Operators should take a holistic approach and look for savings beyond the network to boost opex efficiency

Operators are increasing their investments in 5G standalone (SA) architecture and related technologies that will provide the foundation for new services as the 5G market matures. Most mobile operators will also need to continue to expand or upgrade their 4G networks for years to come, and many fixed operators will invest in expanding and upgrading their fibre networks. These investments will increase opex because operators will need to efficiently run and monetise multiple networks while introducing new architecture, such as cloud RAN, and significantly densifying their mobile sites and fibre networks.

In this article, we share key findings from our strategy report, Opex efficiency strategies for operators, and offer an overview of the main approaches that operators can adopt to control costs. We argue that a single approach to reducing opex is unlikely to be sufficient because new networks create a number of conflicting cost-related challenges. Operators should therefore consider a more-rounded vision of their operating costs and should focus on efficiencies across three main areas: their network, their assets and their organisation.

Operators must consider automation-led efficiencies as they introduce new technologies and deploy new networks

There are a number of ways in which operators can control their networks’ operational costs. We have identified four main strategies, all of which are underpinned by automation-led efficiency and resource optimisation.

- Adopt a platform-based approach. Operators can optimise the use of resources for developing and deploying new solutions or processes by introducing a horizontal approach based on the reusability and standardisation of components. Such an approach will facilitate the development of new business logic that will streamline and shorten development cycles.

- Converge wireline and wireless networks. Operators can implement a single core and consolidate the workloads for network monitoring, maintenance and service management in order to reduce the number of systems that they have to manage, thereby avoiding the need to duplicate technology or effort to support multiple separate networks.

- Move towards cloudified network architecture. Operators’ adoption of cloud-native technologies will deliver great scalability and cost savings because automation is an integral part of cloud-native tools. For example, the Kubernetes ecosystem enables the zero-touch automation of application lifecycle management and embeds scalability and automation at the core of any cloud-based application.

- Move towards the SaaS delivery model. This model increases opex but enables operators to reduce the initial investment required to set up a system and can reduce the total cost of ownership. The SaaS model also fosters a ‘pay-as-you-go’ approach, which increases the predictability and control of costs, and takes away responsibility for the software from the operator, which reduces overheads.

Operators are forming more partnerships with cloud providers in order to better manage their costs and assets

Some network transformations will take years to deliver savings, so in the shorter term, operators may also reduce opex by sharing costs and assets with cloud providers. The magnitude of the costs required to implement new technologies and cultivate skills to run cloud-native systems has triggered a wave of collaborations between operators and cloud providers. Outsourcing services to cloud providers enables operators to optimise the use of their internal resources and redirect their efforts towards service differentiation. Operators can avoid having to build IT platforms or enterprise services from scratch and can instead rely on cloud providers to deliver continuous updates and maintenance, with rapid scaling. Operators have established many partnerships with cloud providers, covering edge compute, enterprise solutions, IT platforms and connectivity.

Operators are showing a greater inclination to move even their critical network workloads and assets to cloud providers’ platforms as their confidence in public cloud infrastructure grows. For example, AT&T and Microsoft, which have been working together since 2019, announced, in June 2021, that Microsoft would acquire AT&T’s Network Cloud technology.1 The acquisition includes AT&T’s IP, talent and assets and will firstly involve the move of AT&T’s 5G network core, workloads and services to Microsoft’s Azure for Operators platform.

Extending operational efficiencies to the whole organisation, not just the network, will deliver greater savings for operators

Operators can derive further opex savings by targeting and improving the efficiency of their overall organisations, instead of focusing solely on the network. Operators’ finances can benefit from strategic approaches in key areas, as described below.

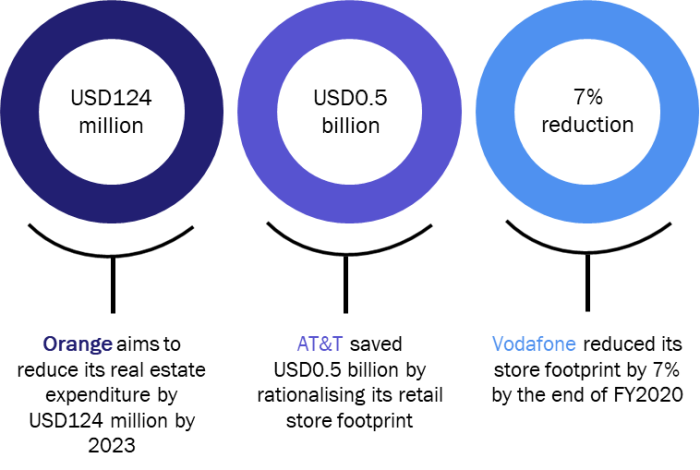

- Adopt a more-frugal approach to real estate, improve office space management and optimise retail spaces. For example, AT&T claimed to have achieved a USD0.5 billion savings by rationalising its retail store footprint (Figure 1). It announced plans to close 320 company-owned AT&T Mobility retail stores in November and December 2020.

Figure 1: Examples of operators’ real estate rationalisation efforts

Source: Analysys Mason, 2022

- Reduce energy consumption. Energy costs accounted for 7.5% of operators’ opex in 2020. A more-careful approach to the way that facilities are operated will result in real bottom-line savings for operators. Avoiding duplication in access network deployment, via network sharing or wireline and wireless convergence, can reduce energy consumption and, consequently, energy expenditure. For example, the network sharing agreement established between China Telecom and China Unicom to construct a 5G SA network across China is expected to greatly reduce CO2 emissions by up to 7 billion tonnes of CO2 per year. Operators can also use technological innovation to improve the energy efficiency of their networks. For example, Elisa Finland is set to reduce its CO2 emissions and energy expenses by 80% and 30%, respectively, by implementing Nokia’s 5G liquid cooling solution.

- Upgrade networks to more-efficient, next-generation technology. This will be an important way to ensure energy optimisation. Research undertaken by Telefónica and Nokia suggests that a 5G network is up to 90% more energy-efficient than a 4G network (on a per-gigabyte basis).

- Adopt strategies such as brand and portfolio simplification and horizontal harmonisation. This can improve the efficiency of operators’ overall organisations. For instance, Vodafone aims to reduce its operating expenses by 20% in 2023, compared to its 2018 expenditure, by combining the network and digital teams in Europe, streamlining its customer care and product development approach and standardising its technology support operations.

1 AT&T’s Network Cloud technology is the platform upon which AT&T’s 5G core network is run.

Article (PDF)

DownloadAuthor

Michela Venturelli

Senior AnalystRelated items

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Podcast

Delayering telecoms operators’ businesses: outcomes and future directions

Article

Many operators have become more productive, but their approaches are not sustainable in the long term