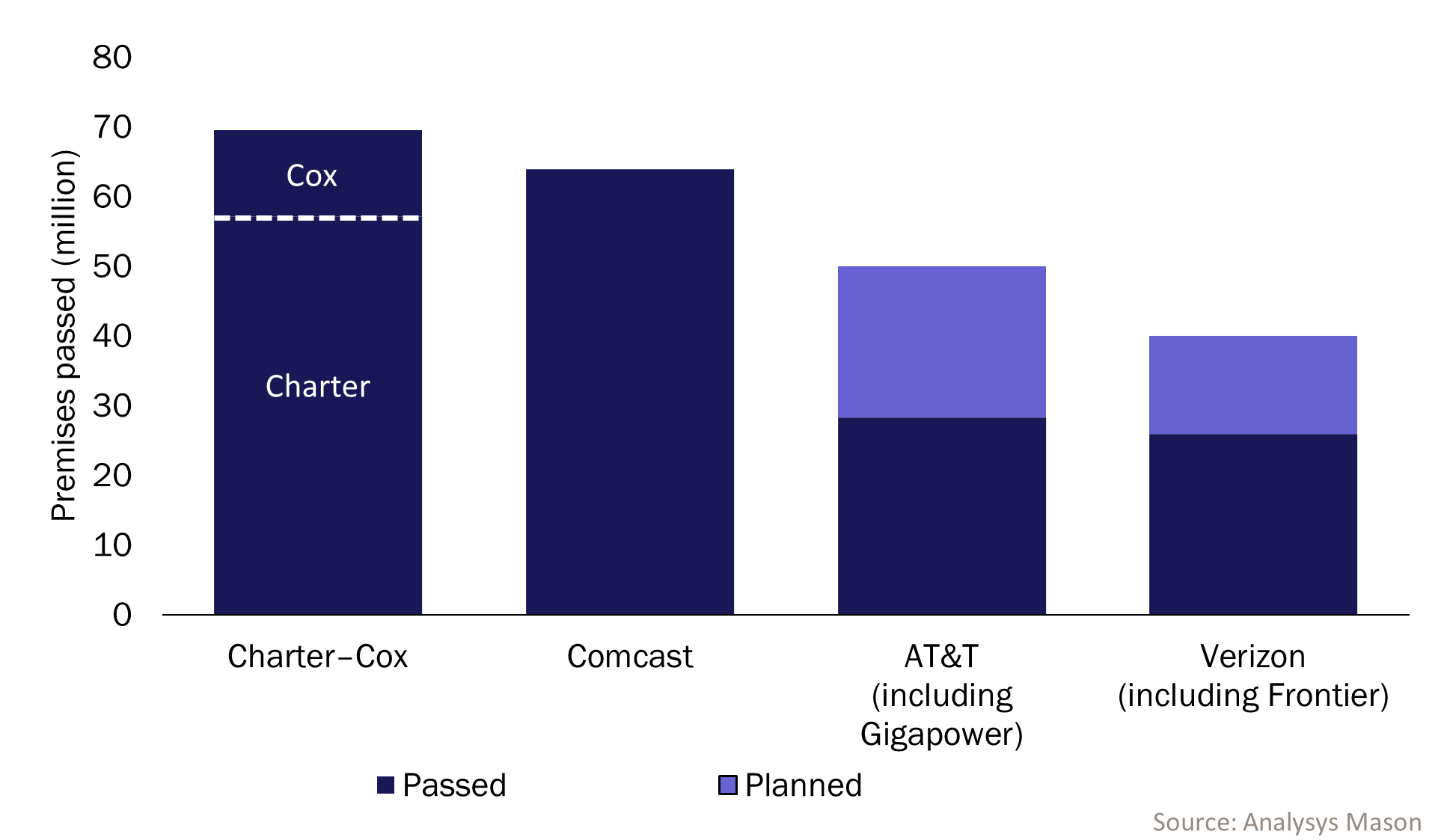

The merger between Charter and Cox Communications will create a new company with 37.6 million customers in the USA and a cable network that will pass 69.5 million premises. The new entity will surpass Comcast, which had 34 million domestic connectivity customers and a network that passed 64 million homes and businesses in the USA at the end of 1Q 2025. And while the merged company is leapfrogging Comcast, the merger will certainly not make Comcast look small.

In contrast, incumbent local exchange carriers (ILECs) have much smaller FTTP networks. The FTTP networks of the largest of these, AT&T and Verizon (including Frontier) currently cover a combined total of around 55 million premises in the USA. However, AT&T and Verizon are rapidly expanding their FTTP infrastructure and plan to deploy FTTP to more than 90 million premises between them. By the time that their network deployments are complete, they will be much closer in size to Charter–Cox and Comcast. They are also offering fixed-wireless access (FWA) services in areas beyond their FTTP footprints, which enables them to compete directly with the cablecos even before FTTP has been deployed.

Figure 1: Number of FTTP and DOCSIS premises (passed and planned) by providers with the largest footprints, USA, 1Q 2025

Many other companies are competing in the fixed broadband market, including T-Mobile, which is moving rapidly into the FTTP market, Altice which is complementing its cable networks with new fibre build-out, as well as over 1000 other FTTP providers.

The merger seems unlikely to meet much regulatory opposition. Although the cable operators have overbuilt one another in a few urban areas, their networks are largely complementary, so the merger will make virtually no difference to the range of fixed broadband providers available for customers. The merger is also unlikely to lead to an undesirable concentration of mobile spectrum. Cox and Charter hold PCS 1900 and 3.5GHz spectrum between them, but they have less spectrum than the leading mobile operators.

Charter and Cox hope that the merger will help them to increase revenue per customer across their combined footprint

Charter and Cox may argue that their merger will increase competition in the US telecoms market as a whole, given their greater combined portfolio. The merger makes it possible for Charter to cross-sell its wireless services (Wi-Fi-based plans for handsets augmented with MVNO-based cellular services for mobility) and content offerings to potential customers within Cox’s footprint.

Meanwhile, Cox hopes that its improved ability to sell additional services to millions of extra customers will change its prospects in the US broadband market. The cable share of the US broadband market peaked in 2021 and has since started to decline. During this period, FWA has grown from having a negligible presence to around 12 million connections, and FTTP has risen from around 23 million connections to around 33 million connections. Much of this growth has come at the expense of DSL, but cable has been suffering too. Net additions across all cable operators went into decline in 2021, and net additions for the top three cable operators by connections/market share have declined every quarter since the end of 2023. This decline is set against the backdrop of a market that has been (slowly) growing in terms of broadband connection numbers.

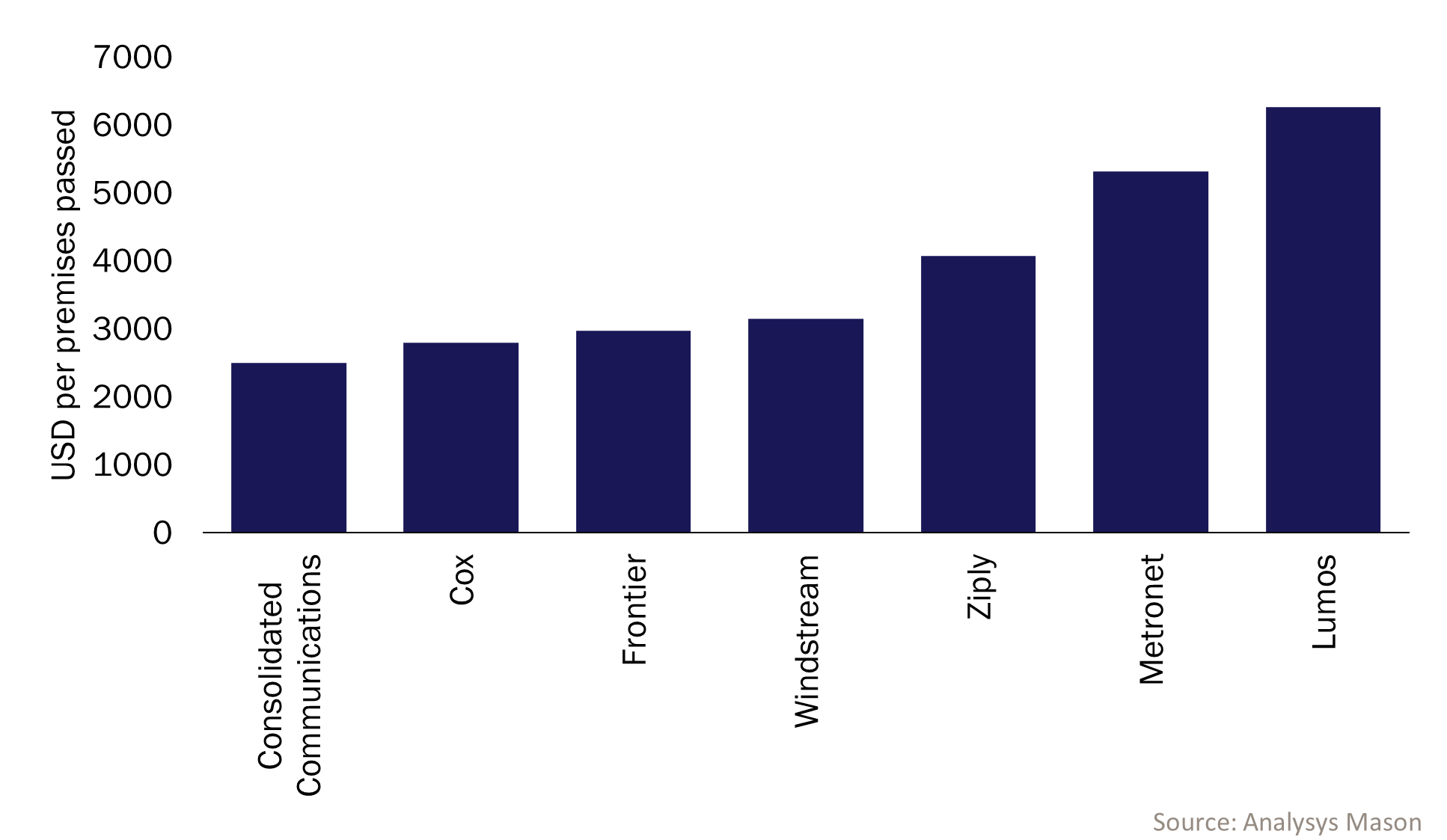

A lower-end valuation reflects the cableco technology challenge

Cox is at the lower end of the range of valuations seen for FTTP/broadband providers that have been acquired recently in the USA. At around USD2800 per premise passed, Cox is positioned in the market between Verizon’s ongoing Frontier acquisition (which works out at around USD2980 per premise passed) and the Consolidated Communications deal (nearly USD2500 per home passed). However, Cox’s valuation based on current premises passed is well below that of Windstream (USD3147), Ziply Fiber (USD 4076), Metronet (USD5315) and Lumos (USD6270) (Figure 2). This price likely reflects the fact that Charter is not getting a next-generation-ready network. The combined business will still need to invest in upgrading Cox’s network to remain competitive with FTTP (indeed, Charter still needs to upgrade much of its own network to DOCSIS4.0 too).

Figure 2: Enterprise value per premises passed, selected deals, USA, 2024

This acquisition may prove to be a short-term fix for the cablecos’ growth problems. However, the deal will do nothing to fix the long-term operating cost challenges that Analysys Mason expects cablecos to face. Our analysis shows that pureplay FTTP opex is substantially lower than DOCSIS opex.1 Although this merger delivers some extra scale, it does not look like it will deliver sufficient economies of scale to offset this technology disadvantage (savings of USD7.2 per customer per year, compared to a HFC/FTTP opex difference that we estimate could in some instances exceed USD100 per year per premises passed). Another substantial risk is that declining cableco market share will spread these higher fixed costs across fewer customers. Comcast/Cox might be able to temporarily reduce the impact of broadband market share loss, or disguise the higher cost base, by cross-selling mobility or extra content, but they will need a more-radical solution to close the cost gap with FTTP in the long term.

1 For more information, see Analysys Mason’s Moving from cable to fibre networks: the economic implications.

Article (PDF)

DownloadAuthor