Satcom pricing is reshaping the telecoms industry landscape

Telecoms companies have traditionally focused on expanding terrestrial infrastructure such as fibre and cellular networks to address the growing demand for connectivity worldwide. However, this trend is changing rapidly. Telecoms players are using their existing infrastructure and expertise to enter into partnerships, make acquisitions and invest in the satellite communication (satcom) sector. They are increasingly integrating satcom solutions into their networks to extend coverage and diversify services thanks to the low cost per Mbit/s of satcom capacity. Indeed, Analysys Mason’s Satellite capacity pricing index, 9th edition reports that the demand for backhaul in Latin America is growing as a result of satcom capacity price erosion. For example, Brazilian mobile network operator, TIM Brasil, recently extended its network from urban centres to rural areas using Gilat’s technology. The network now covers all 5570 cities in Brazil.

Upstream satcom capacity pricing remains a key variable in the pace of satcom integration within the telecoms industry

The satcom industry is becoming extremely competitive as both geostationary-Earth orbit (GEO) and non-GEO players continue to add efficient high-throughput satellite (HTS) capacity in orbit. There has also been a significant shift in the positioning of satcom players; they are moving from wholesale capacity sales to providing downstream end-to-end services. Telecoms players, in addition to addressing their cellular markets, are looking to diversify their solutions into disaster management, IoT connectivity, digital transformation, enterprise solutions and other areas using the ongoing advances of satcom solutions. The satcom industry is addressing the bandwidth supply challenge, but upstream satcom capacity pricing remains a pivotal variable in determining the pace of satcom integration within the telecoms industry.

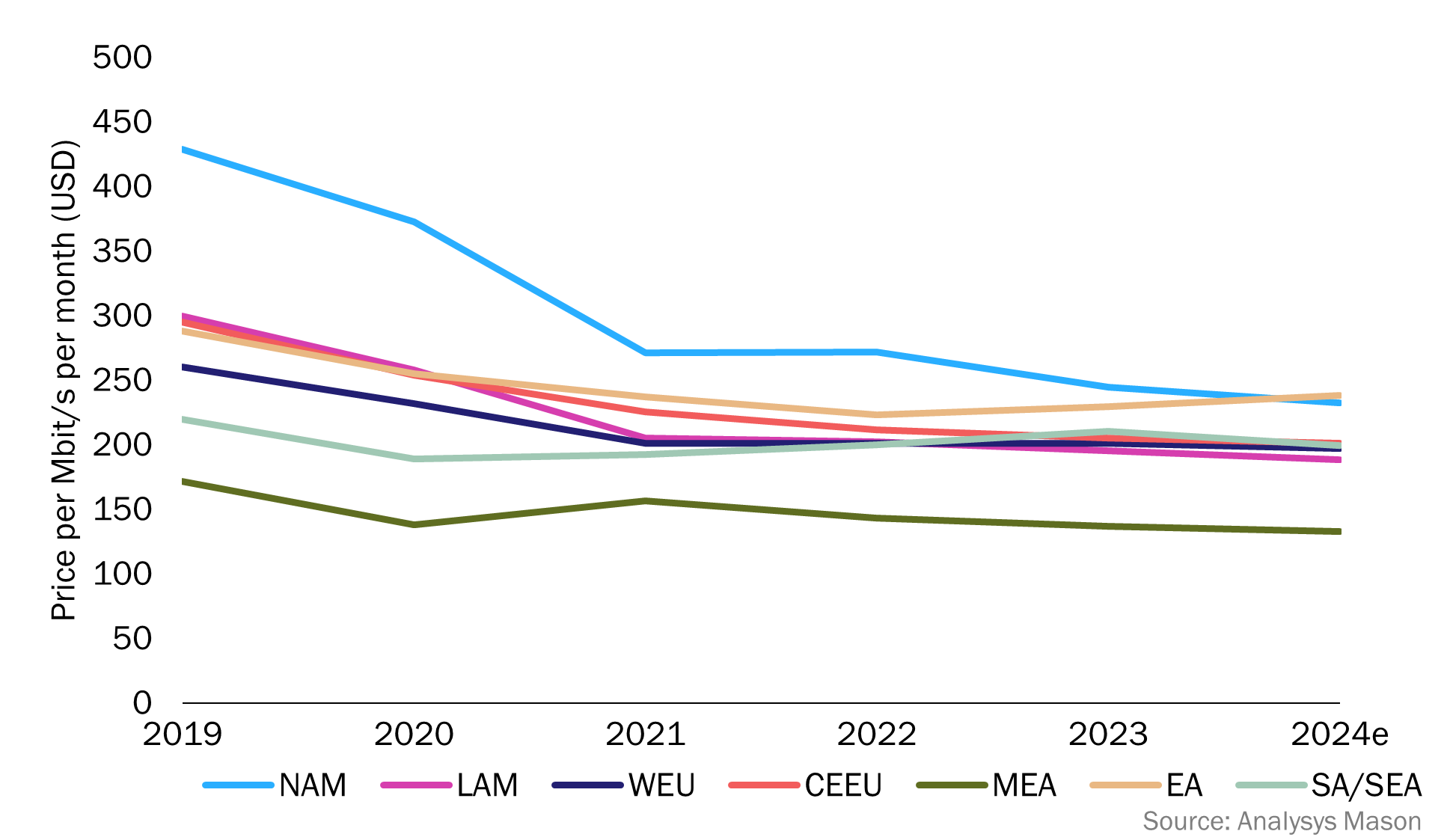

Backhaul GEO-HTS pricing is estimated to decline organically as more capacity is added in orbit, according to Analysys Mason’s Satellite capacity pricing index, 9th edition. There is currently a wide variance in pricing by region because of the different rates of take-up (Figure 1). However, pricing will converge to around USD100 per Mbit/s per month in the coming years as more solutions (particularly non-GEO solutions such as mPower and OneWeb) become available.

Figure 1: Backhaul/data GEO-HTS pricing, by region, 2019–20241

For fixed-satellite services (FSS), prices for the Ku-band for backhaul worldwide are estimated to fall by 4.8% year-on-year in 2024 due to HTS competition. The value of FSS contract renewals in North America is trending towards a 4–6% reduction year-on-year, though the volume of such contracts is increasing. The demand for backhaul in Latin America is soaring due to significant price drops. Mobile network operators (MNOs) expect prices to fall further for HTS solutions, but the supply crunch is cushioning the price erosion for Ku-band.

Telecoms players continue to invest in terrestrial infrastructure, but they also understand that satcom advancements can lead to better price economics and bandwidth supply. This is evident from recent partnerships such as Telstra and OneWeb, Hughes and Stargroup, VEON and OneWeb, TIM Brasil and Gilat, du and SES, Claro Brasil and SES, Axess Networks and ST Engineering and Digicel and SES. Analysys Mason expects that the competition to integrate satcom solutions into telecoms networks will intensify in the next 3–5 years as more partnerships are formed and price erosion unlocks demand elasticities.

Satcom pricing is reshaping the telecoms industry

Satcom pricing is a function of in-orbit cost per Mbit/s, supply–demand dynamics and competition in a particular region. Advancements from players such as Starlink, OneWeb and Viasat are driving down prices, thereby enabling telecoms players to use satcom solution to expand connectivity beyond their traditional coverage areas. Telecoms players are also looking to use satcom to tap into new markets, diversify services and remain competitive. Satcom players continue to deploy cost-effective HTS capacity, so telecoms operators must adapt to the evolving landscape, form strategic partnerships and invest in infrastructure to fully capitalise on the potential of satcom technology and the increase in capacity. The decreasing satcom pricing offers an attractive business case, but telecoms players must balance their investments across satcom and terrestrial infrastructure based on key variables such as technology readiness, lead times, overall cost, appropriate partnerships, demand and revenue models to remain well-positioned and competitive in the market.

Overall, efficient satcom pricing is leading to satcom integration in the telecoms industry. This is setting the stage for a connected future, global connectivity, a bridged digital divide and digital transformation across sectors in the coming years.

1 Regional acronyms are as follows: NAM is North America, LAM is Latin America, WEU is Western Europe, CEEU = Central and Eastern Europe, MEA = Middle East and Africa, EA = East Asia and SA/SEA is South Asia/Southeast Asia.

Article (PDF)

DownloadAuthor