CSP spending on network automation and orchestration will exceed USD16 billion by 2028

24 October 2023 | Research

Article | PDF (3 pages) | Network Automation and Orchestration

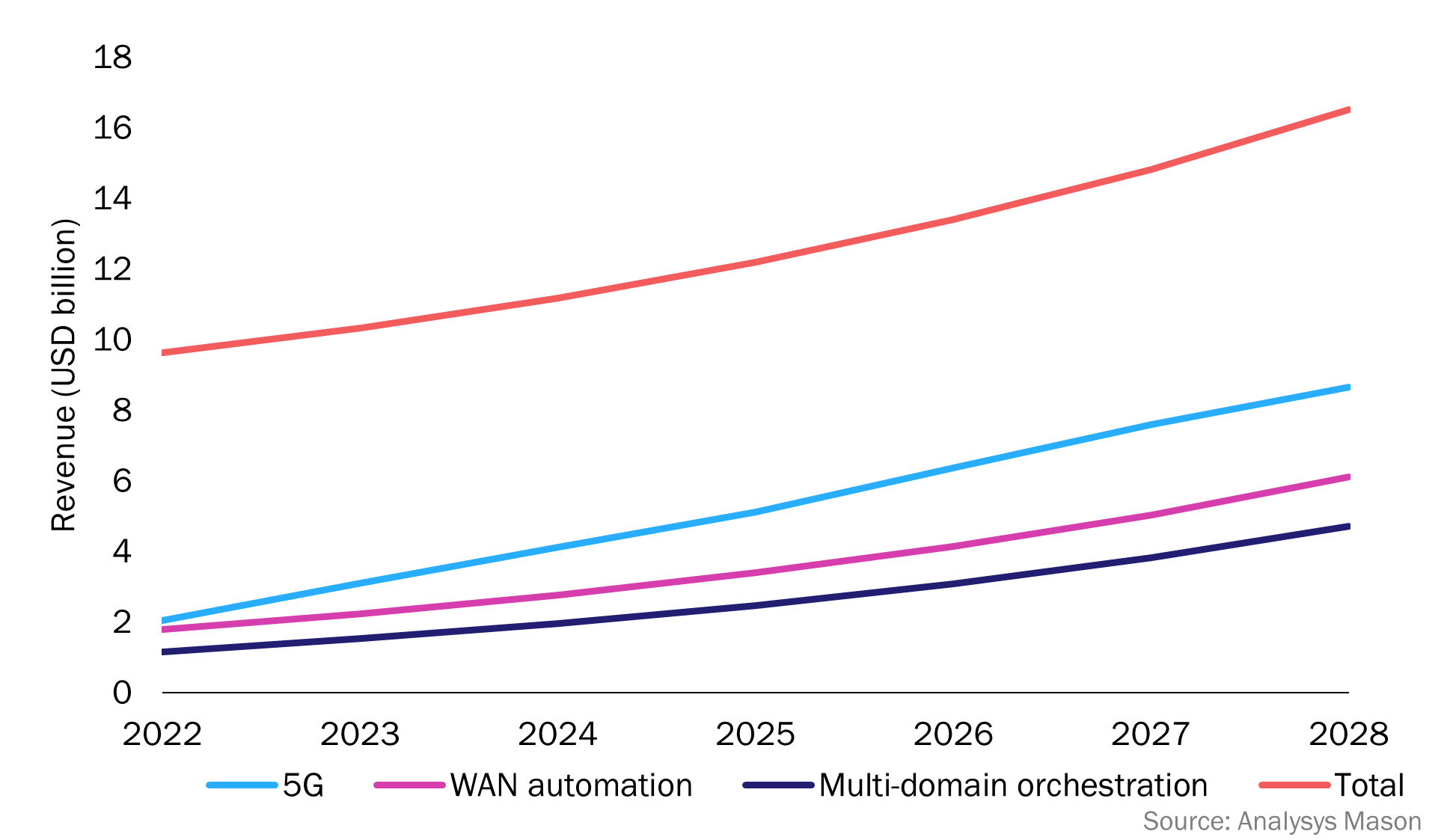

Analysys Mason forecasts that the network automation and orchestration (NAO) market is projected to grow at a CAGR of 9.4% from 2023 to 2028 to reach USD16.5 billion. This growth will be fuelled by communications service providers’ (CSPs’) ongoing roll-out of 5G standalone (SA) and cloud-native digital transformation journeys, which demand higher levels of automation to overcome network complexity. CSPs will be increasing their spending in multi-domain, multi-vendor and multi-technology network control, management and orchestration systems that support hybrid cloud networking environments.

By 2028, it is estimated that 60% of the total NAO expenditure will be dedicated to 5G, WAN automation and multi-domain orchestration

The coming years will be a critical time for 5G, marked by maturing technology and evolving use cases that are prompting CSPs to invest heavily in advanced automation and orchestration capabilities. This investment serves the dual purpose of reducing total cost of ownership (TCO) by streamlining complex operational processes, and secondly, unlocking new revenue opportunities with service differentiation. 5G-related NAO spending is projected to grow at a CAGR of 27.2% during the forecast period to reach USD8.6 billion, aligning with CSPs’ imperative to modernise their 5G SA infrastructure to support end-to-end network slicing, cloud-native automation and intent-based orchestration. CSPs will look towards enhancing these capabilities with artificial intelligence/machine learning- (AI/ML) driven closed loop automation to enable automated slice lifecycle management across multi-vendor, multi-cloud and multi-technology environments. However, these efforts will rely on open standards and the adoption of Kubernetes-based network architectures to facilitate the orchestration of cloud-native network functions (CNFs). Open-source initiatives, such as the Nephio project, will be the driving force to unify CNF orchestration across the RAN, core and transport network and support CNF domain orchestration in multi-vendor cloud infrastructure across large-scale edge deployments.

Figure 1: Forecast for CSP spending on key NAO drivers, worldwide, 2022–2028

The complexity of deploying Open RAN will drive spending on intelligent RAN orchestration systems

The adoption of virtualised RAN (vRAN) and Open RAN often go hand-in-hand with the deployment of 5G SA – a flexible and automated RAN architecture that supports the delivery of services with stringent latency requirements. vRAN domain orchestration technology will play an essential role in managing the operations and lifecycle management of the RAN resources for monetising advanced 5G services. Many large operators are starting to recognise the benefits of disaggregating the RAN in a multi-vendor environment to enable more programmatic control of the network and achieve TOC benefits via access to a wide variety of technologies and price points.

Open RAN and vRAN-related spending is expected to account for 68% of total new RAN revenue by 2028. Some of these will be conventional RAN services such as those related to network roll-out and optimisation, but growth will come from testing, validation, network function development and the integration of multi-vendor cloud-based networks. Initial spending will be attributed to enterprise networks, but it will then expand into public macro networks.

Industry bodies such as the O-RAN Alliance, Telecom Infra Project (TIP) and the Open Networking Foundation (ONF) are actively developing Open APIs and frameworks for the Open RAN. These efforts will further accelerate CSPs’ spending on intelligent RAN systems, such as the RAN intelligent controller which offers a new approach to RAN management and orchestration technologies to support multi-vendor interfaces.

CSPs will continue to bolster their WAN orchestration capabilities to strengthen their enterprise portfolio

The need for WAN automation is growing fast as enterprise networks are becoming more complex as they span across multiple technology domains (data centres, edge and wireless). We forecast that WAN automation-related spending will grow at a CAGR of 22.7% to reach USD6.1 billion by 2028 as CSPs increase their investments in WAN orchestrators that provide automatic WAN configuration, virtualisation, management and other intelligent WAN functions.

SD-WAN has already been widely deployed in many countries due to the benefits of improved cost, agility, security, bandwidth and performance. CSPs are investing in SD-WAN orchestration solutions to provide customers with both the underlying WAN connectivity and the SD-WAN overlay service in one package as part of their enterprise offering, building on their strategy to tap into revenues in the fixed enterprise market. North America will have the largest share of the SD-WAN market until 2028, as CSPs in the USA and Canada are expanding their offerings in managed SD-WAN services. This market is set to experience strong growth in CSP spending over the forecast period as CSPs increase their partnerships with SD-WAN orchestration vendors to provide advanced SD-WAN automation features and capabilities that can be consumed over a SaaS model. Many of these vendors are starting to strengthen their portfolios by including security solutions such as SASE, security service edge (SSE) and firewall-as-a-service (FWaaS) on top of their SD-WAN solutions.

Multi-domain SDN control and automation will be a strategic pillar for future-proof transport networks

The convergence of IP/MPLS and optical networks will pave the way to transforming network economics by reducing the complexity and cost of running separate network domains. These converged networks can be further enhanced by SDN capabilities to enable services such as network slicing and network-as-a-service (NaaS) to improve the agility, flexibility and scalability of converged transport networks. Multi-domain orchestration spending is projected to grow at a CAGR of 26.4% to reach USD4.7 billion by 2028.

The Telecom Infra Project (TIP) is working on creating technical use case specifications and standards for open transport SDN architecture. Deutsche Telekom, MTN, Orange, Telefónica, Telia Company and Vodafone are already part of this initiative. The transformation towards a multi-layer, multi-domain transport network automation platform will be a stepwise approach. CSPs must first ensure that they have deployed domain-specific SDN controllers to operationalise a fully self-contained autonomous network domain as a first step in their transport network automation journey. CSPs who have already achieved this will then move onto deploying multi-domain network automation and service orchestration capabilities across multiple network domains.

Analysys Mason is at the forefront of the network automation and orchestration market forecast analysis

Our recent forecast report, Network Automation and Orchestration: worldwide forecast 2023–2028 provides detailed evaluation of forecast data across different network automation and orchestration market segments, product and professional services delivery types and specific regional developments, as well as an analysis of the key drivers influencing the market and recommendations for vendors and operators.

Article (PDF)

DownloadAuthor