Operating groups in MENA reported strong results in 2022 driven by favourable macroeconomic conditions

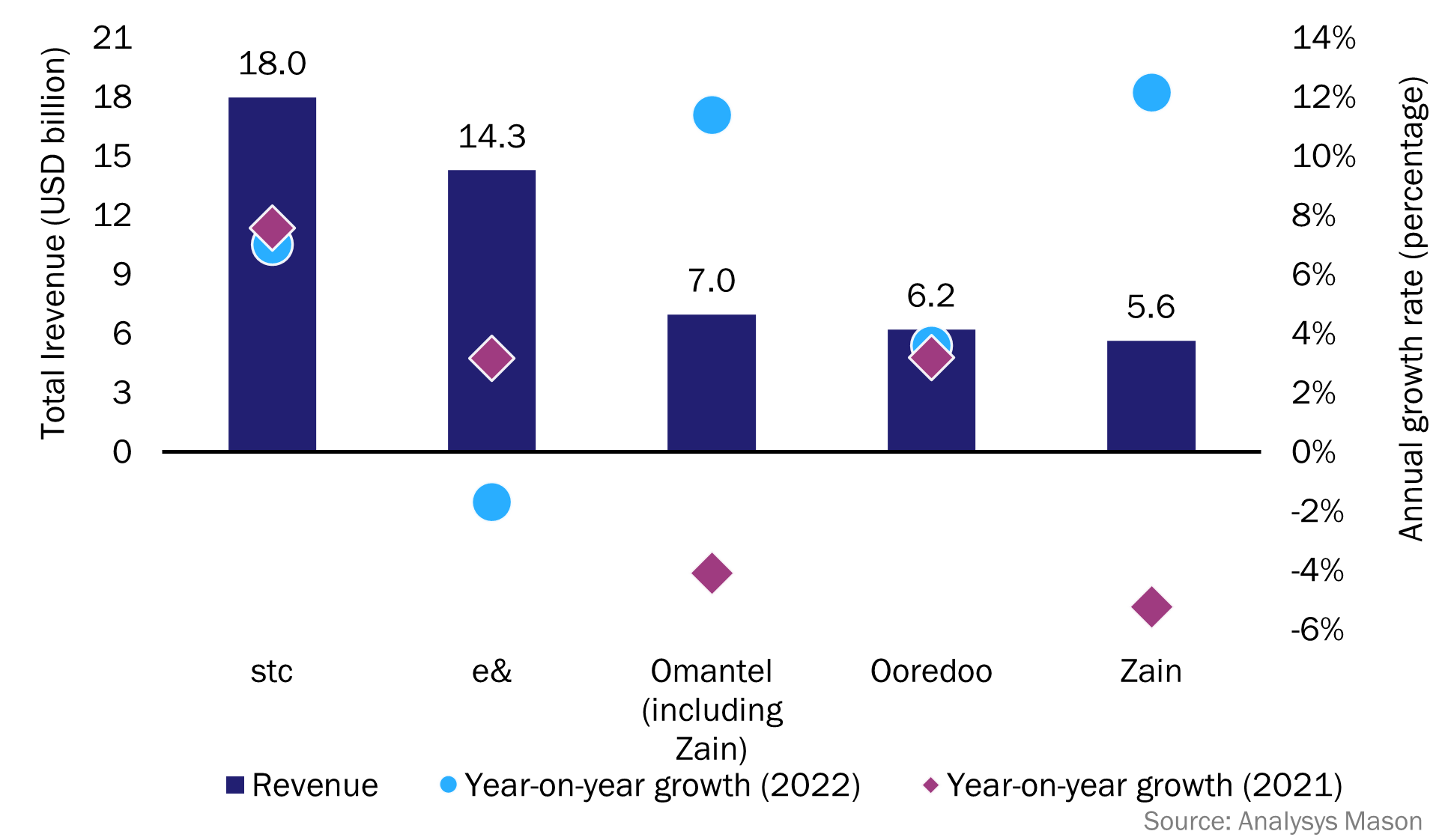

In 2022, e& (formally Etisalat Group) was the only major operating group in the Middle East and North Africa (MENA) that reported a year-on-year decline in revenue in USD terms. Ooredoo and stc continued to perform well, while revenue for Omantel and Zain increased in 2022 after contracting in 2021.

Improved macroeconomic and demographic conditions, as well as the growing demand for data connectivity and business ICT services, underpinned most of the revenue growth of these operating groups in 2022.

Figure 1: Group annual revenue (2022) and year-on-year revenue growth rates (2021 and 2022), e&, Omantel, Ooredoo, stc and Zain, the Middle East and North Africa

Most operators in MENA generated more revenue in 2022 than in 2019

Omantel (which has a 21.9% stake in Zain) performed best out of the five 5groups shown in Figure 1: its group revenue increased by 11% year-on-year after experiencing a significant contraction in 2020 and 2021. This was driven by strong growth in Kuwait, Saudi Arabia and Sudan (where the operator mitigated the impact of currency depreciation with price increases).

Ooredoo and stc continue to perform consistently well, driven by double-digital revenue growth in key markets such as Kuwait and because both operators achieved their highest annual revenue since inception. e& reported a slight overall decline in revenue, with a modest revenue increase in its domestic market (the UAE). Revenue growth was much stronger in Pakistan and Egypt (in local currency), but it was offset by the weak forex in these two countries. Its other operations in Africa faced regulatory pressure and the effect of currency devaluations.

Several drivers underpinned revenue growth in 2022.

- Strong economic recovery and low inflation in the Gulf region. The GDP of most countries in the Gulf region (which represent the largest contributors to each of the group’s revenue) grew in 2022 thanks to rising oil prices and the expansion of non-oil sectors such as tourism.1 Inflation was also lower in Gulf region than in other regions, which suggests that the strong growth was in real terms.

- 4G and 5G network expansions. Demand for 5G in the Gulf region, and 4G in the rest of MENA, continues to be strong as operators expand their network coverage and handsets become more affordable. The number of 5G Standalone (SA) networks deployed also increased in 2022 and 1Q 2023.2 However, capex has been lower than in 2021 thanks to lower equipment costs, a slower pace for 5G roll-outs and more-selective spending on infrastructure.

- Tourist and migrant inflows. The lifting of COVID-19 restrictions (for example, allowing foreigners to conduct Umrah pilgrimage in Saudi Arabia), the organisation of global events (such as the World Cup in Qatar) and more-favourable residency and foreign investment policies (such as those in the UAE) helped to boost subscriber numbers.

- The business segment continues to record high revenue growth rates. For example, the business unit of stc recorded a 9% revenue growth in 2022, and the business units of Zain and e& reported a 28% and 11% increase year-on-year, respectively. This shows that operators have been successful in capitalising on the growing demand for ICT services

Figure 2: Strengths, weaknesses and developments for e&, Omantel, Ooredoo, stc and Zain, MENA, 2022

| Operator | Strengths | Weaknesses | Main developments (June 2022–March 2023)3 | |||

|---|---|---|---|---|---|---|

|

e& |

|

|

|

Stable revenue for Maroc Telecom group in local currency but 12% contraction in USD terms |

|

|

|

Omantel (Oman only) |

|

11% year-on-year growth in postpaid mobile revenue and 3% year-on-year growth in fixed broadband revenue |

|

Contraction of prepaid revenue |

|

Completed the sale of more than 2500 tower sites to Helios Towers for USD494 million |

|

Ooredoo |

|

Revenue growth in Kuwait (11%), Oman (5%) and Qatar (7%) |

|

Forex depreciation impacted revenue in Algeria, Myanmar and Tunisia |

|

|

|

stc |

|

|

|

High amount of government receivables (USD5.2 billion in 2022) |

|

|

|

Zain |

|

|

|

Data revenue increased by only 5% year-on-year due to price competition |

|

Did not proceed with the sale of its operation in Sudan |

Source: Analysys Mason

The positive results of 2022 put Gulf-based operators in a good position to proceed with their transformation and growth plans

e&, Ooredoo, stc and Zain are aiming to transform themselves from regional connectivity providers to regional digital service enablers. They continued to offload their non-core assets (such as towers) and sell their underperforming operations in 2022 in order to direct capital towards growth areas such as digital and entertainment services. They have also made acquisitions and set up joint venture partnerships to access specialised ICT expertise and strategic assets.

These operators remain optimistic about the future despite the potential global economic slowdown, currency devaluation and inflation challenges in some of the countries where they operate. Given the positive economic outlook in key markets, they have better prospects than many of their peers in other regions to aggressively pursue growth opportunities in 2023.

1 According to the International Monetary Fund (IMF), the annual GDP growth rate for Kuwait, Saudi Arabia and the UAE reached 8.2%, 8.7% and 7.4%, respectively in 2022. For more information, see IMF, Real GDP Growth (2023). Available at: https://www.imf.org/external/datamapper/.

2 New deployments include Bahrain (stc), Kuwait (Zain), Saudi Arabia (Mobily, stc and Zain) and the UAE (e&).

3 For the main developments in 1H 2022, please see Analysys Mason’s Operating groups in MENA reported strong results in 1H 2022 due to economic recovery and high oil prices.

Article (PDF)

Download