Fibre-to-the-room (FTTR) represents a promising new opportunity for fixed broadband operators

The pandemic has bought about great changes in how fixed broadband connections are used, and the take-up of applications such as video calling has grown phenomenally. End-user perceptions of the value of a fixed broadband connection have risen, and expectations for in-home network quality have increased. Fixed broadband operators must find new business opportunities that can take advantage of this changed landscape. The vendor community is proposing that fibre-to-the-room (FTTR) could be used to address this new market panorama, as demonstrated by Huawei’s launch of the technology during Mobile World Congress 2022. In this article, we describe how operators could use FTTR as part of their offers to subscribers.

Consumers’ and SMEs’ expectations of their fixed broadband connections have changed considerably over the last 2 years

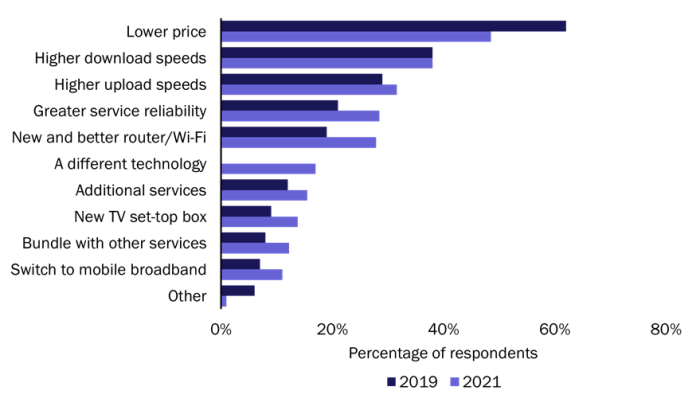

Our annual consumer survey shows that there has been a marked change in consumer preferences with regard to fixed broadband over the last couple of years. The results of our 2021 survey, conducted in August and September 2021, show that consumers are placing a greater value on service components such as reliability and new and better Wi-Fi routers than in previous years, and are less concerned by prices (Figure 1). The importance of such service characteristics is likely to have also increased within the small and medium-size enterprise (SME) community.

Figure 1: Most attractive aspects of a new fixed broadband package, Europe and the USA, 2019 and 20211

Source: Analysys Mason, 2022

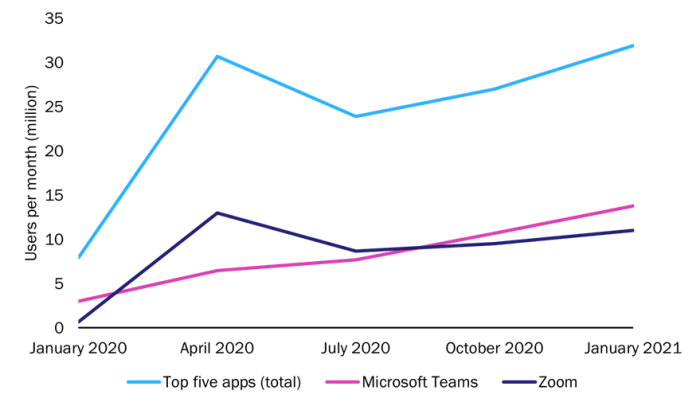

The increased importance of service characteristics such as reliability is unsurprising given that there has been a dramatic shift in fixed broadband application usage during the pandemic. The growth in the use of video calling is a prime example of this (Figure 2).

Figure 2: Number of users per month of the five most-used video communication apps, plus that of Microsoft Teams and Zoom individually, UK, January 2020–January 2021

Source: Analysys Mason, 2022

These changes mean that there will be opportunities for fixed broadband operators that can provide in-home network connectivity that caters to customers’ heightened expectations. FTTR, where fibre is extended into individual rooms within a property and then subscribers connect to multiple Wi-Fi access points, is one way in which operators can provide such connectivity. FTTR promises to offer superior quality compared to existing wired in-home networks, such as those using Ethernet or coaxial cabling. The technology has already been deployed commercially in China and operators elsewhere around the world are trialling it.

FTTR can build on and enhance existing multi Wi-Fi access point solutions

Some operators have sold their multi Wi-Fi access point solutions to 20–30% of their retail subscriber bases; this shows the strong demand for improved in-home connectivity. Operators have also found additional ways to monetise such solutions beyond selling the additional Wi-Fi hardware. FTTR deployments hold the promise of providing a premium experience that can enhance operators’ existing offers that are focused on in-home connectivity. Fixed broadband operators can pursue several strategies to monetise FTTR roll-outs.

- Offer in-home network speed guarantees. Some fixed broadband operators already offer home Wi-Fi speed or satisfaction guarantees that are tied to the sale of multi Wi-Fi access point solutions. Satisfaction guarantees mean that customers get their money back if they are not happy with the solution, but they lack tangible additional monetisable benefits. Home Wi-Fi speed guarantees, conversely, do offer consumers an extra benefit that can encourage them to pay more, but so far, these guarantees are only for low speeds. For example, BT’s Complete Wi-Fi proposition in the UK promises speeds of 10Mbit/s in every room of the house. FTTR offers the promise of guarantees for much higher speeds for which operators could correspondingly charge more. This has significant potential to boost ARPU. For example, BT charges GBP10 per month for its Complete Wi-Fi service, which includes mesh Wi-Fi hardware and its speed guarantee, compared to GBP29.99 for its entry-level FTTP plan. FTTR offers with higher speed guarantees could build on this and have the potential to provide considerable ARPU benefits.

- Introduce new premium service tiers. Some operators are already tiering their fixed broadband retail tariffs based on features related to in-home network quality in addition to, or instead of, using traditional speed tiering. For example, TIM, the incumbent in Italy, offers a Wi-Fi certification service in its mid- and high-tier retail FTTP plans, but not in its entry-level tariff. The service involves certifying that the Wi-Fi connection is sufficient to stream HD video in all rooms of the house. In this way, it is possible to envisage how FTTR would enable the creation of a new premium tier, which could command a higher price.

- Serve as a basis for new connected home services. Fixed broadband operators that focus on providing a high-quality in-home connectivity experience will be best-placed to capitalise on value-added services that rely on home Wi-Fi networks. Some operators already offer such value-added services when customers buy mesh Wi-Fi hardware. These services include connected home cyber security, where the protection is delivered through the customer’s router, and home Wi-Fi motion detection, where end-user Wi-Fi-enabled devices can be turned into motion sensors. The latter may have applications for home security and assisted living for the elderly.

- Offer premium FTTP installation. One barrier to FTTP take-up is the inconvenience of having fibre installed, which may, for example, require the customer to take time off work. Operators can resolve this challenge by offering additional services as part of a fibre installation. Such services could include the technician connecting end-user devices to the Wi-Fi network or giving advice on the optimal locations to install Wi-Fi hardware. Adding FTTR could further drive FTTP subscriber take-up and is a service for which operators could charge extra. For example, Orange in France already offers a Wi-Fi optimisation service in which technicians visit a property to improve Wi-Fi coverage. Orange’s service costs EUR89, which gives an indication of the potential revenue benefits that could be achieved from FTTP installations that include FTTR installation.

Overall, FTTR appears to be an opportunity worth considering for fixed broadband operators. We expect there to be considerable interest among the operator community and a significant number of launches over the coming months and years.

1 Question: “Which of the following factors would most attract you to a new fixed broadband package?” n = 6907 (2019) and 7713 (2021).

Article (PDF)

DownloadRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Article

Operators could maximise the capabilities of existing in-home equipment by offering Wi-Fi motion sensing