Starlink could significantly change fixed broadband services in poorly served locations

22 September 2020 | Research

Article | PDF (4 pages) | Data, AI and Development Platforms

LEO satellites may be of interest to operators that offer mobile services

Low Earth orbit (LEO) satellites are becoming increasingly important for the telecoms industry due to their potential to deliver 20–50Mbit/s or greater broadband worldwide. Indeed, this has driven major technology companies to enter the telecoms market, notably Elon Musk’s SpaceX with its Starlink project. LEO satellites operate 500–2000km above the earth and travel at 27 000km/h. They offer high data throughput and low latency (as low as 20ms). This high data throughput is achieved by using high wireless frequencies in the Ka band and employing enormous numbers of satellites (thousands to tens of thousands more than in previously deployed LEO fleets).

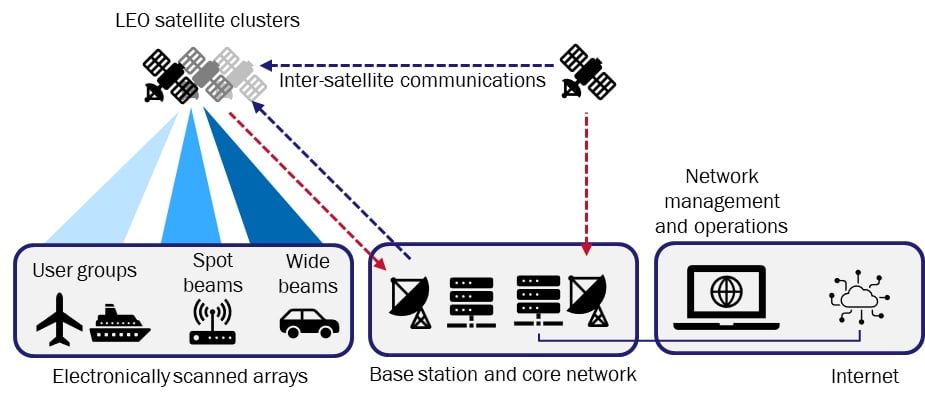

The main components of LEO satellite systems are as follows (see Figure 1).

- Satellites. LEO satellites are smaller than geostationary satellites, but many more are needed for worldwide coverage. The low orbit reduces the latency in services, lowers the launch costs and enables higher data throughput compared to previous generations of satellites. However, hundreds or even thousands must be deployed to achieve this high throughput and provide coverage worldwide. SpaceX launches 60 satellites at a time, and nearly 20 launches a year. It has over 700 satellites in orbit, significantly more than others and other operators are unlikely to catch up.

- Ground stations. Satellites have traditionally been accessed and tracked via parabolic-dish antennas. This equipment is poorly suited to LEO constellations, in which numerous satellites rapidly and simultaneously cross over the ground receiver’s field of view. New antennas with electronically scanned arrays (ESAs) can track large numbers of satellites without physical movement. Ground stations can incorporate ESAs in order to route connectivity services back into telecoms providers’ terrestrial networks.

- User equipment. ESAs currently cost several thousand US dollars, though manufacturing costs may become substantially lower as the volume produced increases. This is possibly the single most significant issue to overcome in order to use LEO satellites for residential services. An antenna module needs to cost just USD15 in order to be able to create a USD200 user terminal (modem and a battery). This is something that Starlink has achieved with its in-house ESA solution.

Starlink and OneWeb (another LEO satellite project) have both filed blanket licence requests with the FCC for 5 million and 1.5 million user terminals, respectively. Amazon has announced its intention to file a request to enable its LEO project Kuiper to connect “tens of millions” of users around the world.

Figure 1: Illustration of the components of LEO satellites

Source: Analysys Mason, 2020

There are some key considerations for the telecoms industry

Starlink, owned by SpaceX, is one of the three main LEO satellite constellations; the others are run by Telesat and OneWeb. Some other credible solutions are starting to enter the market; the most notable of which are Amazon’s Kuiper and the Hongyun Project from China (see Figure 2).

Figure 2: Key LEO satellite-based networks

| Name | Number of satellites in orbit and launches planned | ITU filing to launch | First launch | Focus | Status | Ownership |

|---|---|---|---|---|---|---|

| Telesat |

Plan for 298 by 2023 in the Ka/Ku band 1 satellite launched as of September 2020 |

Approved in the USA | January 2018 | 4G/5G backhaul | Live testing | Canada-based, public listed company |

| Starlink (SpaceX) |

775 Ka-band satellites 60 satellites are launched at a time and there are typically 2 launches per month (though there were 3 in August 2020) |

12 000 approved, 30 000 more applied for | February 2018 | Consumer and commercial services | Live testing | SpaceX – backed by funds and venture capital |

| OneWeb |

74 in the Ka band Plan to launch 26–30 per month |

650 approved and potential application for 48 000 more | February 2019 | Consumer internet services | Pre-live testing; expected to go live in late 2021 | Bharti (55%) and the British government (45%) |

| Hongyun Project (H-Cloud) | 1 | 320–864 proposed | December 2018 | Information not available | Pre-testing | Chinese state government |

| Kuiper (Amazon) | None | 3236 proposed | Not yet launched | Information not available | Pre-testing | Amazon |

Source: Analysys Mason, 2020

The failures of LEO satellite projects, including Globalstar, Iridium, LeoSat, Skybridge and Teledesic, and the bankruptcy of OneWeb, show that this is a high-risk market. However, the rewards will be significant if the goal of providing high-speed, low-latency internet to any location in the world can be achieved. All of the LEO satellite providers in the table above are targeting enterprise services such as connectivity for airlines and remote oil and gas facilities, as well as corporate networks, government and broadcast services. In addition, many are selling mobile backhaul and IoT services to telecoms providers, but Starlink also targets consumer services and will compete directly with terrestrial telecoms service providers.

The key considerations for the telecoms industry are as follows.

- LEO satellites could be used to provide fixed broadband services worldwide, and may be used to replace those with connection rates of less than 30Mbit/s. This is a significant proportion of all broadband services. Even in developed markets such as the UK, 5% of households only have access to broadband with speeds of less than 10Mbit/s.

- LEO satellite projects have had a high failure rate, but Starlink’s resources suggest that it is likely to successfully deliver a worldwide broadband service. Its 700+ satellites in orbit are proof that it has gone further than other projects to date.

- Current high-speed data services (as found in urban areas) for fibre, DSL, 4G and 5G will remain more competitive (in terms of performance and cost) than LEO-based services. The current download speeds for Starlink are only 36–60Mbit/s.

- Starlink and others will need to apply for telecoms licences if they wish to launch services such as voice. Starlink has applied to become a basic International Telecoms Services provider in Canada. It has received approval to provide 1 million terminals in the USA and has expanded its request to 5 million terminals (about 4% of households).

- LEO satellites could also be used for other remote services such as those linked to marine transport and government services.

The potential of LEO satellites is great, but there are risks

SpaceX is significantly ahead of all other LEO satellite players; it has more satellites and a faster launch rate. It is expected to have launched over 1000 satellites by 1Q 2021 and will therefore be able to offer services worldwide. However, SpaceX will also need to build more ground stations; one estimate suggests that 123 ground stations are required for 4400 satellites.

Current tests indicate that LEO satellite-based services can provide bandwidths that are comparable to those from DSL or fibre-to-the-cabinet. The costs for such services are not clear, but it is thought that they will be around USD80 per month, with installation costs of USD200–300. SpaceX has told investors that it is using Starlink to target a USD1 trillion addressable market; this represents two thirds of the total fixed and mobile revenue worldwide in 2019, thereby demonstrating SpaceX’s ambition.

However, not every telecoms regulator will grant SpaceX access to their market for political or economic reasons. Furthermore, SpaceX only has offices in the USA, and there is no easy way to build further offices quickly in order to supply, install and bill for services on a worldwide basis. Local co-operation with telecoms operators is therefore likely to be the preferred go-to-market model. In addition, this scale of LEO satellite constellation has never been tested, managed or used, and there may be unforeseen issues before full services can go live.

Download

Article (PDF)Author

Justin van der Lande

Research DirectorRelated items

Strategy report

Retrieval-augmented generation: considerations for GenAI platform vendors targeting telecoms operators

Article

Telecoms operators’ approaches to GenAI solutions should be shaped by priorities, experience and budget

Tracker

Public cloud provider and CSP partnership tracker 1H 2024