New-entrant FTTP players must carefully design their retail tariff strategies

Investment is pouring into new FTTP networks, but there remains a considerable amount of uncertainty about the best retail tariff strategies for new vertically integrated FTTP entrants that are building fibre networks and also acting as retail service providers. Such new FTTP entrants must formulate winning retail strategies that find the correct balance between growing ARPU and boosting take-up in order to maximise their return on investment in FTTP. In this article, we analyse the best retail tariff strategies for new FTTP entrants and examine the scope for retail price premiums and FTTP installation charges. We also consider whether new entrants should develop multiple retail tariff tiers. More information can be found in our report, Building winning retail FTTP propositions for new FTTP entrants.

New FTTP entrants should limit their retail price premiums

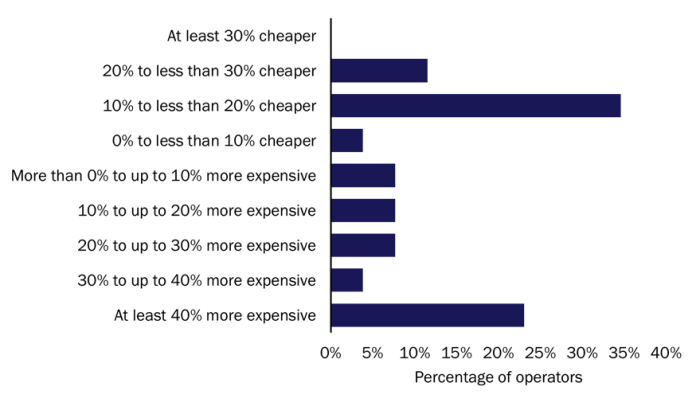

New FTTP entrants must consider to what extent they can charge higher prices compared to legacy xDSL and cable retail offers. This is important because xDSL subscribers remain in almost every market and a significant proportion of new FTTP entrants are likely to be overbuilding cable networks, particularly in urban areas. We assessed the retail tariffs of 40 new FTTP entrants in developed markets and noted a broad range of pricing strategies. Around half of the new FTTP entrants that we surveyed charged less than the largest cable operator in the same market for their entry-level plans (Figure 1). We believe that this is a sensible approach.

Figure 1: Prices of new-entrant FTTP entry-level plans relative to those of entry-level cable plans, worldwide, 2021

Source: Analysys Mason, 2021

There are several reasons why new FTTP entrants should try to limit their price premiums over legacy technology offers and competitors’ plans. Most incumbents in developed markets do not charge a retail price premium for FTTP compared to legacy technologies. Indeed, the entry of new players (and even the threat of new players) has driven incumbents to prioritise boosting subscriber take-up over growing ARPU. New FTTP entrants that charge a high price premium versus their competitors may also increase the risk of overbuild. Furthermore, not charging high price premiums for FTTP will allow new entrants to build up a retail subscriber base. This is important because these FTTP subscribers are likely to have a below-market-average churn rate.

Home working is likely to have driven an increased awareness of the importance of upload speeds, but it is not clear to what extent this will benefit new FTTP entrants compared to established cable operators. Our primary research indicates that upload speeds are still less important to consumers when making their broadband purchasing decisions than download speeds and price.

A retail tariff tiering strategy will benefit new FTTP entrants

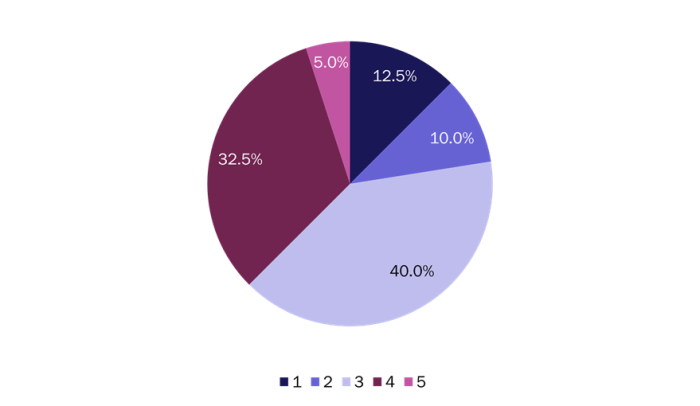

New FTTP entrants must decide whether to offer tiered tariffs with different price points and different features (such as higher speeds for more expensive plans) or a single retail plan. Most of the new FTTP entrants that we analysed do offer multiple retail product tiers (Figure 2) and we believe that this is a sensible strategy.

Figure 2: Number of FTTP retail offer product tiers by selected new entrants, worldwide, 2021

Source: Analysys Mason, 2021

Offering only just one product tier may make potential customers feel like they are being given an ultimatum and that they have little choice in their purchasing decision. New FTTP entrants that offer multiple product tiers will also be better able to segment demand and charge more for higher speeds for the small percentage of customers that are willing to pay more for such services. Data from Sweden and Denmark shows that 7% and 8% of FTTP subscribers, respectively, took gigabit speeds at the end of 2020. In New Zealand, around 18% of wholesale operator Chorus’s mass-market connections have speeds of 1Gbit/s as of the end of 2Q 2021. This is significant because the retail price for gigabit speeds is NZD10–20 (USD6.8–13.6) more per month than that for 100Mbit/s fibre (which accounts for the majority of mass-market connections). Offering multiple product tiers therefore allows new FTTP entrants to better monetise the segment of the market that is willing to pay more for higher speeds.

However, there is more that new FTTP entrants can do to improve their product tiering strategies. Product tiers in other industries are generally differentiated using around four features, but most of the FTTP new entrants that we analysed differentiate their higher tiers solely based on speeds. Incorporating additional features (such as better-quality Wi-Fi hardware) in higher tier tariffs could drive the take-up of these more expensive plans.

New-entrant FTTP operators should limit their installation and set-up fees

New FTTP entrants must also consider the installation and set-up fees that they charge. Our analysis of new entrants found that two thirds do not charge any installation and set-up fees. We believe that this is a good approach; if this is not possible, operators should limit their installation charges to no more than double the monthly subscription fee of their entry-level FTTP plan. The evidence is somewhat inconclusive, but our sense is that high installation and set-up fees can act as a significant drag on subscriber take-up. Indeed, FTTP installation charges in Japan are high (incumbent NTT charges USD174 for installation in a single dwelling unit and USD145 for installation in a multi-dwelling unit) and we believe that this is a factor in NTT’s low fibre take-up rates of around 40%. The use of MiFi and fixed-wireless by some Japanese households may be related to the high fibre set-up fees, though low fibre take-up rates may also be linked to the fact Japan has the oldest population in the world.

New FTTP entrants that are trying to build a positive reputation could also offer additional services, perhaps for free, alongside FTTP installations. This may include mesh Wi-Fi hardware installation or connecting in-home devices to the Wi-Fi network.

Article (PDF)

DownloadRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Article

Operators could maximise the capabilities of existing in-home equipment by offering Wi-Fi motion sensing