Operators could generate USD530 million in revenue from IoT device management platforms in 2029

Businesses are expected to increasingly deploy device management platforms (DMPs) to automate the complete lifecycle of connected assets. As such, the DMP market will represent a USD2.5 billion opportunity for telecoms operators and platform vendors by 2029.

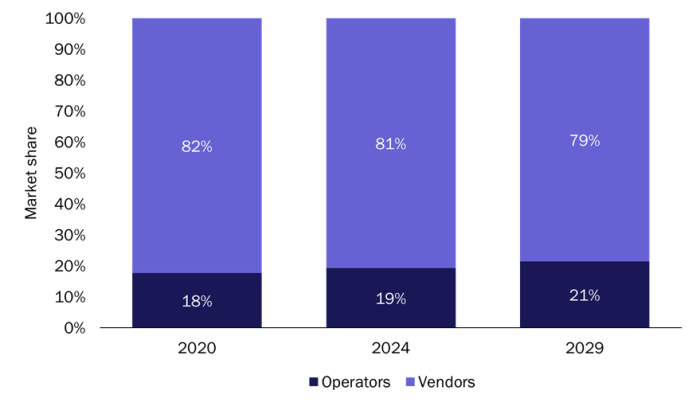

However, operators captured just 21% of the DMP market in 2020 and their share is expected to grow only marginally until 2029 due to competition from vendors that sell to enterprises (either directly or through channel partners such as system integrators). Operators should capitalise on their strong position in the connectivity market to differentiate their DMP offerings from vendors’ and should simplify the sales, deployment and integration processes for customers in order to increase their market share.

Operators currently hold a small share of the fast-growing DMP market, but they can do more to challenge vendors’ dominance

In our latest forecast report, we predict that operators could generate more than USD530 million from IoT DMPs and services in 2029, up from just over USD90 million in 2020.1 However, this represents a small share of the total DMP market, which will be worth USD2.5 billion by 2029 (Figure 1).

Figure 1: Operators’ and vendors’ revenue share of the IoT DMP market, worldwide, 2020–2029

Source: Analysys Mason, 2021

Vendors that sell DMPs to enterprises will continue to dominate the market and will command a higher average revenue per device (ARPD) than operators. Vendors have more sophisticated DMPs than those offered by operators. Their solutions are generally more suitable for IoT applications that have complex and stringent requirements, such as those found in the manufacturing and the utilities sectors. Vendors can therefore support more verticals than operators and can charge a price premium for their solutions and services.

Vendors are better positioned than operators to target enterprises that need to deploy IoT devices that do not require cellular connectivity. For example, Arm signed a contract with Korea Electric Power Company (KEPCO) to deploy 30 million smart meters connected with Wi-SUN and manage them with the Pelion IoT Platform. Nokia has deployed its IMPACT platform to enable companies in the mining, oil and gas and manufacturing sectors to manage their connected equipment over a private network or unlicensed LPWA networks (such LoRaWAN).

Mobile network operators also face competition from connectivity disruptors such as MVNOs that are expanding their IoT platform horizontal capabilities and incorporating device management functions. MVNOs are either building DMPs internally (1NCE and KORE Wireless have done this, for example) or are partnering with specialist vendors to augment their IoT platforms (as Cubic Telecom and PCCW Global have done). Connectivity disruptors pose a threat to operators’ ambitions in the DMP market if they can succeed in growing their share of the connectivity market.

Most operators use third-party solutions from vendors to provide device management capabilities

Many operators are keen to expand their platform capabilities in order to play a greater role in the IoT value chain. However, the complexity and cost of developing an internal DMP is prohibitive for many. Instead, most of them opt to integrate device management capabilities from third-party vendors into their connectivity management platforms or white-label vendor platforms (as Deutsche Telekom did with PTC). Only a few operators with large addressable markets and strong ambitions for IoT revenue growth (such as AT&T and Verizon) have developed their own DMP internally (Figure 2).

Figure 2: Examples of operators’ IoT platforms with device management capabilities2

| Operator | Country | Technology provider | Solution |

|---|---|---|---|

| AT&T | USA | Internal | M2X |

| China Mobile | China | Internal | OneNET |

| China Unicom | China | Ayla Network | Ayla IoT platform |

| Deutsche Telekom | Germany | Software AG | Cumulocity |

| KDDI | Japan | Internal | KDDI IoT Cloud Standard |

| Oi | Brazil | Internal | Oi Smart |

| StarHub | Singapore | Nokia | IMPACT |

| Telstra | Australia | Ericsson | IoT Accelerator Platform |

| Verizon | USA | Internal | ThingSpace |

Source: Analysys Mason, 2021

Operators should make it easier for companies to procure and deploy DMPs in order to grow their share of the IoT DMP market

Operators should work to reduce the obstacles to DMP adoption in order to grow their share of the DMP market. Many enterprises that are looking to deploy IoT solutions for the first time do not have a thorough understanding of device management, and may be less willing to pay for such capabilities if they do not perceive their business value. Operators should help to educate customers about the benefits of a DMP and demonstrate its benefits, for example, by publishing case studies and running proof-of-concept demonstrations.

Most operators procure their DMPs from software and hardware vendors, so it will be difficult to differentiate their offerings from those provided directly by the suppliers on technical features alone. The following examples show what operators could do to differentiate their products.

- Provide easy-to-deploy solutions. Operators could ease the process of connecting customers’ device estates by hiding much of the complexity associated with the deployment process. For example, Deutsche Telekom launched the ‘IoT Solution Builder’ online portal in July 2020 to enable SMEs to procure plug-and-play IoT solutions. It combines connectivity, device management and certified hardware.

- Simplify the pricing model. Operators could introduce a simple and clear offer for connectivity bundled with device management. For example, IoT MVNO 1NCE introduced a device management service in July 2020 that is offered for free with its low-cost flat IoT connectivity plan.

- Provide localised support. Operators should be able to offer better support during the design, implementation and integration phases of a DMP than most platform vendors thanks to their strong local partnerships with technical support teams and their established commercial relationships with local businesses.

The DMP market is becoming increasingly crowded, and operators will have to experiment with new business models as device management becomes commoditised and connectivity revenue per IoT connection continues to fall. They should develop capabilities, either internally or through partnerships, to support the deployment and integration of their IoT DMPs. These two elements are crucial for operators to differentiate their DMP propositions from vendors’ and secure a sizeable share of the growing IoT DMP market.

1 For more information, see Analysys Mason’s IoT forecast: revenue from device management platforms 2020–2029.

2 For more information, see Analysys Mason’s IoT platform operator contracts tracker.

Article (PDF)

DownloadRelated items

Forecast report

Cellular data traffic from connected cars: worldwide forecast 2023–2029

Article

Other operators could follow AT&T in shutting down NB-IoT, but the technology is not obsolete yet

Article

Business trends to watch in 2025: telecoms operators will explore different models to drive revenue growth