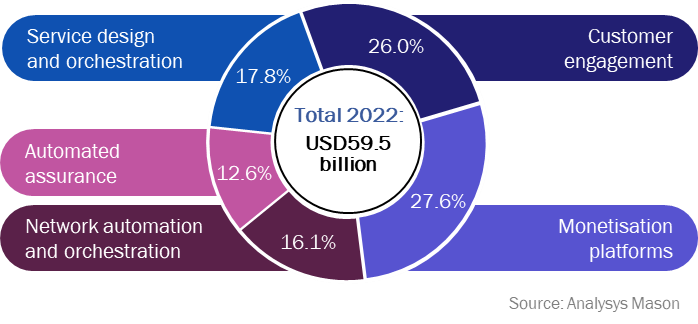

CSPs’ spending on telecoms-related OSS and BSS reached USD59.5 billion in 2022

Communications service provider (CSP) spending in the OSS/BSS market increased by 4.9% in 2022, surpassing the growth rate of the previous year. This surge was primarily fuelled by automation initiatives addressing 5G-related services.

The growth in CSP spending in the OSS segments outpaced that of spending in the BSS segments, because CSPs are pursuing network and service automation projects to deliver the promises of 5G and to increase efficiencies. The established BSS market is facing challenges from vendors offering flexible SaaS deployment options, which require less tailoring and interoperability work than previous BSS on-premises solutions. Consequently, CSP spending on BSS market is exhibiting smaller growth because of the reduced demand for new integrations or point-based solutions. However, CSPs are investing in OSS to address complex operational challenges for 5G and fibre roll-outs, which is driving growth in spending on professional and managed services to aid operational transformations.

As CSPs transform their products and service delivery in their digital transformation journeys, they are required to provide more stringent SLAs to support their customers. Key to transformations is the removal of manual interventions that introduce errors, create delays and do not scale. In addition, the scarcity of high-quality data hinders the development and implementation of robust AI/ML and GenAI models for application and process automation. This realisation is prompting updates in data management, modelling and governance, impacting not just control systems but also record systems.

Market share data shows a significant increase in CSP spending on inventory management solutions compared to spending in the overall service design and orchestration segment. This growth is a result of the tangible growth in closed-loop automation within OSS/BSS, ranking the success of automation during the:

- network plan to build a virtual infrastructure process

- trouble-to-resolution processes where a correlation in infrastructure errors to services can be observed.

Telecoms operations are already embracing the potential of GenAI and AI; but we expect to see a surge in further development towards autonomous automation. This journey for CSPs is far from effortless, with many operators struggling with the management of data quality and accessibility. Many are grappling with the task of handling vast amounts of siloed data from increasingly diverse sources. Despite these challenges, operators are steadily advancing towards greater autonomy in their network, which could shift the overall product/professional services dynamic. The use of applications, where mature models can be purchased pre-tests and are optimised for telecoms-specific use cases helps accelerate the use of AI/ GenAI, without relying of scarce resources skilled in both telecoms and AI knowledge.

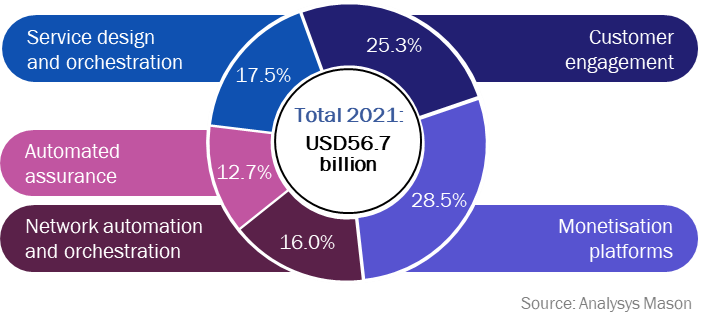

Figure 1: CSP spending on OSS/BSS software systems and services by segment, worldwide, 2021 and 2022

Aspects of digital transformation where CSPs have the least expertise are driving professional service spending in the BSS market

Analysys Mason estimates that CSPs’ spending on BSS professional services reached USD20.3 billion in 2022, an increase of USD800 million compared with 2021. This contrasts with the current product-driven growth in the OSS segment, suggesting that CSPs are over-relying on professional services for the AI-driven transformation that is taking place primarily in the BSS market.

The advent of GenAI/AI and tailored customer solutions, along with the use of new technologies and approaches to monetise 5G and further digitise customer engagement, requires automation and an implementation of AI technologies quickly. CSPs’ spending on professional services is rising due to the need for operational transformation for service agility and enhanced customer engagement. Overwhelmed by the complexity and variety of existing solutions, CSPs, often lacking internal skills and process vision, are outsourcing tasks to professional services for expedited change while building in-house expertise. The current market challenge is finding business-fit solutions rather than adjusting the business to fit the solutions.

On the OSS side, growth in CSPs’ spending on professional services has been lagging, primarily because vendor solutions are growing in their scope, ability and are becoming pre-integrated. In the past, element/network management system (EMS/NMS) solutions had limited scope and relied heavily on higher-order OSS to support them, whereas now these domain specific solutions are becoming more complete and offer high-degrees of automation. Moreover, SaaS-based platforms are now being used within the service orchestration layer, offering a single development platform to replace previously deployed multiple point solutions. These platforms can help CSPs to consolidate, replace and gradually retire existing OSS, which in turn creates a revenue increase for newer products rather than more traditional alternatives. The digital journey has traditionally started on BSS because the business case was stronger and larger staff numbers are involved compared to OSS, but CSPs are now embarking on a transformation of existing OSS stacks. It is anticipated that OSS will follow a similar pattern to that experienced by BSS in previous years.

Emerging SaaS players continue to challenge the market

CSP spending in the BSS SaaS market increased by 20.7% year-on-year, outpacing that in the OSS market, which grew at a rate of 14.3%. The driving force in the BSS market primarily lies in higher levels of interoperability and reduced requirements for extensive system tailoring in the BSS domain.

Most emerging vendors in the segment pride themselves on providing a ‘true’ SaaS experience, with cloud-native SaaS solutions presented as an all-in-one platform. Despite having a relatively small footprint initially in the BSS and more latterly in OSS market, SaaS-based vendor solutions are starting to secure significant wins with Tier-1 operators, posing an increasing threat to established players, which have been slow to adopt the delivery model. This has prompted top vendors in the OSS/BSS market to establish their own SaaS solutions, either by rearchitecting their platforms or by establishing partnerships with SaaS vendors.

Typically, leading SaaS vendors support CSPs and companies in industries beyond telecoms, giving them a scale beyond a single market. Where application workloads have been shifted to the public cloud, it has been noted that not all of these have provided the optimum savings as expected, to the extent that CSPs are now often looking to support hybrid-cloud solutions.

Analysys Mason is at the forefront of analysing the OSS and BSS systems and services for the telecoms industry

Our recent market share report, OSS/BSS software and services: worldwide market shares 2022, provides data for CSP spending in the OSS and BSS markets and includes detailed evaluations of product and professional services delivery types and specific regional developments; an assessment of the key drivers that influence the market; and recommendations for vendors and operators.

1 OSS segments include automated assurance (AA), service design and orchestration (SDO) and network automation and orchestration (NAO); BSS segments include monetisation platforms (MP) and customer engagement (CE).

Article (PDF)

DownloadAuthor