IoT connections and revenue will grow at a steady pace despite supply chain disruptions and economic worries

The total number of wireless IoT connections worldwide will increase from 2.2 billion at the end of 2021 to 7.0 billion in 2031, according to Analysys Mason’s latest IoT forecast. The COVID-19 pandemic disrupted the IoT market in 2020, and had some knock-on effects in 2021 and 2022, but will have less of an effect from 2023. The slowdown in economic growth in many countries will also slightly hinder the growth of IoT connections and revenue.

Nonetheless, the IoT market continues to hold up reasonably well. IoT connections and connectivity revenue growth between 2022 and 2031 will be slower than in a ‘no COVID’ scenario, but we expect that the number of IoT connections will grow at a CAGR of 12%. In contrast, the number of wireless connections excluding IoT worldwide will grow at a CAGR of just 2% between 2021 and 2026.

The effects of the COVID-19 pandemic continue to disrupt the IoT market, but will ease during the forecast period

The COVID-19 pandemic disrupted the IoT market in 2020. Some IoT contracts were cancelled, postponed or the size of the deal was reduced, and some of the effects continued in 2021 and 2022. The COVID-19 pandemic had a delayed effect on IoT markets. This is because IoT connectivity contracts tend to be long term and there is often a 12–18 month delay between a contract being signed and the devices actually being activated. The cancellation of contracts that would otherwise have been signed in 2020 led to fewer new devices being activated in 2021 and 2022.

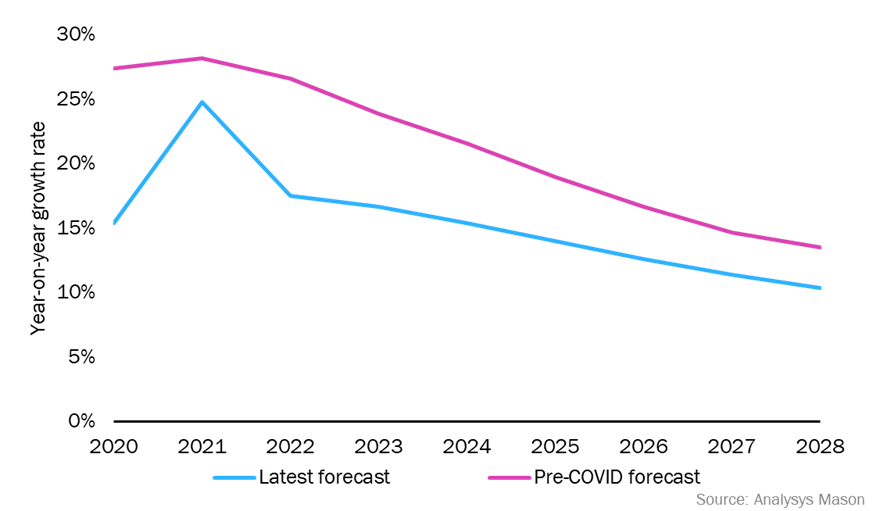

As such, the forecasts for IoT connections and connectivity revenue are lower than in our pre-COVID forecast in 2019 (Figure 1). For instance, in 2019 we predicted a connections growth rate of 24% in 2023, but our latest forecast predicts growth of 17% in 2023. We did see some ‘bounce back’ growth in 2021 – for instance, from large smart metering projects catching up after being paused in 2020 – but this was short-lived.

Figure 1: IoT connections, year-on-year growth by forecast date, worldwide, 2020–2028

Supply chain problems that first arose in 2020 continued to disrupt the IoT market in 2022. Chipset shortages disrupted the automotive market in particular: passenger car sales in the EU in 1H 2022 were 15% lower than in 1H 2021.1 Chipset shortages have since eased, helping the automotive market to begin its recovery in 2H 2022. Indeed, car sales were higher in each of the last 5 months of 2022 in the EU compared to a year earlier. We therefore expect any lingering effects from the pandemic to gradually fade during the forecast period.

The number of commercial contracts in the LPWA market is increasing and 5G IoT will emerge

The IoT market continues to develop despite the negative effects of the pandemic and there are a few positives for IoT players looking for growth opportunities.

The LPWA market. Growth in the number of LPWA connections has been hampered by slow network deployments, a lack of awareness and relatively high hardware prices, but these issues are gradually being addressed. Trials that were carried out shortly after NB-IoT and LTE-M networks were deployed are only just started to translate into significant contract wins (Figure 2).

Momentum is building particularly around smart metering, which will be boosted by stimulus funds for sustainability-based projects. A few high-volume contracts have emerged, such as Telstra’s deal with Intellihub to connect 4.1 million electric meters, worth AUD100 million (USD70 million). Numerous contracts have also been awarded to connect tens of thousands or hundreds of thousands of devices. These contracts may be small individually but will help to drive up the volume of LPWA connections. As such, we forecast that LPWA’s share of wireless IoT connections will increase from around 20% in 2021 to 50% in 2031.

Figure 2: Selected LPWA contract announcements in 2022

| Technology | Connectivity provider (country) | Number of connections | Use case (customer) | Date announced |

| NB-IoT, LTE-M | Telstra (Australia) | 4.1 million | Electric meters (Intellihub) | February 2022 |

| NB-IoT, LTE-M | Bite (Lithuania) | 1.2 million | Electric meters (ESO) | September 2022 |

| NB-IoT | Telefónica (Spain) | 650 000 | Water meters (Canal de Isabel II) | January 2022 |

| Sigfox | Thinxtra (Australia/New Zealand) | 250 000 | Keg tracking (Konvoy) | 2020–2022 |

| LoRaWAN | Connexin (UK) | 150 000 | Water meters (Severn Trent Water) | October 2022 |

Source: Analysys Mason

Public 5G.2 5G will account for a small share of total IoT connections (on public networks) but will be the main form of connectivity for a few IoT applications, such as connected vehicles and CCTV cameras. These applications have high-bandwidth, low-latency connectivity requirements that 5G is suited to. In contrast, the take-up of public 5G in other sectors will be slow because the extra cost of 5G modules will be prohibitive. Many operators and vendors have cited the current lack of availability and choice in the 5G device market as a barrier to 5G IoT adoption.

The automotive sector will drive the take-up of 5G IoT and will account for 80% of 5G connections in 2031. Figure 3 provides details of a few 5G automotive contracts already signed by large automotive manufacturers. 5G in the automotive sector will provide an opportunity for operators to boost their average revenue per customer (ARPC) because 5G will enable higher-value in-car services, such as in-car entertainment and over-the-air software updates.

Figure 3: Selected 5G connected car contracts

| Operator | Country | Car manufacturer | Car model year | Date announced |

| AT&T | USA | Ford | 2023 | September 2022 |

| Swisscom | Switzerland | BMW | 2022 | November 2022 |

| Verizon | USA | Audi | 2024 | February 2022 |

| Not disclosed | Not disclosed | Stellantis | 2024 | April 2022 |

Source: Analysys Mason

The IoT market offers opportunities despite the growing negative sentiment in some parts

The narrative around IoT has shifted in recent months, with a more pessimistic outlook and an acknowledgement that IoT has not lived up to previously inflated expectations. This continued in 2022 when several high-profile names, including Ericsson, Google and IBM, withdrew from or reduced their investment in the IoT market. However, plenty of opportunities remain in the IoT market for those with the patience to stick with it. These include using LPWA for utilities and smart city applications, high-value 5G applications, and the eventual link between public and private cellular networks.

1 ACEA (2022), Passenger car registrations: -14.0% first half of 2022; -15.4% in June.

2 Our forecast does not include NB-IoT in 5G, despite NB-IoT being classed as a 5G technology under 3GPP.

Article (PDF)

DownloadAuthor