The road to building a commercial orbital space tourism ecosystem will be long

The orbital space travel market may sound futuristic, but it is becoming a reality as governments increasingly send their astronauts to the International Space Station (ISS), often on commercial missions (such as Axiom Space’s first all-European astronaut mission). Axiom plans to launch its space station in 2025 and other players are also achieving milestones such as Sierra Space’s tests of an inflatable module that will be used for its Orbital Reef space station (scheduled to launch in 2027).

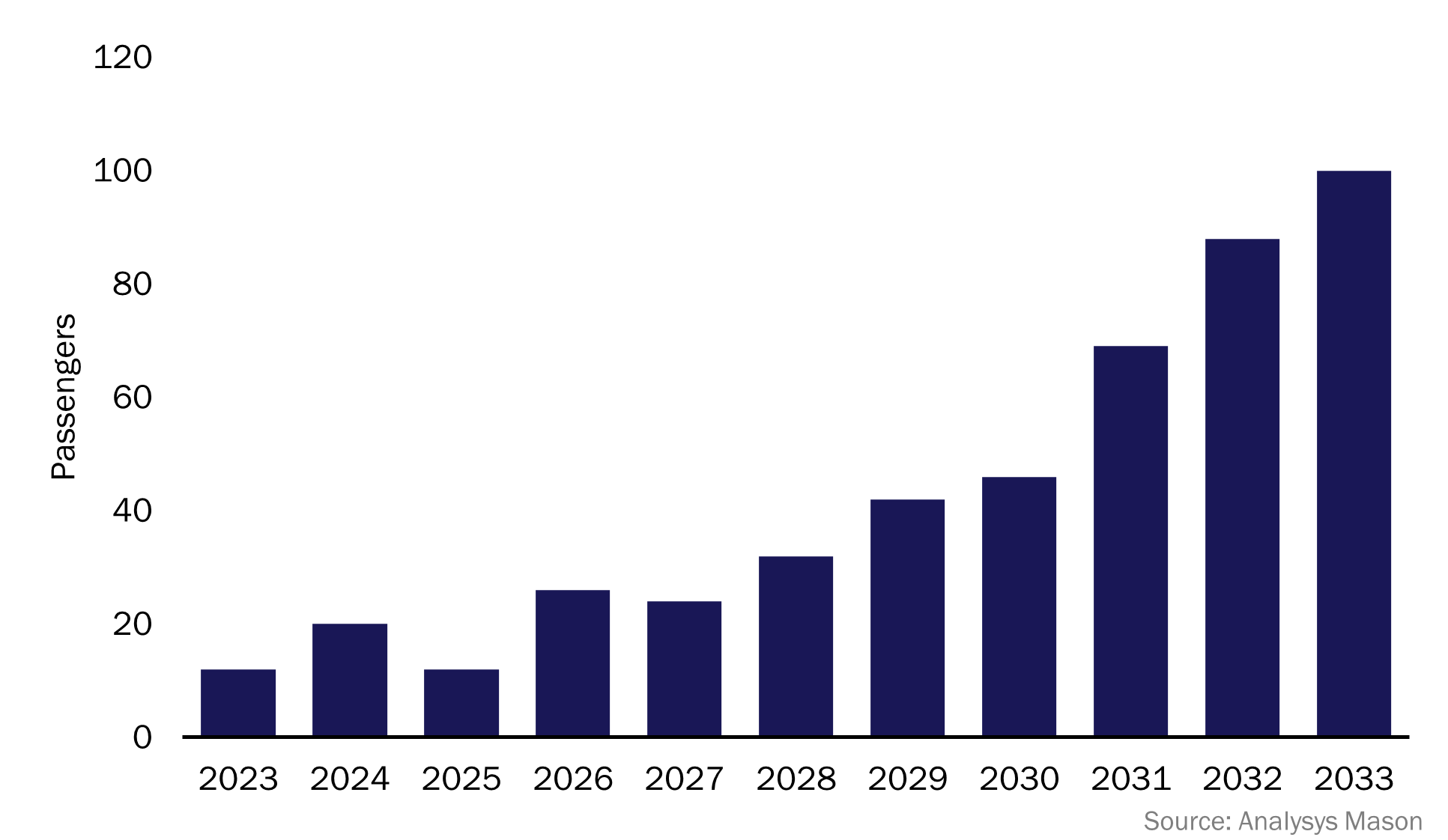

Analysys Mason’s Space travel and tourism markets, 5th edition forecasts that more than 100 commercial orbital space flights will take place between 2023 and 2033. These flights will carry more than 450 passengers in total (Figure 1) and will generate over USD19.5 billion in cumulative revenue. However, this forecast is based on a number of assumptions, as outlined below.

Figure 1: Passengers on commercial orbital space flights, 2023–2033

The ISS will be retired slowly

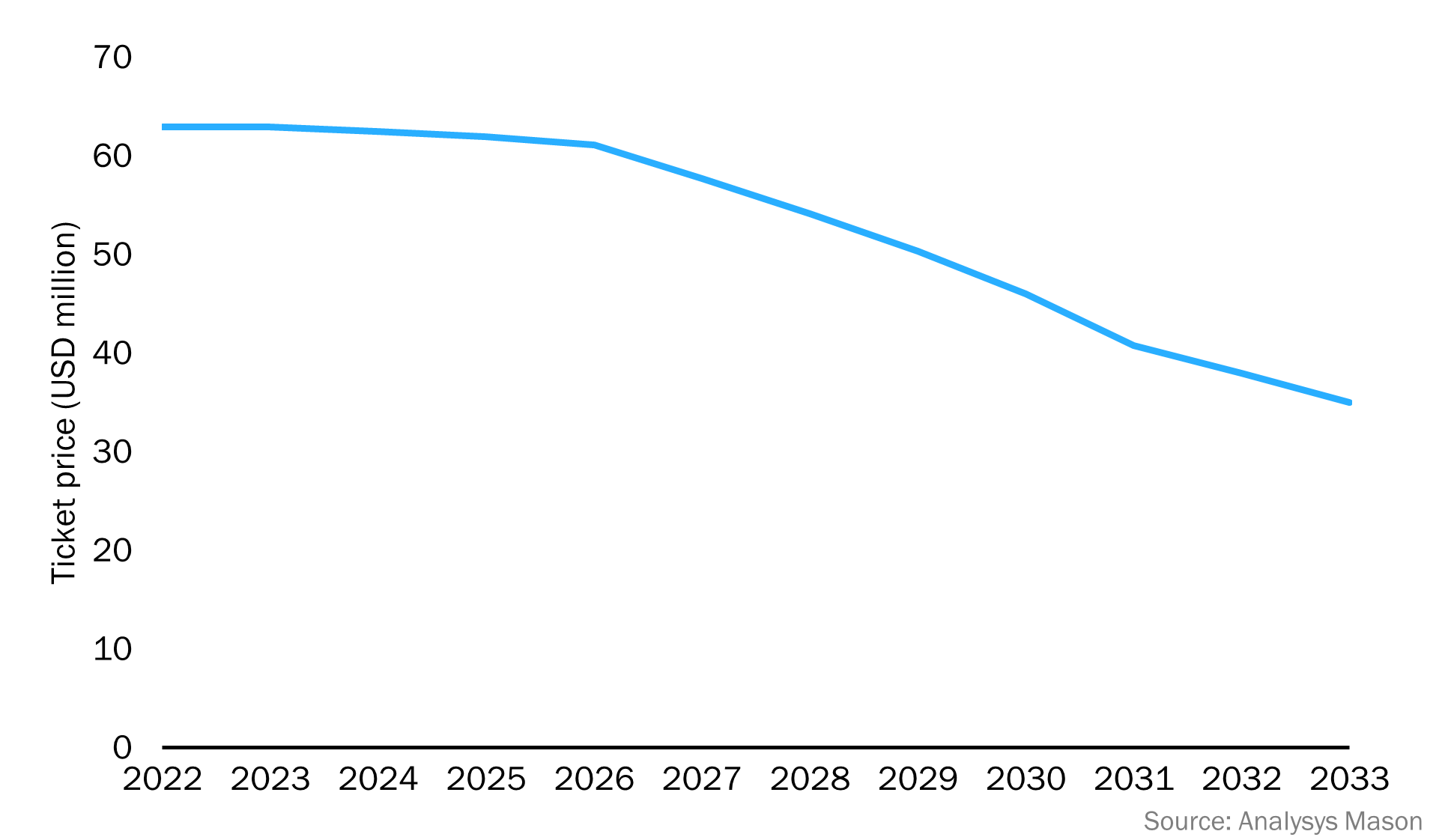

The first assumption is that the ISS will retire slowly. The growing obsolescence of the ISS and the will of the Member States, and mainly NASA, to deorbit it means that retiring the ISS is inevitable, though the retirement date has not yet been set. The transition between using the ISS and using commercial space stations will not be sudden; instead, activity on the ISS will slowly decrease while commercial activity emerges. Government agencies are expected to be the key customers for orbital travel during this transition phase because the average ticket price for an orbital space flight is currently almost USD63 million (Figure 2) and the cost of having crew is almost USD5.2 million per mission.

Figure 2: Average ticket price for an orbital space flight, 2022–2033

At least one commercial space station will be in orbit by 2030

Another assumption is that at least one commercial space station will be launched by 2030. Many governments and commercial players have already been working to secure investment for modules and other equipment. For example, the Chinese government has launched two modules for its Tiangong space station (and has plans to launch more) and conducts regular crew flights. This activity is very promising, but the opportunities for collaboration are limited due to the government-oriented nature of the Chinese market. We expect that the Russian government will take a similar approach with its ROSS space station, which is due to be launched in 2028.

On the commercial side, Axiom Space plans to launch modules in 2026. These will initially be integrated to the ISS, and the ISS’s slow retirement offers a longer timeline for testing. The Starlab and Orbital Reef space stations are being built by collaborations between some of the industry’s key players, but substantial funding is required. For example, the ISS was built for USD150 billion, and systems operations and maintenance costs reached USD1.1 billion per year between 2016 and 2020. Even if we consider that commercial space stations will initially be smaller than the ISS and that cost-efficient technologies may lower production costs, there is not yet any commercial player that is close to securing such amounts. Nonetheless, players are moving ahead with their plans and are forming partnerships and signing launch deals (for example, Starlab Space has agreed to use SpaceX’s Starship to launch the Starlab space station).

Much of the existing investment has come from advertising. Brands from the fashion, professional goods and food industries have been keen to send their logos to these orbital outposts. For example, Estée Launder is paying for a skincare photoshoot on the ISS and Maison Mumm is collaborating with Axiom Space to promote champagne in orbit. Such deals are expected to continue to be made as brands look for new ways to sell their products and as more commercial space stations come online.

Government agencies will be the key customers for commercial space stations

Governments will be the key customers for commercial space stations because their science and research missions will be more profitable than private flights. Indeed, most space stations are, and will continue to be, partially funded by NASA and other government agencies, and such players will aim to commercialise the orbital space travel market and stimulate a sustainable demand for flights to orbit. They hope that the new space stations will support their long-term plans for increased low-Earth orbit (LEO) activity and long-duration, deep-space human exploration missions. However, these government and commercial players will need to overcome financial challenges and ensure that there are new stable LEO destinations once the ISS has been deorbited. Billionaires will also contribute to the market as they seek to secure a seat for the once-in-a-lifetime experience of space travel.

Commercial players should continue to form partnerships with players in other industries to support the development and future operation of commercial space stations. Indeed, collaborating with professional goods and services companies could provide prestige, awareness and confidence so as to secure customers until private space tourism takes off.

Article (PDF)

DownloadAuthor