Romania’s largest fixed operator, Digi, is using the tactics of a small challenger to increase its share

In most European countries, incumbents and large fixed operators have struggled to increase their share of fixed broadband connections because of price competition from small challenger operators, the growing demand for fibre and competing fibre networks, especially open access ones.

Digi, the largest fixed operator in Romania, is an exception to this trend. Digi has increased its share of fixed broadband connections by keeping tariffs low and expanding its fibre coverage, but it has also been able to defend a high EBITDA margin.

The Analysys Mason DataHub contains an extensive set of historical and actual data on the Romanian telecoms market. You can also find out more about the market in our Romania telecoms market report.

Digi in Romania is perhaps the only large broadband operator in Europe that has been rapidly increasing its fixed share

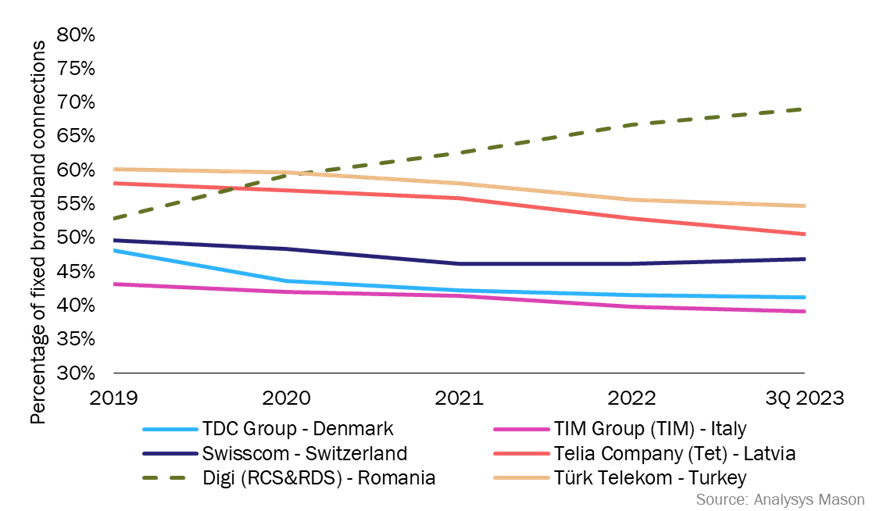

Incumbent operators in Europe have seen a decline in their share of fixed connections (Figure 1).

Figure 1: Fixed broadband connections market share, by operator, Europe, 2019–3Q 2023

Challenger operators are taking market share away from incumbents and large broadband operators by offering an attractive mix of lower prices, higher speeds and the promise of better customer service. For example, in Switzerland, Salt entered the fixed market in March 2019, and accounted for 6.6% of fixed broadband connections by 3Q 2023. This growth is attributed to Salt’s strategic promotion of fixed–mobile converged services and improved customer service.

Challenger operators are often only using fibre, rather than the mix of older copper technologies offered by the incumbents. With growing demand for fibre and the formation of open access fibre networks, challenger operators find it easier to provide FTTP/B services to a larger section of the population. For example, in Denmark, incumbent fixed broadband operator, TDC Group, offers DSL, cable and FTTP/B services. However, due to the growing demand for fibre, TDC has been losing market share to fibre-only challenger operator Waoo!, which is using multiple open access fibre networks to have better FTTP/B coverage.

Digi Romania started expanding its FTTP/B network early by acquiring smaller FTTP/B networks and investing in its own fibre network. As of November 2023, its FTTP/B network covered almost 100% of households in Romania.

Digi also continuously invested in updating its fibre network to reduce operational costs and to offer speeds up to 8Gbit/s. Digi’s FTTP/B network coverage is more extensive and its speeds are higher than those of its competitors in Romania. For comparison, Orange, the second-largest fixed broadband operator in Romania, has FTTP/B coverage of less than 40% of households while its highest speed offering is 2.1Gbit/s. With higher coverage and faster speeds at affordable tariffs, Digi has been able to continue to increase its number of revenue-generating units (RGUs).

Digi appears to be the most profitable operator in Romania, despite investing heavily in its fibre network and keeping tariffs low

Romania has three major fixed broadband operators, Digi, Orange and Vodafone, and a few smaller operators. However, Orange and Vodafone have not been able to compete with Digi’s tariffs, internet speed and FTTP/B coverage. Figure 2 compares the average price of fixed broadband per month for a 24-month contract offered by operators in Romania. Other fibre prices can be found in our tracker.

Figure 2: Operators’ average price per month for a 24-month fixed broadband contract in Romania

| Operator | Technology | Maximum download speed offering | Price per month |

| Digi | FTTP/B | 500Mbit/s | RON30 (EUR6.03) |

| 940Mbit/s | RON40 (EUR8.04) | ||

| 2.5Gbit/s | RON45 (EUR9.05) | ||

| 8Gbit/s | RON50 (EUR10.05) | ||

| Orange | FTTP/B | 480Mbit/s | RON31 (EUR6.23) |

| 940Mbit/s | RON37 (EUR7.44) | ||

| 2.1Gbit/s | RON52 (EUR10.46) | ||

| Vodafone | FTTP/B - HFC | 500Mbit/s | RON37.29 (EUR7.50) |

Source: operators' websites

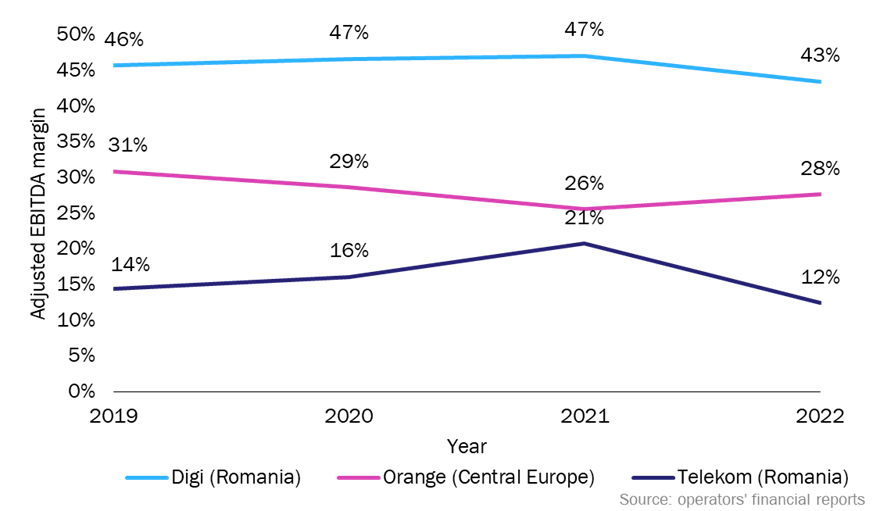

Digi offers higher speeds at relatively low tariffs. Orange reduced its prices in 2023 for 940Mbit/s offering (from RON42 (EUR8.50) to RON37 (EUR7.44)) and 480Mbit/s offering (from RON37 (EUR7.44) to RON31 (EUR6.23)) to better compete with Digi’s price offering for similar speeds. Digi has been able to keep fixed broadband prices low while maintaining a relatively high EBITDA margin because of its growing number of RGUs. For comparison, the EBITDA margin of Digi and Telekom in Romania along with EBITDA margin of Orange’s operations in Central Europe (Romania, Slovakia and Moldova) is compared in Figure 3.

Figure 3: Adjusted EBITDA margin of operators in Romania, 2019–20221

Digi’s strategy is to focus on increasing the number of RGUs to increase revenue while keeping tariffs low

Digi’s business strategy is to develop an advanced fixed network that offers quality service while offering competitive prices. Its major drivers for revenue growth are as follows.

- Increasing the number of RGUs organically or through acquisitions, and migrating existing RGUs to more than one service while adjusting the EBITDA margin.

- Careful management of expenses through negotiations on content, interconnection costs and other similar expenses.

- Updating technology to reduce operational costs, and conducting some operational/investment activities in-house to reduce expense.

Digi’s strategy is more reminiscent of a small challenger operator that offers full fibre than most large broadband operators.

However, other large operators and incumbent operators might face multiple challenges while adopting a strategy similar to that of Digi.

- Undercutting other operators on pricing would result in reduced revenue from existing customers as well as new customers, which may not be desirable. Lower pricing may also undermine the incumbent’s premium position in the market.

- The structure of wholesale markets in other countries would not allow incumbents to compete on price so aggressively.

- Regulators in other countries may not allow incumbents or large operators to introduce such levels of price competition.

Despite these challenges, Digi’s example does provide an alternative strategy that offers a potential counter to the standard strategy followed by most large operators. It is also interesting to note that Digi is expanding operations in other European countries by expanding its FTTP/B coverage in Spain and by commencing operations in Portugal in early 2024. Digi’s performance in these countries in the longer term would provide more evidence on how replicable its business strategy is in other European markets.

1 Romania accounts for 70% of Orange’s revenue in the Central Europe segment. Vodafone is not included in this chart as it does not report a comparable figure for Romania. Romania is included in Vodafone’s ‘Other Europe’ category, and generates around 21% of this segment’s revenue.

Article (PDF)

DownloadAuthor

Jonathan Daniel

AnalystRelated items

Tracker

European quarterly metrics: Western Europe 1Q 2025

Tracker

European quarterly metrics: Central and Eastern Europe 1Q 2025

Article

Telecoms operators are hoping to defend ASPU by bundling in AI products such as ChatGPT and Perplexity