Europe telecoms market update 1Q 2024: mobile ARPU declined significantly for some MNOs

This article highlights major market developments from Analysys Mason’s 1Q 2024 update of the European quarterly metrics for both Central and Eastern Europe and Western Europe. The full dataset for all 32 countries is available in the Analysys Mason DataHub.

Recent market developments in Europe include the following.

- Mobile ARPU is declining significantly for some mobile network operators (MNOs) in Western Europe.

- Fixed broadband providers are shutting down legacy services, such as DSL and 4G fixed-wireless access (FWA), and are launching 5G FWA.

- Fibre broadband take-up growth remains strong, but is beginning to slow down slightly.

- The decrease in the number of satellite TV connections is becoming more rapid in some countries.

Mobile ARPU fell significantly for some MNOs in Western Europe in 1Q 2024

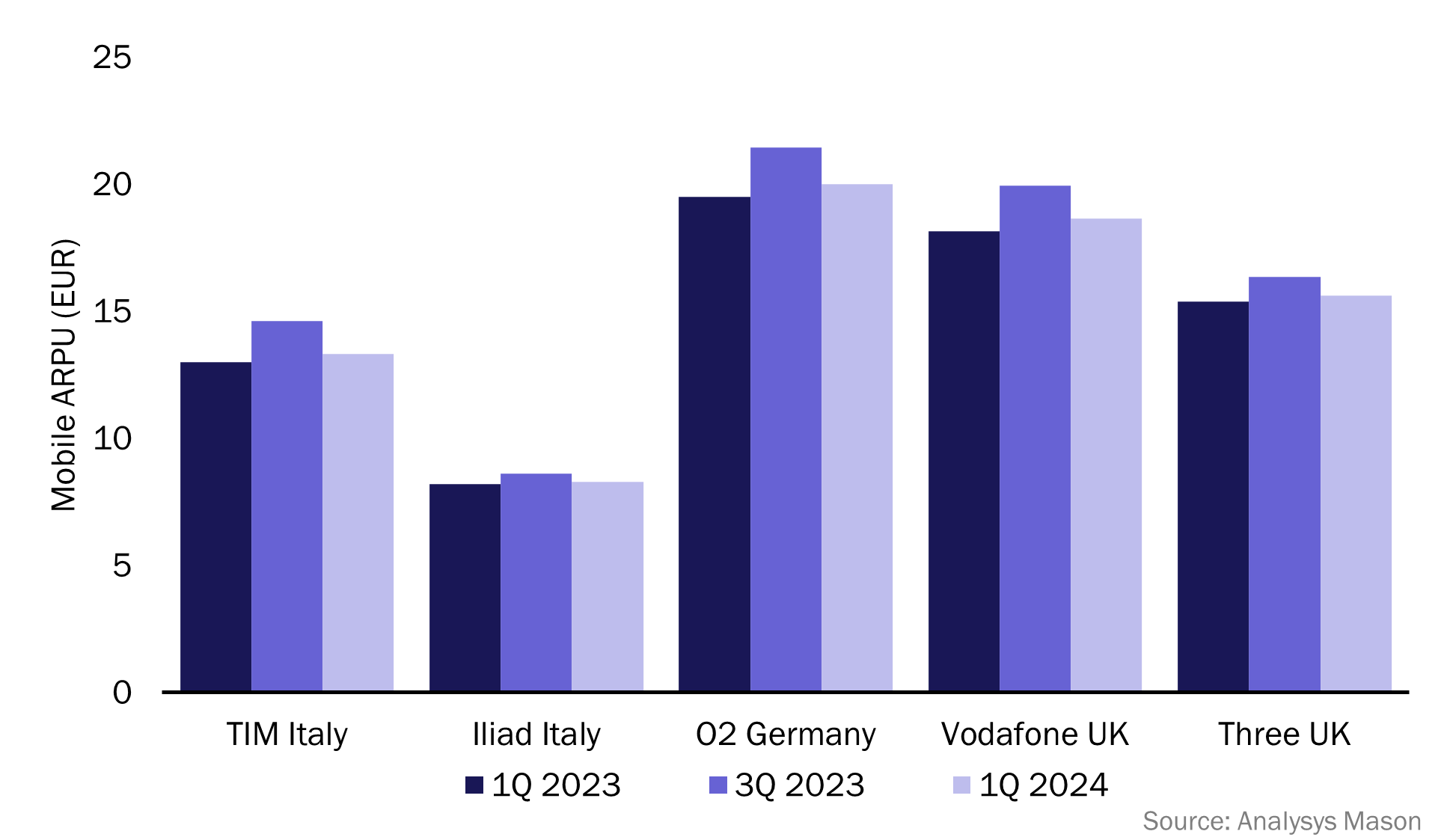

Mobile ARPU grew for many operators year-on-year in 2023 following price rises at the start of the year, as previously discussed. However, ARPU declined for over 70% of MNOs in 1Q 2024, and in some cases, these declines were particularly large. For example, ARPU for TIM and Iliad in Italy declined by 4.6% and 10.1%, respectively, while that for O2 Germany fell by 5.9% (Figure 1).

Figure 1: Mobile ARPU for selected operators, Western Europe

These declines were caused by customers seeking better deals to reduce their own costs. Customers who experienced mid-contract price increases had to wait until the end of their contract before they could change their plan. For example, Vodafone and Three in the UK raised prices in April 2023, which resulted in ARPU growth. However, ARPU then fell by 3.6% and 5.1%, respectively, in 1Q 2024, because customers came to the end of their contracts and moved to cheaper plans. Sky benefitted significantly from this trend; its revenue increased by 1.4% in 1Q 2024 due to a 1.8% increase in its number of connections.

Nonetheless, the long-term effects of the price increases have been positive for MNOs in Western Europe; nearly 75% achieved year-on-year revenue growth in 1Q 2024. Challenger operators and mobile virtual network operators (MVNOs) also achieved significant revenue growth because they gained customers by keeping their prices low.

Growth in the number of fibre connections in Western Europe was slower in 1Q 2024 than in 1Q 2023

The total number of fibre broadband connections in Western Europe grew by 4.0% year-on-year in 1Q 2024, compared to 5.4% year-on-year in 1Q 2023. The growth rate in Central and Eastern Europe remained largely unchanged (1.9% in 1Q 2024 and 2.0% in 1Q 2023).

The slowest growth in the number of fibre broadband connections was seen in Lithuania; the number of connections increased by just 0.3% year-on-year in 1Q 2024. This was due to the decision by Telia, the market leader in terms of the number of fixed broadband connections, to upgrade its DSL network to S-VDSL technology rather than focus solely on its fibre roll-out.

The fastest growth was found in Belgium; the number of fibre broadband connections increased by 14.1% year-on-year in 1Q 2024. The fibre share of broadband connections in Belgium is one of the lowest in Europe at just 9.9% in 1Q 2024. However, recent acquisitions, joint ventures and infrastructure-sharing agreements are allowing Belgian operators to accelerate their fibre roll-outs.

Operators are accelerating their migration to newer technologies

Many operators are updating their FWA offerings to move customers onto 5G plans

Over 30% of FWA connections in Europe used 5G technology by the end of 1Q 2024 following action taken by operators at the beginning of 2024.

- Telenor in Montenegro and Orange in Slovakia both launched 5G FWA. Telenor no longer advertises 4G FWA plans on its website.

- Vodafone Spain no longer has separate 4G and 5G FWA plans. All FWA customers will automatically get 5G services unless they are not yet covered by 5G, in which case they will connect to the 4G network.

- Telia in Lithuania discontinued its 4G FWA service entirely in 1Q 2024.

The number of satellite TV subscribers has started to decline more rapidly

Sky still has many subscribers of its satellite TV services in the UK. Indeed, it had 9.1 million satellite subscribers in 1Q 2024, which represents 82.9% of its total pay-TV subscriber base. However, its number of satellite TV subscribers fell by 1.4% year-on-year in 1Q 2024, compared to a year-on-year decline of 0.7% in 1Q 2023.

Sky announced, in January 2024, that it plans to cut 1000 jobs in the UK and Ireland in 2024. Most of these will be satellite installation engineers. This shows that Sky is expecting that the decline in satellite TV usage will continue to accelerate as customers move towards streaming video services.

This trend is also being seen in several other European countries. For example, the number of satellite TV subscribers in Slovenia fell by 15.2% year-on-year in 1Q 2024, having fallen by just 5.2% year-on-year in 1Q 2023. Other countries demonstrating this trend include Greece, Latvia and Lithuania (Figure 2).

Figure 2: Year-on-year growth in the number of satellite TV connections, selected countries in Europe

| Country | 1Q 2023 | 1Q 2024 |

|---|---|---|

| Greece | –11.9% | –14.3% |

| Latvia | –7.0% | –11.4% |

| Lithuania | –11.4% | –27.1% |

| Slovenia | –5.2% | –15.2% |

| UK | –0.7% | –1.4% |

Source: Analysys Mason

Article (PDF)

DownloadAuthor

Stephen Day

AnalystRelated items

Tracker

European quarterly metrics: Western Europe 1Q 2025

Tracker

European quarterly metrics: Central and Eastern Europe 1Q 2025

Article

Telecoms operators are hoping to defend ASPU by bundling in AI products such as ChatGPT and Perplexity