Gulf operators are scaling up their IT capabilities for enterprises but should do more to attract SMEs

Listen to or download the associated podcast

e& (formerly Etisalat), stc and Zain are expanding their IT portfolios so they can sell business services to enterprises in the Middle East and North Africa (MENA).

These groups are well positioned to continue to boost their business revenue by delivering connectivity and customised IT services to the public sector and large enterprise customers but they should not neglect small and medium-sized enterprises (SMEs) because this high-growth segment will contribute more than 60% of operators’ business revenue growth between 2022 and 2027 in MENA.

Operator revenue growth will be driven by connectivity services, but IT revenue offers the best long-term prospects

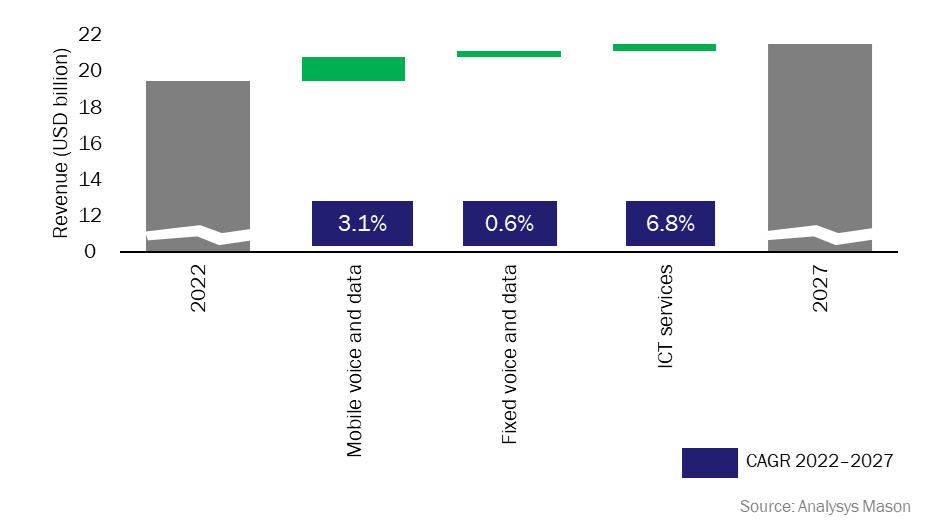

Operator business services revenue in MENA will increase by over USD2 billion to reach USD21.5 billion in 2027. In absolute terms, most of this growth will come from mobile voice and data services. We expect operators to benefit from an increased number of business mobile handset connections and increased usage of mobile data and IoT connectivity services (Figure 1).

Business revenue from fixed connectivity services is expected to increase at a more modest rate between 2022 and 2027. Revenue growth from the expansion of fibre coverage and demand for high-speed dedicated connectivity will be partially offset by declining voice revenue.

IT services (including security, data centres, and cloud services) will complement the growth of core services. Operator revenue from IT services is expected to increase quickly as businesses adopt more cloud-based services.1 However, operator revenue is not expected to grow as quickly as that of local IT specialists and global hyperscalers, pointing to an opportunity for operators to boost IT revenue further if they focus on these services.

Overall, SMEs (with fewer than 250 employees) will contribute more than 60% of operator business revenue growth, including most of the growth from connectivity services.

Figure 1: Operator business revenue and CAGR by type of service, MENA, 2022–2027

e&, stc and Zain have expanded their ICT portfolios to improve their ability to address the digital and cloud needs of local enterprises

Operators in the Middle East have adopted different approaches to bolster their ICT capabilities to support enterprises’ digital transformations and accelerate revenue growth in cloud and cybersecurity. e&, stc and Zain’s business units reported strong performances in 2021 and 2022, driven by growing demand for connectivity and IT services.

These three operator groups continue to use acquisitions and joint venture partnerships to access specialised expertise and strategic assets such as data centres to boost their capabilities (Figure 2). These initiatives are expected to accelerate their revenue growth in the future and increase their share of the addressable IT market in MENA, which will be worth USD7.3 billion in 2027.

Figure 2: M&A activities related to enterprise ICT services, by operator, 2021 and 2022

| Operator | Initiatives | Performance KPIs |

|

|

|

| stc |

|

|

| Zain |

|

|

Source: Analysys Mason

Operators need to offer well-integrated and relevant IT solutions that can appeal to SMEs

Incumbent operators in MENA stated their ambition to increase the business revenue contribution of SMEs, but they have primarily focused on serving large enterprises and public institutions. Operators have the opportunity to increase their non-core revenue from SMEs, which is forecast to account for more than a third of operators’ IT revenue by 2027.

Operators in the region should first exploit their significant presence in the SME connectivity market to provide bundled services, rather than separate products, to their existing customers. These should not be limited to IT services but may include professional support such as administrative and procurement services to differentiate the operators’ offerings from those of the many local IT specialists and managed service providers (MSPs).

They have invested in sophisticated propositions such as robotic process automation (RPA) and drone-as-a-service (DaaS), which are unlikely to get much interest from local businesses, especially SMEs, that have simpler requirements. The continued expansion of their enterprise ICT portfolio may risk overstretching resources. They should instead align their portfolio and capabilities with local needs and develop off-the-shelf offerings to target SMEs.

They should also help to educate SMEs about the value and potential of converged ICT services because many businesses lack an understanding of their benefits. Operators should address these misconceptions by publishing case studies, providing public training sessions and educating their sales staff. Operators in other regions already have such initiatives in place.

Unlike operators in many other regions, operators in MENA still have the potential to grow their business connectivity service revenue thanks to the limited competition and the positive economic outlook, which will drive the demand for data and ICT services and support further infrastructure investments. However, they need to be more focused and dedicate resources to selling products that add value to customers, if they are serious about increasing their share of the ICT market.

1 Excluding professional services and custom projects. We also have business forecast reports for individual MENA countries.

Article (PDF)

Download