Open RAN stakeholders should collaborate to ensure take-up in private networks

Open RAN is ready for deployment in private networks, but its adoption by enterprises is being limited by high integration costs and uncertainty about its business value. It is vital that stakeholders collaborate to reduce integration costs and prove that Open RAN can enhance the private network business case.

Open RAN and private networks could be synergistic

Private networks are likely to be more suited to Open RAN than public networks in the next year or two for the following reasons.

- Performance. In public networks, the performance of Open RAN will find it difficult to match the performance of traditional RAN, particularly in terms of Layer 1 processing and support for massive MIMO. However, in enterprise applications, Layer 1 processing is generally less demanding.

- Greenfield deployment. In public networks, operators face difficulties in managing Open RAN and traditional RAN from the same platform, and incumbent network equipment providers (NEPs) currently offer limited support for this. However, most private networks are greenfield cellular deployments and therefore Open RAN does not need to coexist with traditional RAN.

- An abundance of enterprise integrators. If these integrators develop skills in Open RAN integration, they could be a vital resource for unlocking its benefits across different verticals and use cases. This contrasts with Open RAN in the public network, which faces a shortage of suitable and independent systems integrators.

Open RAN could also provide a range of flexibility benefits for private networks, potentially enabling the optimal combination of different vendor solutions to support a wide range of varied customers or use cases.

These benefits include the following.

- Flexibility in hardware. For example, Open RAN could enable enterprises to use optimised combinations of radio units to meet specific requirements in terms of coverage, cost, mobility, spectrum usage, latency or other KPIs, depending on the application. Enterprises could install radio units and distributed unit (DU)/centralised unit (CU) software, all from different vendors.

- Flexibility in software. For example, Open RAN allows CU and DU software or xApps and rApps in the RAN intelligent controller (RIC) from different vendors to be used together. RIC apps can support a range of use cases including automation, quality-of-service optimisation, traffic steering and energy efficiency. In a multi-vendor system, these RIC apps from different vendors can be interchanged to achieve the optimal combination that suits a specific or evolving deployment.

- Flexibility in deployment models. Interoperability between different vendors’ products allows service providers to deploy multiple virtualised networks, using shared infrastructure, for example, in hybrid private/public or Wi-Fi/cellular networks or neutral host models.

The cost of integrating Open RAN in private networks is high and enterprises must be convinced of the business case

Although Open RAN and private networks could be synergistic, Open RAN’s strengths in private networks are relatively unproven in real-world deployments. The flexibility benefits outlined in the previous section are also difficult to prove conclusively, because they will be unique to each enterprise and use case. Until Open RAN stakeholders can fully prove how it benefits private network deployments, enterprises will find it difficult to justify the business case and additional costs.

From the enterprise perspective, Open RAN is not necessarily less expensive than traditional RAN for private networks. This is because interoperability testing, open interfaces and security concerns make it complex and costly to deploy. The challenge is then exacerbated by a lack of experience in RAN integration. Despite the wealth of vertical integrators in the enterprise market, many lack knowledge of Open RAN and the technical skills required to install and maintain it.

In addition, enterprises do not have the same goals of supplier diversity as public mobile network operators (MNOs), nor can they affect the ecosystem to the extent that a large public operator can. Therefore, they have few incentives to make the first step to drive the ecosystem by supporting new vendors. This also means that the incumbent NEPs are getting little encouragement from enterprises to adopt Open RAN and may not prioritise private networks.

A range of stakeholders must collaborate to prove the business case of ‘open private cellular’

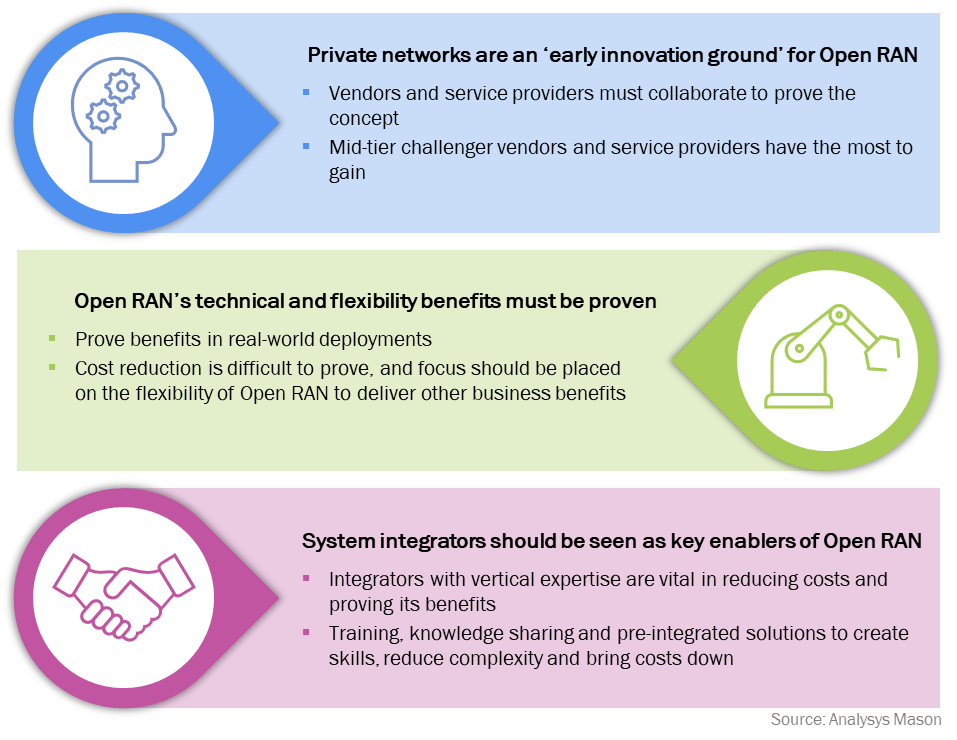

A wide range of stakeholders must collaborate to reduce the complexity and costs of integration and prove the unique benefits that ‘open private cellular’ could bring to enterprises (Figure 1).

Figure 1: How to enhance the business case for ‘open private cellular’

Vendors should aim to decrease the cost and complexity of integration by providing pre-integrated designs and solutions. They should also treat prospective enterprise integrators as important customers and encourage their maturity as integrator partners by increasing knowledge sharing, involving them in pre-integration and providing training and support. Systems integrators will be a vital resource in proving the business case for Open RAN on a vertical industry basis, and integrators should also see the opportunity to expand their addressable market using Open RAN.

Stakeholders, such as governments, alliances and certification bodies such as the Telecom Infrastructure Project (TIP), will also be essential to reducing integration complexity.

Furthermore, all of these stakeholders must focus on proving Open RAN’s strengths across different verticals and applications. Real-world deployments must demonstrate how the flexibility of Open RAN can serve an enterprise’s unique needs.

The role of central governments should also not be underestimated, with their ability to fund Open RAN pre-integration projects and commission their own deployments. For example, the recent National Defense Authorisation Act (NDAA) in the USA has initiated plans to deliver private cellular networks to all US military bases, leveraging 5G and Open RAN technology.

More analysis of Open RAN in private networks is provided in Analysys Mason’s report Enhancing the business case for enterprise private cellular networks using open RAN.

Article (PDF)

DownloadAuthor