Not just future-proofing: why and where 25GS-PON makes commercial sense now

In the real commercial world, there is little point being theologically orthodox about the future direction of PON technologies and standards. For the operator, the questions that really matter are: what is currently available, what are the current practical and likely mid-term commercial use cases and how cost-effective is implementation. 50G-PON variants will become available later this decade and will find their commercial uses. 25GS-PON is available right now.

Much is made of future-proofing networks with the highest-capacity broadband technologies. However, it also makes sense to highlight the current potential use cases because 25GS-PON is ‘oven-ready’. It is based on optical components that are already widely used in data centres, it comes as part of a Combo-PON, co-exists with both GPON and XGS-PON and, as such, incurs low additional network or success-based capex. 50G-PON will (initially) provide asymmetrical 50Gbit/s down and 25Gbit/s up, which means that for leased Ethernet line replacement, 50G-PON will initially provide only as much symmetrical capacity as 25GS-PON: about 20Gbit/s.

Currently there is no obvious consumer case for 25GS-PON, and ONT costs would have to fall a long way for it to be viable. The popularity of future consumer services is still highly uncertain, but what we do know is that the largest xR developers expect multi-gigabit last-mile and individual gigabit Wi-Fi streams to be both available and widely adopted by consumers by the end of the decade.

The absence of any short- or mid-term commercial case for B2C means that activating 25GS-PON capability is likely to be done on a geographically selective basis. However, the commercial opportunities are still significant. The main functions are providing a disruptive alternative to standard PTP dedicated Ethernet connections and providing low-cost transport – including fronthaul – to clusters of mobile small cells.

B2B connectivity opportunities

There is immediate commercial potential for disruptive new-entrant plays in the high-quality connectivity market, especially targeting the full 10Gbit/s leased-line market with very high-spec service-level agreements (SLAs). For established operators with significant legacy high-quality connectivity revenue, shifting to a multi-service xPON-based access network reduces costs, which is especially useful if they face lower-price competition from new fibre networks. As the FTTP market becomes more mature and more competitive, there will be more cannibalisation of traditional Ethernet revenue. Spain, which is several years ahead of the UK and the USA in terms of FTTP infrastructure deployment, is exhibiting a more-marked shift in revenue and connections from Ethernet to high-quality FTTP/xPON.

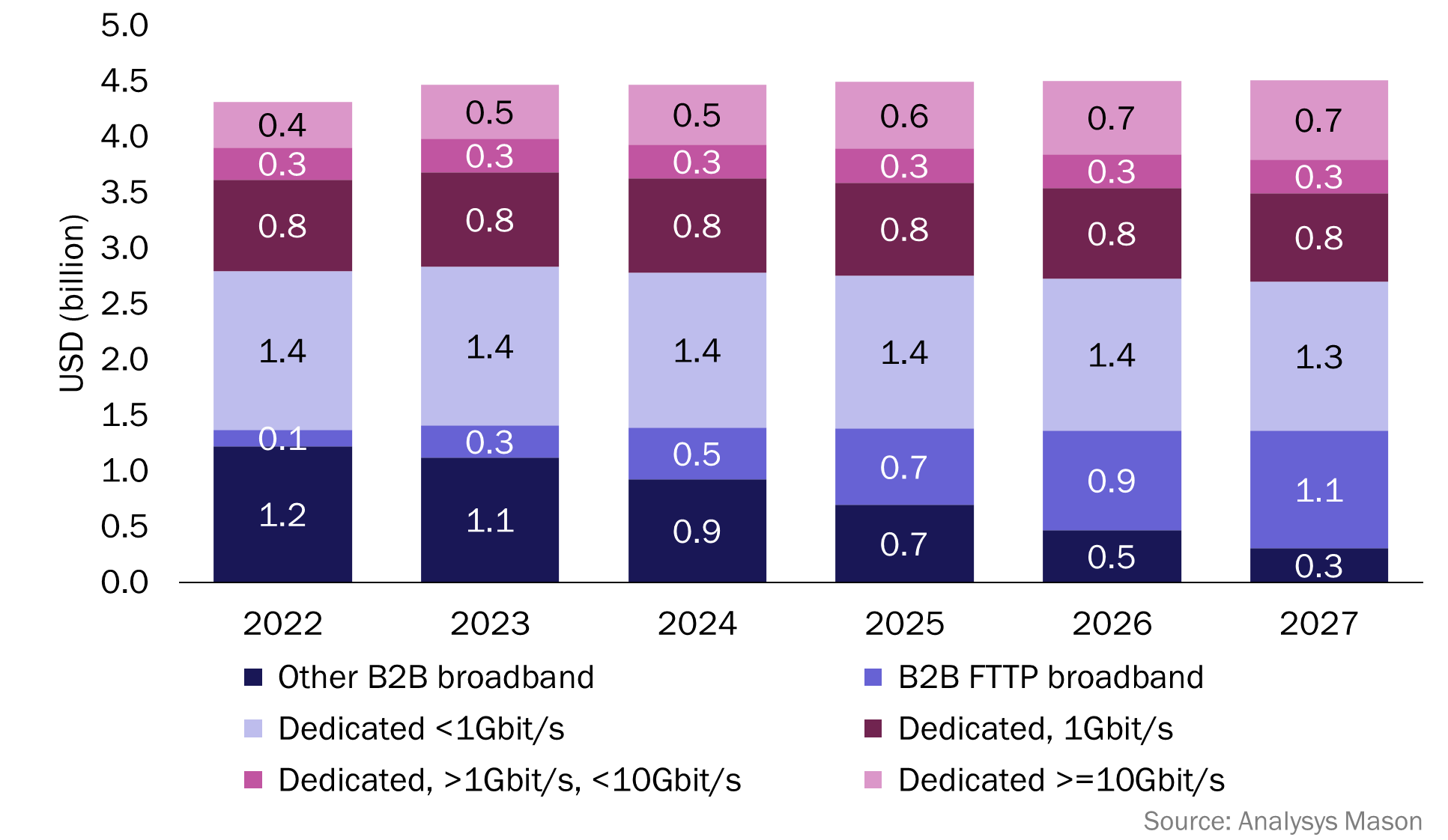

The UK is an example of a mid-sized market with rapid FTTP roll-out. Analysys Mason estimates there are almost half a million dedicated B2B Ethernet connections, with an annual value in service provider recurrent revenue of USD3.1 billion (GBP2.4 billion). This is 2.2x greater than that of B2B broadband (fibre and non-fibre) currently (USD1.4 billion) and is also about 30% of the total value of broadband, B2C included.

Figure 1: B2B retail connectivity revenue, UK, 2022–2027

These numbers point to a credible revenue opportunity: depending on the SLAs, practically all of that dedicated connectivity market is addressable for an operator with 25GS-PON capability. The addition of 25GS-PON to XGS-PON makes the fastest-growing portion in revenue terms, ‘true’10Gbit/s (and even above) symmetrical connectivity, addressable right now.

Examples of current end users of 25GS-PON include a convention centre in Chattanooga, Tennessee, and a collaborative tech hub in Cardiff, Wales. These sorts of enterprise locations, with highly variable, even unpredictable, demands are just the kind that will most benefit from taking connectivity to the next level. Networks are not simply their plumbing; they are key selling points. Beyond that, industries that regularly circulate massive files – for example, health and media – can immediately make use of the bandwidth.

Mobile transport opportunities

Other than B2C and enterprise connectivity, the main component of the multi-service access network is mobile transport. 25GS-PON can deliver, in co-existence with services on XGS-PON and GPON, low-latency true 10Gbit/s links, particularly suited to small cells.

5G mid-band has limitations in terms of reliable indoor coverage, and these weaknesses are further exposed if public 5G is used for private enterprise networks. Building penetration loss is more severe with the higher-frequency mmWave frequencies that offer useful targeted capacity where required. Reutilising FTTP infrastructure for indoor small-cell coverage makes commercial sense; not only do the lower, shared unit costs of a PTMP xPON network make denser deployments economically viable, but they turn what is generally thought of as a cost-pool into new opportunities.

Looking further ahead, mobile network operators (MNOs) are investigating the advantages of more-centralised or cloud-based architectures that rely on ultra-high capacity and low-latency fronthaul links to multiple and potentially densely distributed antennas in the field. One MNO, Chunghwa Telecom in Taiwan, has already validated 25GS-PON for fronthaul. Wherever MNOs need broader urban coverage with the capacity that only mmWave can deliver, there are potentially enormous economies of scale in a multi-service access architecture that delivers fronthaul to massively densified and simplified small cells.

This article was commissioned by Nokia.

Article (PDF)

DownloadAuthor