MWC 2023: Open RAN demonstrates progress amid many challenges

Mobile World Congress (MWC) 2023 came at an interesting time for Open RAN. Initiatives such as the O-RAN alliance and the Telecom Infra Project (TIP) have demonstrated significant progress over the past few years, in specifying interfaces and deployment platforms that will enable a broad ecosystem and multi-vendor networks.

This progress was shown at MWC 2023 through new collaborations, new product releases and initiatives to support multi-vendor network testing. For most stakeholders, Open RAN will be virtualised, and MWC also evidenced a certain momentum behind vRAN with efforts in vRAN energy efficiency and massive MIMO support were noted from companies such as Analog Devices (ADI), Intel, Marvell, Samsung and Qualcomm.

Open RAN generated enthusiasm at the show, though there was also a heavy focus on addressing the many challenges to its deployment in high-performance public 5G networks. The number of new O-RAN compatible products demonstrated growing interest from the vendor and mobile network operator (MNO) communities, as well as a broadening of the vendor ecosystem. However, it was announcements of multi-vendor deployments or examples of interoperability from companies such as Fujitsu, Juniper Networks, Mavenir, NEC, Nokia, Parallel Wireless and Samsung which demonstrated the most tangible progress.

Another important focus at MWC was on developing testing and certification processes for O-RAN, which reduce the time and cost of integrating elements from multiple vendors because compliance to key interfaces is guaranteed. This is critical to multi-vendor systems and even within single-vendor deployments, open interfaces allow MNOs to future-proof their networks, enabling them to introduce new suppliers when it comes to updating systems. Although many feel this demonstrates slow progress towards “true” multi-vendor open RAN, it allows MNOs to limit the risk and complexity in opening their networks and will be a popular option in the first wave of vRAN/O-RAN deployments.

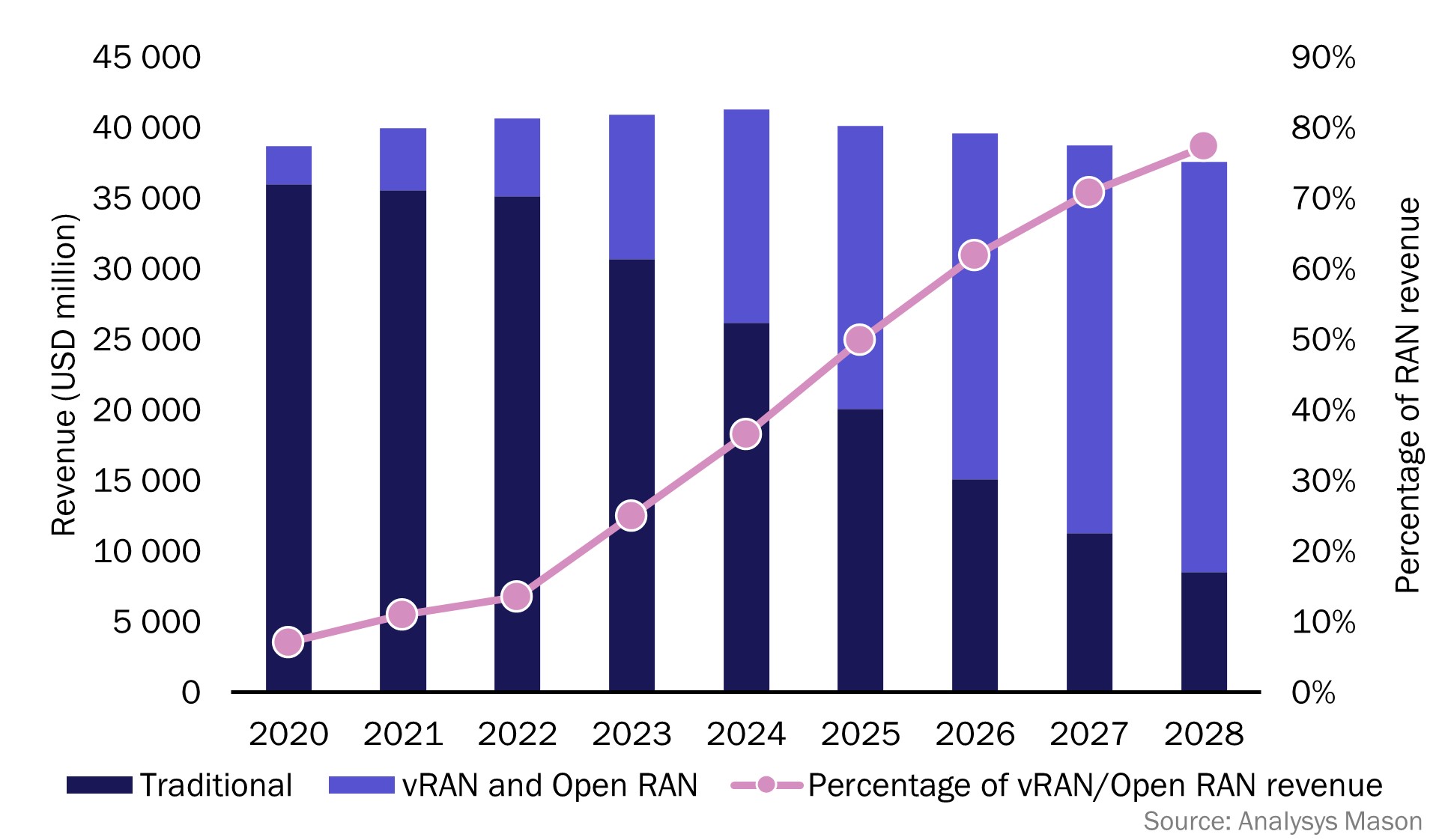

Figure 1: RAN revenue, traditional and vRAN/Open RAN, worldwide, 2020–20281

Outside of O-RAN compliance, there were other announcements of note:

- Open RAN energy-saving frameworks from Deutsche Telekom, Vodafone and partner vendors targeted an important factor in the Open RAN debate.

- Vodafone announced plans to deploy O-RAN compliant systems from Samsung in Germany.

- Deutsche Telekom announced plans to deploy Open RAN across Europe using Fujitsu, Mavenir and Nokia.

- Juniper Networks, Parallel Wireless and Vodafone showcased a key multi-vendor demonstration. In addition, Vodafone’s progress with silicon providers and RAN vendors was clear (e.g ADI and Intel’s new radio unit reference design).

- A new cloud-native partnership was announced by Dell. Participating brands include Amdocs, Juniper Microsoft, Networks, Nokia, Samsung and Qualcomm.

Challenges remain for multi-vendor Open RAN, which are limiting the scope for a broad ecosystem

Despite significant progress for O-RAN compliance being demonstrated at MWC, full multi-vendor Open RAN still faces many challenges. There were some new deployments announced in the lead up to the show, these included trials from KDDI (using Samsung vRAN with Fujitsu radios) and the aforementioned plans from Deutsche Telekom. However, there are still only a handful of MNOs at trial or pilot stage for multi-vendor systems. This reflects the difficulty of translating multi-vendor initiatives into solutions that are deployable in the mass market.

Compared to single vendor O-RAN systems, multi-vendor deployments introduce the requirement to test the entire system for each different vendor configuration and combination. Even when tested, the actual deployment of such systems is complex and often requires a great deal of system integration, and the necessary skills and expertise for this are still in short supply. Once deployed, real-world operational performance, security and resilience are all more complicated than in single-vendor solutions. There has been some progress towards overcoming these issues, but far more is needed for fully open deployments to become realistic in the macro network.

While obstacles to multi-vendor solutions continue to slow progress, there is also concern that a focus on single-vendor systems could permanently impact the development of the multi-vendor ecosystem, or that multi-vendor solutions will be dominated by top tier brands (as in Samsung’s cooperations with Fujitsu, or Nokia’s with Dell, both highlighted at the show). New challenger vendors are to some extent being blocked by top tier and single-vendor deployments, hampered by their lack of experience in scaling up to large MNO deployments. As a result, the situation is becoming urgent for these non-incumbents, and without early traction, they could miss a significant foothold in the Open RAN market. This would ultimately reduce the overall benefits of Open RAN in diversifying the supply chain for MNOs.

Vendors and MNOs should drive maturity through real-world deployments, and commit the time and investment that this requires

To ensure the health of the vendor ecosystem and to avoid the benefits of O-RAN and vRAN being confined to top-tier manufacturers, stakeholder MNOs should focus significant effort on real-world trials and pilot deployments with a diverse set of vendors. This will help drive greater inclusion for non-incumbents, while also maturing the third-party system integration resource needed for multi-vendor deployments.

It is clear that large deployments, even by greenfield operators such as Dish Network in the USA, can be risky ventures for smaller vendors. Scaling up resources to deliver a macro network project in these early stages of Open RAN is a significant challenge. These new vendors need to be given the opportunity to mature at a gradual pace. This will take time but can be helped significantly by leading MNOs committing to test sites, in-field trials and pilot deployments with a more inclusive vendor strategy that pushes large suppliers to work with new entrants. This will support challenger vendors in achieving gradual scale, in turn improving eventual vendor diversity as Open RAN moves towards consistent deployments on the macro network.

To achieve this, more partnership initiatives are needed with diverse vendors, in which new challengers can work alongside large incumbents to specify full solutions and drive more trials and pilot deployments. Until this point, the delta between new challengers and incumbent vendors within the Open RAN ecosystem will continue to grow.

1 Further information on RAN technology and forecasts is available from Analysys Mason’s Next-Generation Wireless Networks programme. Please follow this link for more details on our latest research: https://www.analysysmason.com/knowledge-centre/?web=0&ct=&re=&rp=Next-Generation+Wireless+Networks&sort=most+relevant.

Download

Article (PDF)Analysys Mason's Mobile World Congress 2023: key findings and implications

Watch nowAuthor