Connectivity management platform vendors’ annual revenue will grow to USD845 million by 2028

Connectivity management platforms (CMPs) enable operators (and their enterprise customers) to manage their connectivity subscriptions and monitor their IoT estates. We forecast that 90% of all IoT connections will be managed through a CMP by 2028 (up from 75% in 2019). This will generate USD845 million in revenue for CMP vendors such as Cisco and Ericsson.

The demand for CMPs will be driven by the rapid growth in the number of IoT connections and the implementation of new IoT use cases

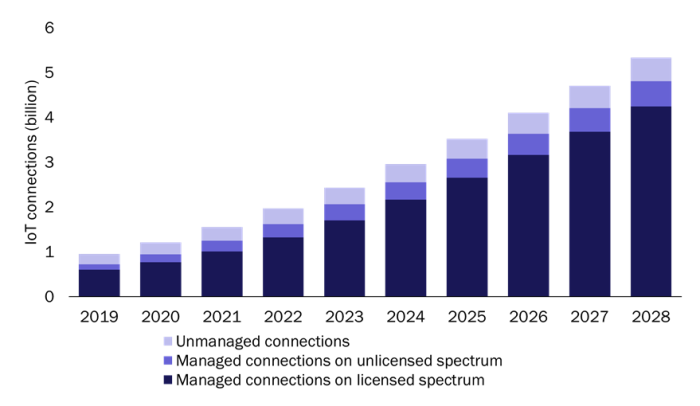

Analysys Mason forecasts that the number of IoT connections managed by CMPs will grow at a CAGR of 24% between 2019 and 2028 to reach 4.8 billion (Figure 1). Further details of this forecast can be found in the report, IoT forecast: connectivity management platforms 2019–2028.

Figure 1: IoT connections, by spectrum type, worldwide, 2019–2028

Source: Analysys Mason, 2020

The expansion of the CMP market will be driven by the rapid growth in the number of IoT connections and enterprises’ growing need to keep track of connectivity contracts, optimise data usage and integrate billing and traffic data with their back-end systems.

We forecast that 90% of IoT connections worldwide will be managed by CMPs by 2028 (up from 75% in 2019). Our IoT platform contract tracker lists more than 200 platform deals that have been signed by operators and involve connectivity management functions. A further 12 operators have developed their own CMPs.

We anticipate that most IoT connections will run on licensed spectrum (that is, 3GPP standards), and most of these will be used for NB-IoT and LTE-M. Connections that use non-licensed spectrum (such as those for LoRa and Sigfox) will account for only 12% of all managed connections by 2028.

Large operators are increasingly favouring their proprietary platforms, but vendors will maintain a sizeable share of the CMP market

Most operators use a combination of CMPs to avoid vendor lock-in, ensure commercial flexibility and satisfy certain use case requirements (for example, providing global connectivity). However, our interviews suggest that some large operators (such as Deutsche Telekom, Orange and Telefónica) have also been improving their proprietary CMPs and reducing their dependency on platform vendors.

Licensing a third-party CMP, which usually includes a global connectivity service, is more cost-effective than developing a tailored solution for smaller operators. This helps these operators to quickly commercialise IoT services without committing resources to developing a tailored platform.

Overall, we think that large operators’ shift to proprietary solutions will outweigh smaller operators’ use of third-party solutions. Indeed, we forecast that the proportion of managed connections that will be managed using vendors’ CMPs will decrease from 61% in 2019 to 45% in 2028. However, the total spend on third-party CMPs will continue to grow because the rapid growth in the number of IoT connections will offset the decrease in spending on third-party CMPs caused by competition and vendors’ falling market shares. As such, there remains a significant opportunity for vendors; they may be able to generate a total of USD845 million in revenue from CMPs by 2028, 2.5 times more than that in 2019.

Established CMP vendors face several threats that could affect their current strong position in the market

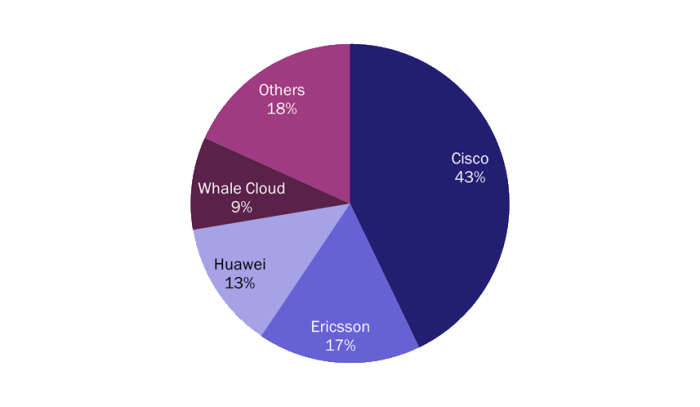

The CMP market is concentrated and dominated by several large providers (Figure 2). Cisco and Ericsson gained an early-mover advantage, and Huawei and Whale Cloud emerged as strong contenders thanks to their partnership with Chinese mobile operators. More than 82% of IoT connections that use licensed spectrum and are managed by third-party CMPs are managed by the platforms of these four vendors as of 2020.

Figure 2: Market shares of IoT connections that use licensed spectrum and are managed by third-party CMPs, worldwide, 2020

Source: Analysys Mason, 2020

Operators typically use third-party IoT CMPs on a connectivity revenue share basis. That is, connectivity revenue is split between the operators and their vendor partners. The vendor share of connectivity revenue typically ranges between 10% and 30%. These vendors face the following challenges.

- Operators may wish to shift most of their managed IoT connections to their proprietary platforms.

- The revenue from licensing CMPs could fall because of the decline in the average revenue per connection and operators’ common practice of using multiple platforms to manage IoT connectivity.

- Competition from small vendors (such as Comarch) and connectivity enablers (such as 1NCE, Arm and EMnify) that bundle a CMP with access to their virtualised connectivity infrastructure is increasing.

- Some operators believe that large CMP vendors’ platforms are expensive and less flexible than those of their smaller competitors, and that they have fewer features.

Large vendors need to assess their offerings and ensure that their platforms continue to address operators’ evolving requirements if they are to maintain their position as primary platform suppliers. Cisco and Ericsson have already invested in new platform features (such as adding device management and eSIM support). They have also capitalised on their relationships with enterprises and their ecosystem partners to enable operators to deliver specific IoT solutions and to provide support for IoT sales and marketing efforts.

Large vendors should do more to address concerns regarding high costs and a lack of flexibility by offering a wider range of pricing models and more-customisable propositions. They should also demonstrate that they can effectively support the requirements (and challenges) related to the deployment of new IoT use cases (that use NB-IoT and 5G, for example) and that they can help operators to generate more revenue from IoT.

Article (PDF)

DownloadRelated items

International IoT connectivity: challenges and solutions for providers

Strategy report

UK wireless IoT market: trends and forecasts 2022–2032

Forecast report

IoT connectivity disruptors: case studies and analysis (volume VII)