IIoT: operators must build a strong network of relevant partnerships

Listen to or download the associated podcast

Cellular networks have largely failed to meet the needs of the industrial sector. 5G represents another opportunity for operators to enter this market. Indeed, the telecoms sector is developing 5G with new industrial use cases in mind. 5G is being promoted as a networking solution that will unify the three domains (in-building, campus and wide area) of the industrial sector and support diverse asset requirements.

Gaining acceptance of 5G for industrial applications, especially in-buildings and across campuses, will be extremely challenging. 5G is only one part of an industrial IoT (IIoT) strategy. Ahead of the future 5G technology releases, operators need to better understand and address the other aspects of IIoT.

The telecoms industry has developed 5G to resolve the networking complexity in industrial IoT

The strategic and economic rationale for 5G in industrial IoT hinges on the telecoms sector's vision to provide a single network in buildings, across campuses and beyond, and replace at least some of the established technologies, such as Wi-Fi, Ethernet and many proprietary wireless solutions. Decreased complexity should reduce costs, particularly operating costs. The telecoms industry also extolls other benefits. An overarching 5G architecture should provide greater agility and flexibility for industrial enterprises when connecting new devices and applications and will support many different types of device. 5G is able to support high-bandwidth, low-latency and bandwidth-constrained devices (massive IoT devices). These represent just a few of the benefits of 5G in the industrial sector, but the telecoms industry faces significant challenges.

Operators should not underestimate the challenges of delivering on the 5G vision for IIoT

The key challenges for 5G include the following.

- Existing network technologies and resistance to change. Industrial firms are reluctant to replace proven networking solutions.

- Upfront cost. Operators will incur a cost when deploying 5G, but operational costs are expected to be lower than the current operational costs of managing multiple networks across the three domains.

- Addressing negative perceptions of cellular technologies. Industrial firms that we have interviewed have cited issues such as poor coverage, poor propagation and inability to meet reliability requirements These perceptions are mainly based on the smartphone and wide-area network experience.

- Public and private networks. Enterprises in our research have been sceptical of public networks for supporting their business and mission-critical applications. Their network choices are determined by the private network model, which they perceive to be more secure and permit greater control of the network.

- Ecosystem. Operators especially, but also telecoms vendors and solutions providers, are not involved in the IIoT ecosystem. Therefore, industrial firms are unaware of the solutions that telecoms providers offer and do not perceive them to be viable partners.

The biggest challenge for operators is to build credibility in the industrial IoT ecosystem. Having the right partners will be instrumental in changing negative perceptions of cellular networks, showcasing new business models and encouraging migration away from entrenched networking technologies.

5G is only one component of an industrial IoT strategy

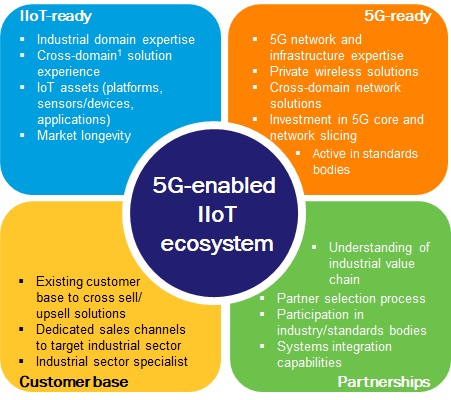

Based on interviews, we have evaluated technology suppliers that are involved in IIoT on four key criteria: IIoT readiness, 5G-readiness, existing IIoT customer base and their partnerships and visibility in the IIoT ecosystem. Some of the requirements to fulfil each of these criteria are outlined in Figure 1.

Figure 1: Key requirements for a 5G-enabled IIoT ecosystem

Source: Analysys Mason

1 The three domains of industrial IoT are in-building, campus and wide area. They are defined and explored in Analysys Mason's Industrial IoT: opportunities for operators.

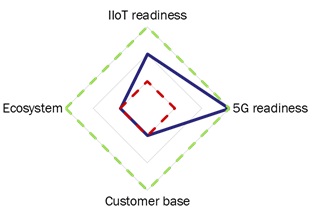

In general, operators do not score well in any of the above except for 5G readiness (see Figure 2), but they face challenges even in this category. Many of the features that will enable 5G to deliver for industrial IoT will only become available when Release 16 is commercialised (targeted completion 2020, commercialisation around 2022). In the interim, operators need to demonstrate some of the capabilities that 5G will bring, namely by deploying private LTE as a forerunner.

Figure 2: Operator score for each area of the four criteria2

Source: Analysys Mason

2 The positions on the spider charts relate to the average score of all companies in each group for each area of assessment. The red and green lines indicate scores that are below and above the average for all companies, respectively. The scores are based on qualitative data collected through research interviews.

Some operators have a strong set of IoT assets, but they are not necessarily tailored for the industrial sector. The operators that we interviewed are advanced in IoT but need to build more-tailored propositions to target the IIoT opportunity. Tailored propositions will require strong partnerships within the industrial ecosystem – precisely where operators are weak. They do not have an existing presence in the industrial IoT ecosystem that will be instrumental in building IIoT solutions and services but also the channels to market.

Interesting partnerships between operators and other companies to target the industrial sector are starting to emerge and include the following.

- Network infrastructure. China Telecom, Deutsche Telekom, Telefónica and Vodafone's partnerships with network vendors such as Ericsson, Huawei and Nokia to bring private networks to market.

- Public edge and cloud. Vodafone's partnership with IBM for cloud and AWS Wavelength for public edge. Also, KDDI, SK Telecom and Verizon for the latter. AT&T's partnership with Microsoft Azure.

- Industrial platforms. Orange's partnership with Siemens to leverage its Mindsphere platform and Telefónica's partnership with Geprom for its Legato Sapient platform.

- Hardware. Telefónica's partnership with ASTI and Deutsche Telekom's partnership with EK Automation both for automated guided vehicles (AGVs).

Operators have only recently formed some of these partnerships and it is too early to gauge the impact on their industrial IoT initiatives.

The IIoT market will be fiercely contested; operators need to prioritise their IoT sector strategy

Many operators have struggled to build new competencies in IoT, even for use cases such as fleet management where there are few substitutes for cellular. The industrial IoT opportunity will be more challenging. Operators will compete with companies that may be far better equipped to serve requirements and that already have a strong track record in serving the sector. Many will also have a large base of existing customers to address with new IoT solutions. Building a strong network of relevant partnerships will be paramount for operators to address market requirements and build the channels to market.

Downloads

Article (PDF)Latest Publications

Article

If Vodafone IoT is a success as an independent firm, other operators will also spin off IoT divisions

Forecast report

Italy: wireless IoT market trends and forecasts 2023–2032

Forecast report

Sweden: wireless IoT market trends and forecasts 2023–2032