vRAN today entails compromises in multi-vendor support, but operators must keep interfaces open

In 2023, many large operators are starting to seek the benefits of virtualised radio access networks (vRAN). Currently, it is impossible to deploy high-performance 5G vRAN cost-effectively without specialised hardware, especially if massive MIMO (mMIMO) antenna arrays are required. vRAN acceleration (specialised chips that offload intensive tasks from the central cloud processor) can improve its performance, but since it relies on proprietary hardware, it also presents the risk of vendor lock-in at the chip level. This is because current acceleration solutions are not interoperable, and standards are immature.

This situation could compromise the future of Open RAN (O-RAN), which could leave operators that wish to deploy vRAN with the dilemma of choosing between performance and openness, as discussed in our recent strategy report. Operators that wish to deploy vRAN in high-density urban areas without a significant loss of performance should pursue high-performance single-vendor accelerated solutions for now, but they must insist that these solutions have open interfaces to ensure future-proofing. Operators should also use their influence to steer the vendor ecosystem towards open frameworks.

While vRAN offers operators increased agility, reduced costs and simplified infrastructure expansion, radio performance is reduced

vRAN offers operators a more agile network than traditional RAN, which can reduce costs and enable more scalable infrastructure. However, most vRAN baseband functions run on commercial off-the-shelf (COTS) servers, rather than specialised radio equipment– so there are significant performance trade-offs. Currently, vRAN cannot achieve the same price/performance and energy efficiency as traditional RAN in high-performance environments, because of the heavy processing demands of the 5G radio, especially with mMIMO. According to a recent survey conducted by Analysys Mason, 40% of operators that are considering vRAN consider potential performance trade-offs to be one of the top barriers to deployment.

Operators can mitigate these performance trade-offs by incorporating hardware acceleration into vRAN servers. vRAN accelerators are specialised cards that improve performance by offloading the most demanding tasks (in network Layer 1, or L1) from the central processing unit (CPU) to a specialised chip. This frees up a CPU’s resources within the virtual distributed unit (vDU), allowing it to process the general compute tasks for which it is designed.

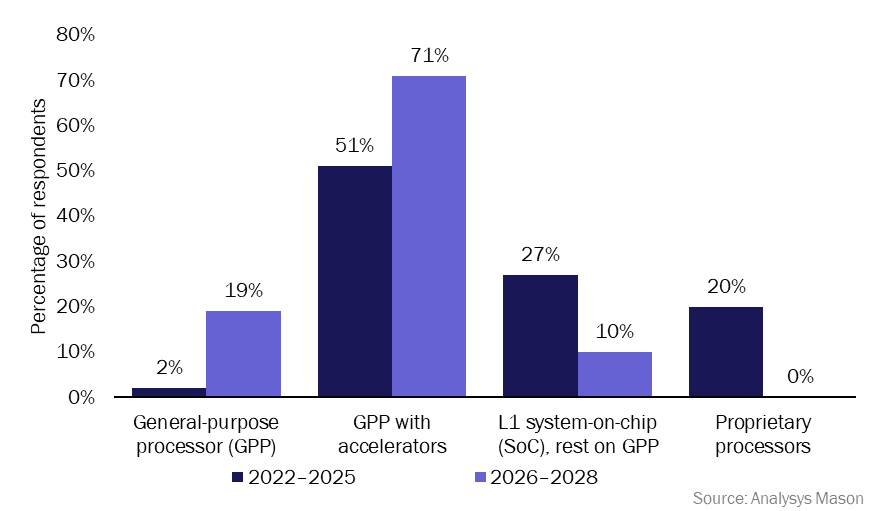

Operators recognise the need for acceleration solutions. According to Analysys Mason’s survey, most operators that are planning vRAN deployments are expecting to use accelerators in their deployments. In our survey, 51% of the operators that are considering or planning to deploy vRAN are expecting to use accelerators in their deployments between 2022–2025, with this figure rising to 71% between 2026–2028 as performance demands rise (Figure 1).

Figure 1: Expected processor architecture for vDU in two phases of vRAN deployment

Question asked: ‘What processor architecture do you expect to support your vDUs in 2022–2025, and from 2026–2028?’; n = 75 respondents

Although acceleration improves vRAN performance, it can also jeopardise the future of O-RAN through vendor lock-in

To address this market, large chip providers such as Intel, Marvell, NVIDIA and Qualcomm are developing vRAN accelerators, as are several start-ups, while Ericsson and Nokia also have their own accelerator chips. Many of these acceleration solutions are expected to come to market by the end of 2023 or early 2024 and will enable vDUs that are based on standard servers to support high-performance 5G radios at a lower cost and power consumption than is possible now.

However, these solutions are proprietary and do not interoperate with one another, and efforts to develop open acceleration frameworks are still immature. The proprietary acceleration of vRAN facilitates their deployment in high-density, urban areas, but also presents the risk of vendor-lock in at chip layer. That means that, once an equipment vendor or operator has selected a proprietary acceleration solution, they will find it difficult and expensive to introduce another supplier in the future. This lock-in at the vDU semiconductor layer would compromise the key goal of O-RAN, which is to enable different vendors’ solutions to be combined or swapped in any layer of the network. Our RAN forecast indicates that, while many operators will start deploying single-vendor vRAN, more than half of new vRAN deployments will be multi-vendor by 2027.

However, if the chip-level interfaces and frameworks are not open, operators will compromise those O-RAN objectives of interoperability and future-proofing. To avoid this risk, many operators may delay their vRAN plans, or opt to deploy vRAN only in relatively unchallenging environments, such as rural areas, until fully open solutions are developed. These operators will be unable to harness the cost saving and scalable infrastructure benefits of vRAN for the next 2–3 years.

Our report also highlights other drivers to support openness at the chip layer by different ecosystem players. Operators aim to establish a vRAN ecosystem that is shaped by their requirements instead of the technologies of a few large vendors; hardware makers want to avoid reliance on one single acceleration solution and vendor; and small chip designers can only compete if the platform remains open.

Operators can opt for single-vendor accelerated solutions, but use their market influence to mandate openness at the chip layer

Operators that want to deploy vRAN imminently in high-density urban areas without a significant loss of performance and energy efficiency should pursue single-vendor acceleration solutions, but they must insist that these solutions have open interfaces and frameworks. Although operators rarely procure semiconductors directly, in a new market such as vRAN, they can use their market weight to influence equipment vendors to choose chip suppliers and solutions that enable flexibility, innovation and support the future of O-RAN.

There are already numerous initiatives to develop open application programming interfaces (APIs) and frameworks so that different RAN acceleration solutions can be interoperable. Operators can follow Vodafone’s example and invest directly into co-developments or eco-system labs to drive the acceleration market to suit their goals and objectives.

Openness at the chip layer will mean that chips are easy to integrate and share a common software architecture, while retaining programmability to support future 5G changes. A single-vendor solution with open interfaces offers operators a chance to pursue the benefits of vRAN immediately, without significantly compromising performance or openness. However, this will only be an option if operators choose to proactively drive the acceleration ecosystem to mandate open frameworks and APIs.

Article (PDF)

DownloadAuthor