GenAI in the network: who is making real progress, and what is driving it?

10 June 2025 | Research and Insights

Article | PDF (4 pages) | Cloud and AI Infrastructure| AI and Data Platforms | AI

Generative AI (GenAI) adoption is rapidly expanding within telecoms operators’ network operations, evolving from the experimentation phase to real-world implementations. Telecoms operators are using GenAI to support automation, network and cloud modernisation, and their shift to new service and business models.

Analysys Mason, together with Google Cloud, developed the GenAI maturity index for networks − an in-depth assessment that tracks the evolution of GenAI in network operations. It explores operator priorities, implementation strategies, challenges, best practices and organisational shifts needed to support GenAI at scale. This article spotlights the study’s main findings.

GenAI adoption is at an early stage, but some operators are already leading the charge towards large-scale implementation

While GenAI adoption in network operations is still at an early stage, some operators are already paving the way for widespread deployment. As part of the study, we gathered input from 98 operators on their adoption of GenAI-driven use cases across Day 0, Day 1 and Day 2 network operations in multiple domains. These operators were benchmarked against a set of technological and organisational maturity criteria and plotted in Figure 1.

Figure 1: GenAI maturity index for networks, 2025

Our GenAI maturity index shows that a clear gap is emerging between operators advancing rapidly in the GenAI space and those lagging behind. While most operators are still in the early stages of implementation, 14% have already achieved the readiness to scale GenAI across their networks. These frontrunners (categorised as GenAI trailblazers and GenAI emerging adopters, primarily from the Asia−Pacific region) are setting the pace for the industry.

GenAI trailblazers stand out not just for early action but a strategic ambition supported by concrete organisational and operational execution:

- GenAI trailblazers have clear C-level sponsorship and strong conviction in the return on investment (ROI) of GenAI. They are integrating it into their systems across multiple network domains, including advanced cross-domain use cases.

- GenAI trailblazers are investing heavily in technical capabilities, underpinned by robust data strategies, common data platforms and governance frameworks.

- GenAI trailblazers have established centres of excellence (CoEs)1 to embed GenAI across their organisations.

GenAI emerging adopters are not far behind. They share a strong vision and executive backing but their transformation is more gradual. Many rely on vendors to fill capability gaps and are still developing in-house data foundations and AI talent.2 Some are also struggling to prove GenAI’s ROI, which may slow their progress.

Beyond these leading groups, 34% of operators are GenAI navigators, actively experimenting through proof of concepts (PoCs) and starting to shape their strategic approach. Meanwhile, over half of operators (52%) remain GenAI explorers, taking a wait-and-see approach. These operators are running small internal GenAI pilots but have yet to define a strategy or commit significant resources to developing GenAI further within their businesses.

Overall, the widening GenAI gap in network operations offers a glimpse into the future landscape of the sector. Operators that are taking early, strategic steps, particularly around vision, data foundations and organisational readiness, are better positioned to progress more rapidly and capture value ahead of the curve.

GenAI is moving fast in network operations, with use cases progressing from trials to widespread commercial deployment

GenAI adoption in network operations is well underway: 82% of operators in our study are trialling or using GenAI in at least one domain, with another 9% planning to follow within 2 years.3 Operators are zeroing in on mobile core and RAN for maximum impact, with plans to expand into transport and fixed access over time.

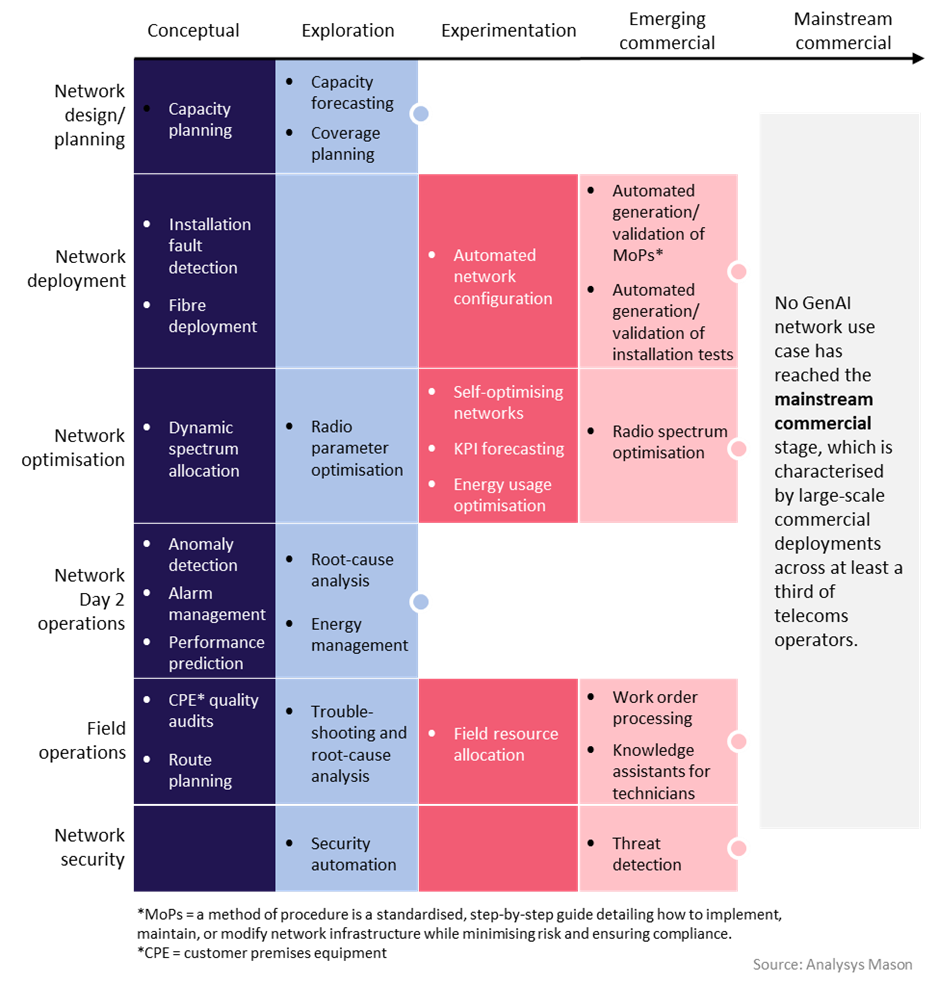

The maturity of GenAI use cases varies widely. As shown in Figure 2, most are in PoC or trial phases with none yet reaching full-scale commercial deployment. However, a few are already live at limited scale, indicating that real-world GenAI applications in network operations are no longer a hypothetical. A clear pattern is also emerging in the areas that operators are focusing on. The most strategically prioritised use cases centre on network optimisation, where value is most immediate and measurable. Radio spectrum optimisation in RAN stands out as the most mature, followed closely by energy management and self-healing and performance optimisation, indicating a strong potential for AI RAN.

Figure 2: GenAI maturity for network operations use cases, 2025

Progress is hindered by lack of GenAI skillsets, data readiness and uncertain ROI

GenAI momentum in network operations is growing, but so are the challenges. As operators move from experimentation to early implementation, many face roadblocks that threaten to slow progress and limit impact.

Model accuracy stands out as the most pressing challenge. Four in five operators report difficulty achieving expected GenAI performance, making it harder to scale use cases or demonstrate ROI. A major hurdle is tailoring models to the unique demands of network operations – something that directly impacts accuracy. While part of the issue stems from limitations in evolving GenAI tools, it is compounded by two key factors:

- Internal skill gaps. Model customisation and fine-tuning require advanced data science and AI engineering capabilities that are under development across much of the industry. Indeed, employee skillset is cited as the top organisational challenge, reflecting a broader shortage of GenAI expertise across data, AI and engineering functions.

- Data readiness constraints. Many operators have yet to fully meet the foundational data requirements needed for effective GenAI deployment. Gaps in data availability, quality and governance directly undermine model accuracy.

Unproven ROI remains a major barrier: 44% of operators, primarily those at earlier stages of maturity (GenAI navigators and explorers), struggle to justify the business case, which limits investment. While technology cost is a concern, there is more uncertainty around returns such as cost savings, agility or revenue uplift. This highlights a strong need for the industry to demonstrate the tangible benefits of GenAI use cases and share proven outcomes from advanced operators to drive broader adoption.

Operators should address organisational, data and ecosystem gaps to unlock GenAI’s full impact on network operations

The GenAI maturity index for networks shows GenAI advancing from a productivity tool into a central pillar of network operations. To overcome adoption challenges and accelerate progress, operators need a C-level-backed strategy grounded in strong data foundations, organisational transformation and robust vendor ecosystems. In particular, operators should:

- prioritise use cases aligned with business goals that deliver near-term ROI and can scale over time

- strengthen internal capabilities through upskilling, targeted hiring and establishing CoE to guide implementation and governance

- develop a unified data strategy with shared architecture to break siloes and enable secure, accessible, high-quality data

- select strategic partners with deep AI expertise, flexible toolsets and hybrid cloud support to accelerate adoption.

Analysys Mason’s Cloud and AI Infrastructure and AI and Data Platforms research programmes collectively cover the technologies and requirements for supporting AI workloads, from infrastructure (compute, networking, cloud software) to platforms (AI platforms, data, models). We monitor operators’ progress in adopting these technologies and analyse the vendor landscape and evolving value chain. We also support clients in developing thought leadership research, including benchmarking studies, total cost of ownership (TCO) and ROI analysis, survey-based reports and competitive assessments.

1 A centre of excellence drives scalable adoption of key technologies by defining strategy, developing use cases and standardising tools and practices across an organisation.

2 AI talent includes employees with the skills and expertise for developing and managing AI such as data scientists, AI/ML engineers, developers, etc.

3 While the operator sample in this study includes both Tier 1 and Tier 2/3 operators, it is generally weighted towards those active or interested in GenAI in the network and therefore is not fully representative of the broader operator landscape.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research DirectorRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads