New O-RAN interface may address massive MIMO challenge at the expense of supply-chain diversity

The O-RAN Alliance agreed new specifications for its Open Fronthaul (OFH) interface on 20 June, combining proposals led by Ericsson and Qualcomm. The new interface, called Next Generation Lower-Layer Split (NG-LLS), promises to address some critical challenges that operators face when deploying Open RAN with massive MIMO (mMIMO) antenna arrays. In addition, Ericsson has committed to launching its first commercial Open RAN equipment from 2024. However, these developments also raise questions about the O-RAN goal of diversifying the radio supply chain and lowering barriers to smaller vendors.

The new specifications address one of the biggest barriers to Open RAN adoption

One of the biggest barriers to the adoption of Open RAN in high-performance 5G networks is its sub-optimal support for mMIMO antenna arrays, which are increasingly vital to operators’ plans to increase 5G capacity and coverage. To address this challenge in full will involve developments in silicon and fibre technology, as we discuss in a new report.

However, the O-RAN Alliance has taken a significant step forward with its agreement of a new fronthaul protocol that is optimised for mMIMO. This will address some operator concerns, and it comes with a commitment from Ericsson to support the platform from next year, which will add significant scale to the Open RAN market.

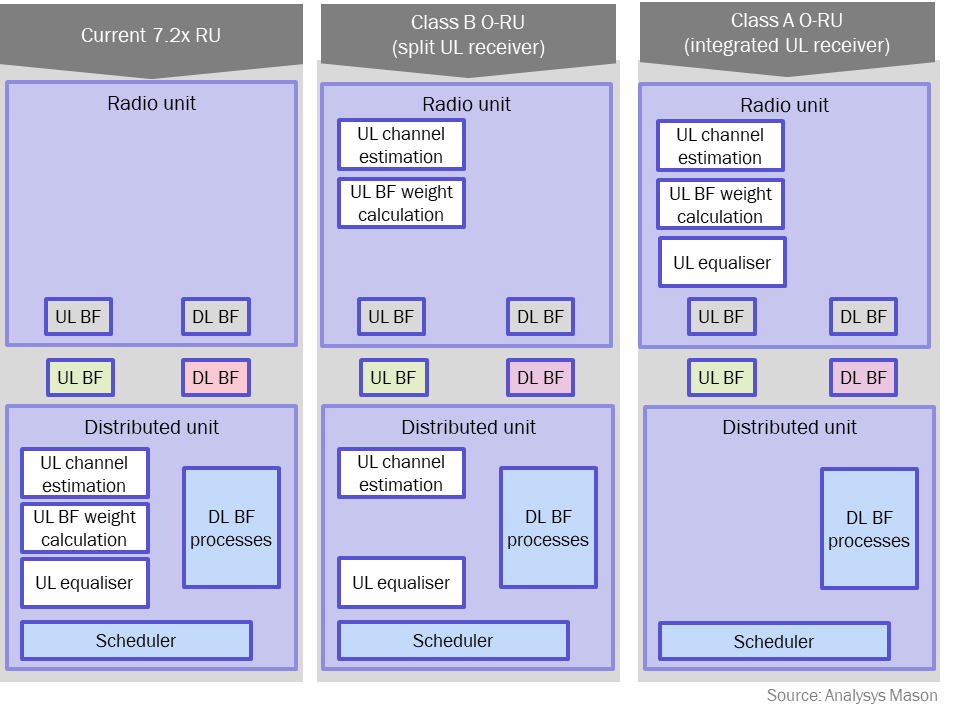

The new specification addresses some mMIMO challenges by reorganising where the most demanding RAN functions, associated with mMIMO beamforming, are processed. In Open RAN, Layer 1 functions are split between the physical radio unit (RU) and a cloud-based distributed unit (DU). This is called a lower-layer split (LLS) and several options are defined by 3GPP. The current O-RAN Alliance OFH uses a split called 7.2x, and the Alliance has defined two flavours of that split, one for RU with eight or fewer antenna elements, and one for mMIMO RU (16–64 transmit and receive elements). The former flavour will remain unchanged, but the latter has proved inadequate to support the full performance of mMIMO, especially in uplink beamforming (UL BF).

This is because 7.2x places UL BF in the DU, but cloud processors handle these intensive tasks far less efficiently than the purpose-built chips in the RU. Ericsson demonstrated a performance gap of 60–80% between its proprietary Cloud-RAN architecture, which incorporates the whole uplink receiver responsible for UL BF (consisting of channel estimation, beamforming weight calculation and equalisation) in the RU, and O-RAN 7.2x, which only places the pre-filter in the RU (Figure 1).

In response to concerns initially raised by AT&T, Ericsson, Orange and Qualcomm, the O-RAN Alliance set up a new work item called Uplink Performance Improvement (UPLI), which focused on two proposals led by Qualcomm (Class B) and Ericsson (Class A) respectively. Ericsson’s approach places the whole uplink receiver in the RU, while Qualcomm’s splits the receiver, carrying out channel estimation in both units (Figure 1).

Figure 1: The current O-RAN Alliance lower-layer split (LLS), and two proposals for a new LLS1

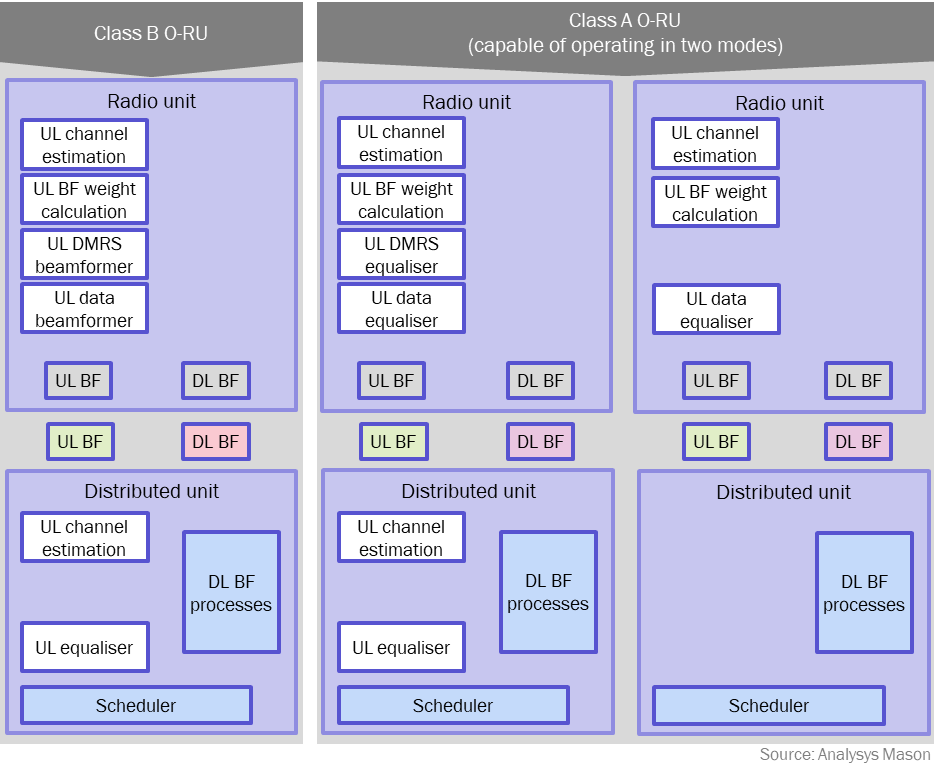

The O-RAN Alliance group’s new NG-LLS combines both approaches (Figure 2). The RU can be either Class A or Class B. The DU must support UL equalisation whether working with Class A or B radios. It may also support an optional mode in which all equalisation is done on the RU, to reduce the processing burden on the DU in some scenarios.

Figure 2: The agreed specifications for NG-LLS, Classes A and B2

By supporting both proposals, the Alliance has avoided damaging fragmentation, although there are some compromises. For instance, Class B provides better support for co-ordinated multipoint, which helps to minimise interference, while Class A better facilitates multi-vendor networks, because there is no need to align channel estimation algorithms from two different suppliers.

Traditional vendors have dominated the latest standards process

Three leading operators (AT&T, Docomo, Verizon) and challenger RAN vendor Mavenir were the main companies that worked on the combined solution, in addition to the two proponents During the discussion process, a significant step to unity came when AMD, Docomo, Nokia, Vodafone and ZTE signed an agreement to support the Ericsson-led approach.

But with the exception of Mavenir, the list of contributors could be related to any traditional RAN standards work. It is hard for small companies to afford the resources to help define standards, but their lack of involvement can limit their influence and provide larger competitors with a headstart in implementing new specifications. Some operators expressed concern that the O-RAN processes were threatening a key goal of supporting Open RAN, opening up the supply chain to a large number of vendors, including in the radio unit.

Ericsson’s commercial entry will boost Open RAN and increase operator support for open platforms

The commercial entry of Ericsson next year will bring welcome scale and credibility to Open RAN in the high-end 5G market. Ericsson plans to offer the new OFH in its Cloud-RAN range from next year, in parallel with its proprietary interface. When the performance of NG-LLS is fully proven, Ericsson will standardise on the open specification, and says it will be open to support third-party RUs, on a case-by-case basis. In the longer term, it aims to use the same OFH in its non-virtualised RAN, to link remote radios to baseband units that run on Ericsson hardware, and it will develop a common management and orchestration layer for all its RAN architectures.

Ericsson’s presence will make it more difficult for challenger radio vendors to win contracts in public macro networks, and some may need to focus on private or rural RAN. Ericsson acknowledges the challenge for small companies to invest the large sums needed to develop a mMIMO radio, although its O-RAN OFH lead, Matteo Fiorani, argues that the availability of merchant RU silicon, from vendors such as AMD, Marvell and Qualcomm, will lower barriers. It will be vital that open platforms, in silicon and software, are vigorously supported by large operators and by cloud ecosystem players such as Dell and HPE, in order to keep the multi-vendor dream alive.

And despite some performance compromises, it is very positive for the Open RAN community that its members have united around a single specification that will help to address the most important performance challenge for 5G operators, support for mMIMO. If that challenge is not addressed soon, Open RAN will not be adopted at all in urban macro networks. The agreement on NG-LLS is a significant step towards avoiding that outcome.

1 For a full description of RAN functions, see Analysys Mason’s Perfect RAN or perfect edge: the Open RAN dilemma facing operators.

2 DMRS = demodulation reference signal.

Article (PDF)

Download

Discover our range of curated resources with all the latest data and analysis related to vRAN and Open RAN.

Author