Is Satcom Pricing Reshaping the Telco Industry Landscape?

Telecommunication (Telco) companies have traditionally focused on expanding terrestrial infrastructure such as fiber and cellular networks to address the growing demand for connectivity across regions. The trend is changing rapidly as Telco players are increasingly integrating Satellite Communication (Satcom) solutions in their networks to extend coverage and diversify services. The key driver for this shift is the Satcom ecosystem investing in low cost Mbps capabilities.

For example, NSR in its Satellite Capacity Pricing Index, 9th Edition report noted that Latin America is witnessing growth in Backhaul demand because of Satcom capacity price erosion aligning with the addressable demand. Recently, Brazilian Mobile Network Operator TIM Brasil extended its network from urban centres to the countryside covering all 5,570 cities in Brazil, using Gilat’s technology. By utilizing their existing infrastructure and expertise, Telcos are entering into partnerships, acquisitions and investments within the Satcom sector. Is this reshaping the industry landscape and market dynamics?

The overall Satcom industry is becoming extremely competitive as players in GEO (Geostationary Earth Orbit) and Non-GEO continue to add efficient HTS (High Throughput Satellites) capacity in orbit. There has also been a significant shift in the Satcom industry, positioning from wholesale capacity sales to providing downstream end-to-end services. Telco players, in addition to addressing cellular markets, are looking to diversify their solutions into disaster management, IoT connectivity, digital transformation, enterprise solutions and others, utilizing the ongoing advancements of Satcom solutions. While the Satcom industry is addressing the bandwidth supply challenge, upstream satcom capacity pricing remains a pivotal variable, which will determine the pace of Satcom integration with Telcos.

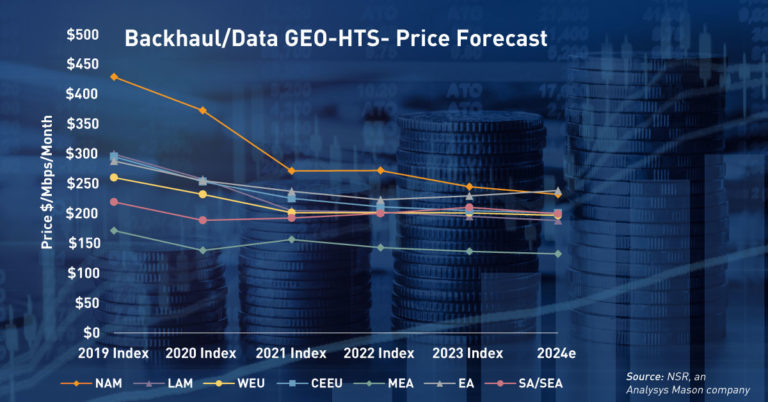

According to NSR’s Satellite Capacity Pricing Index, 9th Edition report, Backhaul GEO-HTS pricing is estimated to decline organically as more capacity is added in orbit. Currently, there is a wide variance in pricing as the rate of uptake is different across various regions. In the coming years, however, as more solutions are available especially in Non-GEO (mPower, OneWeb, others), pricing will converge closer to $100/Mbps/Month. On the FSS (Fixed Satellite Service) side, Ku-band for Backhaul pricing is estimated to fall by 4.8% on a global average in 2024 owing to HTS competition. Contract renewals in North America trend towards a 4-6% reduction but with volume uptake. Latin America is witnessing soaring demand for backhaul after significant price drops. Mobile Network Operators (MNOs) expect more price reduction with HTS solutions, but the supply crunch is cushioning the price erosion for Ku-band.

While Telco players continue to invest in terrestrial infrastructure, they also understand the benefits of Satcom advancements leading to better price economics and bandwidth supply. It is evident from recent partnerships such as OneWeb & Telstra, Hughes & Stargroup, OneWeb & Veon, Tim Brasil & Gilat, SES & Emirates Telco Du, SES & Claro Brasil, Axess Networks & ST Engineering, Digicel & SES, and many more are to come. NSR expects competition to infuse Satcom solutions in Telco networks to intensify in the next 3-5 years as more such partnerships are executed, and price erosion unlocks demand elasticities.

The Bottom Line

Is Satcom pricing reshaping the Telco industry landscape? Most definitely!

Satcom Pricing is a function of in-orbit cost per Mbps, supply-demand dynamics and competition over a region. Clearly, the pricing curve is moving downwards owing to advancements such as Starlink, OneWeb, ViaSat, etc. Resultantly, it is reshaping the telco industry by offering affordable solutions and expanding connectivity beyond their traditional coverage areas. Telcos are also looking to leverage Satcom to tap into new markets, diversify services, and remain competitive. As Satcom continues to deploy cost-effective HTS capacity, telcos must adapt to the evolving landscape, form strategic partnerships, and invest in infrastructure to fully capitalize on the potential of Satcom technology and capacity influx. While evolving Satcom Pricing offers an attractive business case, Telcos must balance their investments across Satcom and terrestrial infrastructure based on key variables such as technology readiness, lead time, overall cost, appropriate partnerships, demand, revenue models and many other elements to remain well-positioned and competitive.

Overall, efficient Satcom pricing leading to Satcom Integration into the telco industry is setting the stage for a connected future, enabling global connectivity, bridging the digital divide, and digital transformation across sectors, in the coming years.

Author