Network capex has started a long decline, opening up new options for operators

The latest sets of results from operators confirm that capex declined worldwide in 2023, and predictions in end-of-financial year results indicate further declines. This tallies with the outlook in Analysys Mason’s latest telecoms capex forecasts. This article looks at changes in capex in different geographical regions. Falling capex will be bad news for vendors and contracted civil engineering businesses, but improving cashflow opens up interesting strategic choices for operators.

Capex fell away in 2023 and will fall further in 2024

Figure 1 aggregates change in capex, excluding spectrum, in 2023 (or FY2023/2024) for 50 of the largest operators in the world, all with annual capex of over USD1 billion in 2023. These operators account for about 78% of telecoms capex worldwide.

Figure 1: Change in large operator capex, by selected geographical region, 2019–2023

Capex among these players was down 3.5% in 2023, after a jump of 7.8% in 2022, when there were stronger inflationary pressures.

The steepest decline was in North America. The decline was steeper for the three largest mobile network operator (MNO) groups (–18.1%). This was offset by rises in capex by the two large US cablecos, for which upgrades of HFC plant are now an imperative. The obvious reason for the sharp decline is the near-completion of 5G roll-out, although FTTP capex remains flat.

In China, capex was flat overall. This disguises a decline in 5G and fixed broadband capex, which, taken together with transmission, fell 7% in 2023. The delta of capex has gone on what operators call ‘computility’ (compute power in data centres and edge) and capabilities (developing the ability to serve mainly the industrial enterprise). Together these two items now account for about 35% of operator capex.

In Japan and South Korea, capex was also more or less flat (+0.5%). As in China, a high proportion of capex in Japan now goes on adjacent lines of business.

Capex declined by 5.5% in Europe. The European figure disguises the impact of the large number of smaller players in the continent. 5G spending has peaked, but so too has FTTP spending. FTTP spend represents a very high share of capex in Europe (about one half), although this is distributed differently across individual countries. Countries like France and Spain have passed that peak, but even in the UK, a relatively late starter, spend has plateaued.

Among operators in emerging markets, the smallest group in absolute capex terms, there was a rise of 8%, steady now for 3 years running, driven almost entirely by India, and offset by declines elsewhere.

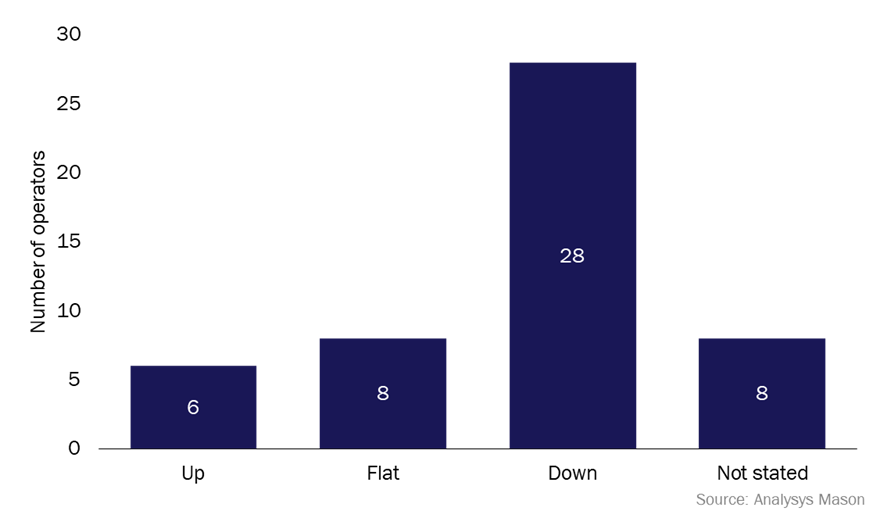

Figure 2 shows the same 50 operators’ own guidance on capex for the next financial year.

Figure 2: Large operators’ own guidance on capex in FY2024

Of the 42 operators that provided guidance on capex in 2024, 28 forecast a fall. A notable class of exceptions consisted of cable operators and latecomers to FTTP upgrade, but most of the emerging-market-focused operators indicated a decline.

There will not be cyclical recovery of capex

Operators’ longer-term projections of capex suggest, if anything, steepening declines in capex. Our forecasts indicate that capital intensity (capex/revenue) will fall from around 20% now to 12–14% by the end of the decade. Capex will fall basically because customers do not need more than the 1Gbit/s fibre and unlimited 5G that the current networks are easily capable of delivering, and growth in measurable demand slows every year. This will have the following effects.

- Fall in fixed access spend. Capex on FTTP is essentially a one-off investment in passive assets with very long useful lives. Future capex on upgrades (in effect replacements) of FTTP actives will come at a tiny fraction of this cost. The pipeline of plans for commercial build is running dry, although this is offset by some hefty subsidies for rural build, particularly in the USA. Those cablecos that have not already started will have to brace themselves for programmes of replacement of HFC/DOCSIS by FTTP/xPON.

- We expect only limited uplift for 5G SA/5G Advanced. This is in part because some operators will not be able to justify a further upgrade after 5G NSA, in part because of slack demand, and in part because the sums involved will be lower than for the roll-out of 5G NSA.

- 6G will not be capex-intensive. There is little appetite in free-market economies without centralised planning (and perhaps not so much even there) for a capex-intensive generational upgrade to 6G. There will be no cyclical uplift.

- There will be more outsourcing (that is, replacement of capex by an opex line). This occurs mainly in infrastructure, but also in migrations of operations (IT capex) to the cloud. Yet this does not mean that capex is simply shifting from one class of business to another; infracos exist in a world with similar constraints.

- In these circumstances, there is a clear case for capex investment in anything that maximises the efficient (and sustainable) use of the physical assets as they stand, and unlocks any opportunities that exist in new business-models. This is prominent in many operator outlooks.

Longer-term projections are indications only of known buckets of spending. On the basis of steep capex reductions, hard-won opex efficiencies, plus slower depreciation as the benefits of fibreisation and decommissioning kick in, many operators predict, if not exactly an embarrassment of riches (competition may erode it), a clear improvement in cashflow.

Additional cashflow will allow operators to make less proscribed choices about their futures

Operators may start investing in scale (after years of doing exactly the opposite) with a focus on horizontal consolidation.

- Potentially, this could be acquisitions at an international service layer (consumer or enterprise), which would be facilitated by developments in network virtualisation.

- Alternatively, it could be at the infrastructure layer. They could buy back carved-out assets if they prove to be sufficiently unique.

It could be a window of opportunity to shift their investment away from the old productive forces that deliver bandwidth at ever-lower cost, and instead harness new and higher-quality productive forces that exist outside those traditional perimeters. They might even consider investing in adjacent networked infrastructure businesses (for example, green power distribution, electric vehicle grids), or, as Chinese and Japanese operators have done, in a broader set of digital infrastructure assets.

Article (PDF)

DownloadAuthor

Rupert Wood

Research Director, expert in infrastructure, fixed networks and wholesaleRelated items

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Podcast

Delayering telecoms operators’ businesses: outcomes and future directions

Article

Many operators have become more productive, but their approaches are not sustainable in the long term