‘Moon-as-a-service’ business models: the next leap for commercial space players

NASA has selected Intuitive Machines, Lunar Outpost and Venturi Astrolab for the development of lunar terrain vehicles (LTVs), adopting the ‘as-a-service’ acquisition model. This approach, encapsulated within an indefinite-delivery/indefinite-quantity, milestone-based contract framework, boasts the potential value of USD4.6 billion across all LTV awards, setting a bold precedent for future lunar endeavours. This strategic shift towards firm-fixed-price task orders, in the context of historical budget overruns and delays in Artemis programmes, signifies NASA’s commitment to mitigating fiscal uncertainties while catalysing the ‘moon-as-a-service’ (MaaS) business model. This model promises scalable and cost-effective lunar access and stands at the forefront of commercial opportunities in the lunar market.

The lunar opportunity is anchored to government and military demand

Government and military organisations will be the main driver of demand for ‘as-a-service’ models from commercial entities. These models can optimise the costs of the developmental stages and extended service offerings. However, the lunar market landscape is expected to change post 2029, particularly after the expected success of crewed Artemis missions. At that point, missions will shift their focus to infrastructure development and in-situ resource utilisation endeavours. This transition will mark a pivotal moment for commercial entities; opportunities will emerge, depending on the availability of resources and the growing interest in resource extraction, spurred by insights from sample return missions.

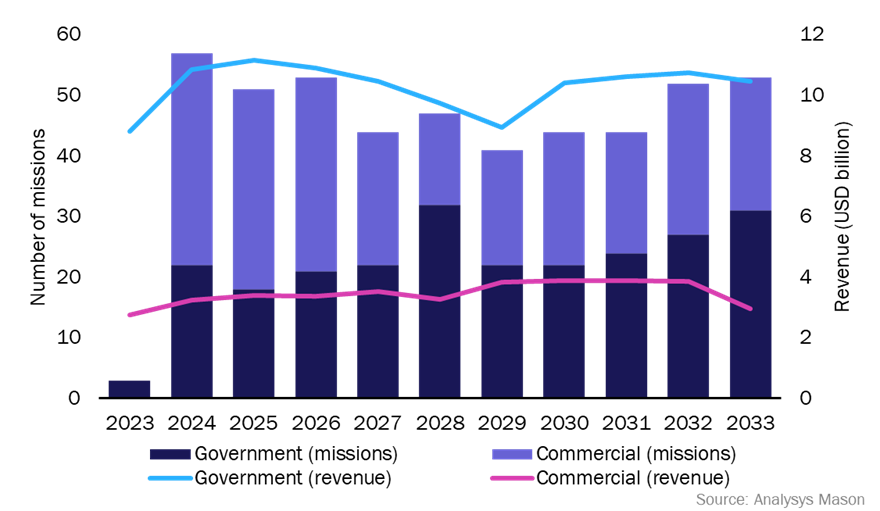

Analysys Mason’s recent report, Lunar markets, 4th edition, forecasts over 450 missions will be launched between 2023 and 2033 generating cumulative revenue of USD151 billion (Figure 1).

Figure 1: Lunar market, missions and revenue by segment, 2023–2033

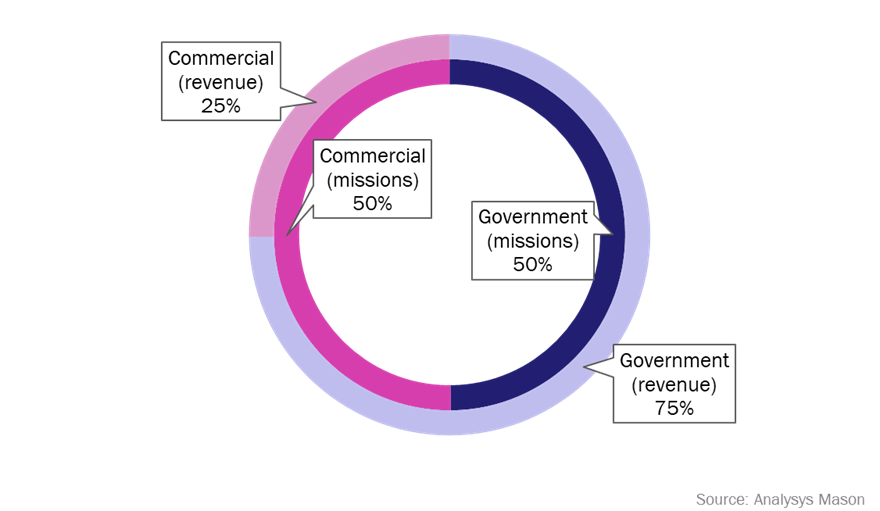

About 50% of these missions are led by commercial players. However, the revenue from commercial missions is expected to represent only 25% of the total and governments will continue to dominate lunar economic activity (Figure 2).

Public–private partnerships between commercial entities and government/military organisations will be instrumental in propelling the lunar economy through programmes such as Commercial Lunar Payload Services (CLPS), Human Landing System (HLS), Lunar Cargo Transportation and Landing by Soft Touchdown (LCNS), Advanced Tipping Point Technologies (ATPT) and Lunar Surface Technology Research (LuSTR).

Figure 2: Lunar market, cumulative missions and revenue share by segment, 2023–2033

Amid the current climate of delays and setbacks in lunar missions, NASA is continuing to nurture technologies that fulfil the demands of its envisioned exploration framework. The organisation is taking a three-pronged approach: financial prudence, technical proficiency and regulatory adaptability. These approaches will ensure that mission budgets are realistic, risks are managed and frameworks are conducive to safety and economic growth.

NASA’s strategic approach to lunar exploration

NASA has capitalised on its initiatives in low Earth orbit (LEO) and recognises the potential of the ‘'as-a-service’ model. This model is suitable for the lunar domain, where signatories of the Artemis Accords, including NASA, can benefit from cost efficiencies as one among many clients of the private sector. The outsourcing of specialised services to experts and a collaborative approach to technology development allows NASA and other government/military organisations to access leading-edge technology and know-how with minimal upfront investment and shared risks. This approach includes activities, ranging from payload integration to complex mission management endeavours. The flexibility of the ‘as-a-service’ philosophy aligns neatly with the evolving aspirations of space exploration and NASA’s indefinite delivery, indefinite quantity CLPS contracts, capped at USD2.6 billion to 2028, underscore NASA’s commitment. Cost-effectiveness, resilience and sustainability are key components of as-a-service business models that will increase customer reliance on commercial vendors.

NASA’s procurement strategy illustrates its interest in commercial alliances to extend and build its capabilities for lunar exploration and habitation. Significant contracts with Astrobotic Technology, ICON, Redwire Space, and Zeno Power totalling over USD200 million, reflect a deliberate shift toward cost-effective, resilient and sustainable space systems, using in-situ resources for Moon and Mars missions. ICON’s Project Olympus, which focuses on space-based construction systems for lunar exploration, marks a significant step towards establishing a permanent foothold on the Moon’s surface. This strategy is not simply about overcoming traditional space development hurdles; it is also about establishing a self-sustaining lunar economy, minimising the dependency of the lunar economy on Earth resources, and seeding the growth potential of an off-world industry.

European initiatives, such as Argonaut and Moonlight, are being established to secure autonomy. Collaboration with NASA is catalysing market demand within Europe. Despite encountering funding challenges, the long-term outlook for Europe is optimistic. Europe is positioning itself to build autonomous capabilities ready to capitalise on the growing opportunities presented by the Moon’s untapped potential.

The ‘as-a-service’ model will be the new norm in lunar missions

As the ‘as-a-service’ models solidify and become the mainstream procurement channel for capex-intensive and long-term development projects, commercial players are poised to establish a strong foothold in the lunar market. This will lead to stable and recurring revenue, increased customer engagement through long-term multi-year contracts, and an enhanced capability to scale based on customer needs. The market demand is anchored to the government and military ‘as-a-service’ model, and as such, commercial demand is expected to surge in infrastructure and in-situ resource utilisation. This could potentially enable commercial entities to engage ‘as-a-service’ models for lunar resource extraction, infrastructure building, and more. As sustained operations on the Moon are established with increased reliability of transportation and supporting position navigation and timing (PNT), communication services, etc., these ‘as-a-service’ models could become even more prevalent and impactful.

Therefore, commercial entities are advised to strategically embrace ‘as-a-service’ models for developmental pursuits, capitalising on the infrastructure established to cater to governmental/military and commercial missions. It is imperative for these entities to broaden their horizons, incorporating commercial ventures into their strategic roadmaps alongside their commitments to governmental and military contracts, which are projected to be the cornerstone of lunar market opportunities from 2023 to 2033. This dual-focus strategy ensures sustained engagement with traditional contracts and positions commercial players at the forefront of the evolving lunar exploration landscape.

Article (PDF)

DownloadAuthor