Operators with IoT divisions will watch KORE Wireless’s NYSE listing closely

Listen to or download the associated podcasts

KORE Wireless (KORE) announced, on 12 March 2021, that it will list on the NYSE following a merger with a special purchase acquisition company (SPAC), Cerberus Telecom Acquisition Corp (CATC). This deal is hugely significant for the IoT connectivity sector; KORE will be the first publicly traded IoT connectivity specialist. The enterprise value of KORE, at USD1 billion (or 18 times its 2020 EBITDA), also sets a valuation benchmark for others.

The listing and associated valuation give telecoms operators with large IoT divisions strong motivation to explore new ways of realising the value of these divisions.

The transaction sets KORE up for further acquisitions

KORE will acquire both cash (USD484 million) and new shareholders (including KOCH Industries and BlackRock) as part of the deal, which is expected to close in 3Q 2021. The deal will also enable KORE to use its stock to make further acquisitions, which is a central part of its growth plan.

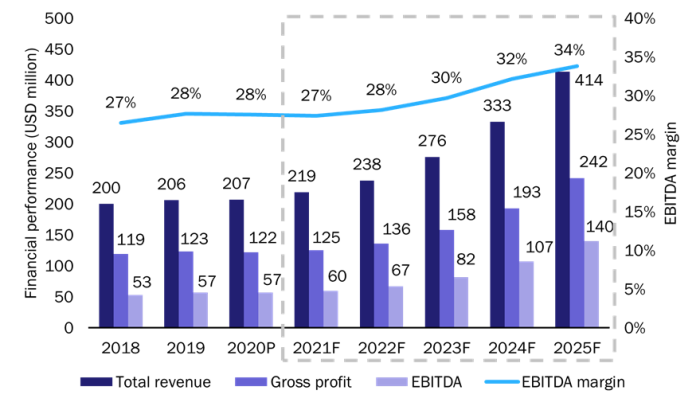

The investor presentation on the deal provides plenty of information on KORE’s business and its plans. Figure 1 shows the key data for KORE’s business. Note that the chart does not include the impact of any future acquisitions, but KORE hopes to add USD245 million in revenue by 2025 by buying other IoT firms. The investor pack lists, but does not name, ten targets, six of which are in the USA. For more on KORE’s M&A strategy, see Analysys Mason’s Consolidation among IoT connectivity disruptors will have major implications for operator IoT business units.

The investor presentation does not provide information on the revenue per connection, but KORE had 12 million SIMs at the end of 2020, so we calculate that this figure is approximately USD1.5 per SIM per month.

Figure 1: Past and forecast financial performance, KORE, 2018–2025 (P = provisional, F = forecast)

Source: KORE, 2021

The following points stand out.

- Total revenue has grown only slightly in the past 3 years (from USD200 million in 2018 to USD207 million in 2020). We explore the breakdown of this revenue below.

- KORE is hoping for rapid growth in the future: it forecasts that revenue will double between 2020 and 2025, at a CAGR of 15%.

- Gross profit and EBITDA are also increasing slowly. The figures for 2019 and 2020 for both measures were almost identical.

- The implied EBITDA multiple for 2020 is 18. Other IoT MVNOs have changed owners for similar multiples. This figure will fall to 15 in 2022 and 7 in 2025 if KORE achieves its plan of sharply increasing its EBITDA and EBITDA margin, from 28% in 2022 to 34% in 2025. For comparison, a typical telecoms operator in a developed market trades at an EBITDA multiple of around 6–7.

KORE’s forecasts for IoT Solutions revenue look ambitious

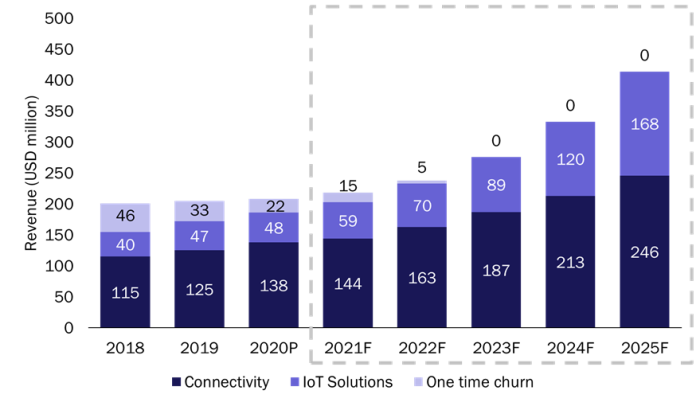

KORE has split its business into the following three categories.

- Connectivity (described by KORE as connectivity-as-a-service (CaaS)). This encompasses the ongoing connectivity revenue for its business, including that from connectivity management. KORE is hoping to grow the revenue in this category from USD138 million in 2020 to USD246 million in 2025. This gives a CAGR of 12%, which is slightly higher than the 2018–2020 CAGR of 10%.

- IoT Solutions (including device management, security and location-based services). KORE forecasts that its IoT Solutions revenue will grow from USD48 million in 2020 to USD168 million in 2025. The forecast CAGR of 28% is significantly higher than the 2018–2020 CAGR of 10%. IoT Solutions accounted for 23% of the total revenue in 2020; this share is forecast to grow to 41% by 2025. We assume that this category will also include products for vertical markets and private networks (for which it is developing a solution). KORE is aiming to generate USD300 million in connected healthcare revenue in 2025, though this would presumably come from acquisitions as well as existing assets.

- One time churn. This includes the revenue from contracts that have not been renewed (a legacy of past acquisitions of Raco and Wyless). These contracts were worth USD46 million in 2018, but this will decline to zero by 2023. The category is an unusual one, and KORE will need to explain to potential investors how these One time churn figures differ from standard churn.

KORE presumably hopes to make its revenue performance in the Connectivity and IoT Solutions categories look stronger by separating the impact of ‘one-time churn’ (Figure 2). However, it expects a significant improvement in the combined Connectivity and IoT Solutions business lines, even when the One time churn numbers are excluded. Indeed, annual revenue growth for Connectivity and IoT Solutions is forecast to be 17% during 2020–2025, compared to 10% between 2018 and 2020.

Figure 2: Revenue by category, KORE, 2018–2025 (P = provisional, F = forecast)

Source: KORE, 2021

The KORE listing could have a wide-reaching impact on the market

The KORE NYSE listing will have implications for more companies than just KORE itself. KORE will be the first listed company that looks like the IoT division of a telecoms operator and will get close attention from such players as a result.

IoT divisions may come under new scrutiny as operators look at ways of realising their value. Telefónica has already started this process by splitting its IoT division into a separate legal entity, and it may be open to outside investors. Others may make similar moves. At a minimum, operators may want to provide investors with more information on their IoT divisions in an attempt to grow their valuations.

Operators will be keen to show how their IoT divisions compare with KORE. For example, the IoT divisions of the big operators are far larger than KORE. For example, Vodafone’s IoT division has roughly ten times as many connections and generates five times as much revenue as KORE. Deutsche Telekom, Orange, Telefónica, and all operators in the USA and China have more connections and generate a higher IoT revenue than KORE. Even Telstra, which has fewer connections (4 million), has similar IoT revenue (USD171 million in 2020). Few operators report IoT revenue, but those that do are reporting growth rates in line with, if not faster than, that of KORE (typically 5–20% in 2020).

The steps that these operators take with their IoT divisions will depend, at least in part, on the success of KORE as a publicly traded company. Its performance will be closely watched.

Article (PDF)

DownloadAuthors

Tom Rebbeck

Partner, expert in TMT consumer and business servicesRelated items

Forecast report

Cellular data traffic from connected cars: worldwide forecast 2023–2029

Article

Other operators could follow AT&T in shutting down NB-IoT, but the technology is not obsolete yet

Article

Business trends to watch in 2025: telecoms operators will explore different models to drive revenue growth