Satellite direct-to-device technology needs to evolve through four phases before reaching its full potential

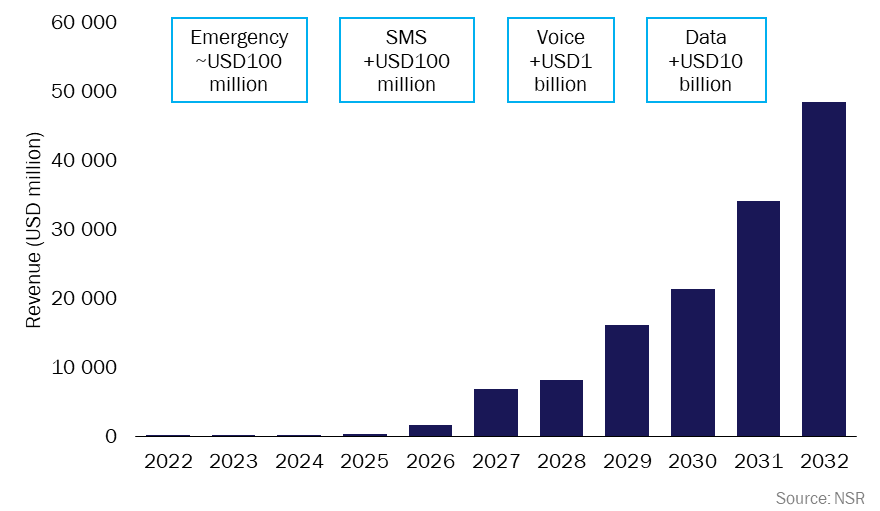

Satellite direct-to-device (D2D) is one of the most exciting areas of the space industry. Satellite D2D could generate USD137 billion in cumulative service revenue between 2022 and 2032, which we explore in more detail in our Satellite direct-to-device market, 4th edition report. However, the technology will need to advance through four ‘waves’ or phases of connectivity capabilities (emergency alerts, messaging, voice and data) before the market can reach its potential (Figure 1).

Figure 1: Satellite D2D service revenue, worldwide, 2022–2032

The direct revenue opportunity in the early years is low, although the perceived value of potentially lifesaving connectivity is high

The characteristics of the currently available systems limit the offerings to basic emergency alerts and messaging services. Networks like Globalstar, Iridium and ViaSat/Inmarsat were designed with legacy satellite use cases in mind, which usually prioritise narrowband and high-availability offerings. Consequently, the amount of bandwidth available is not big enough to support advanced voice and data services direct to unmodified phones at scale. These systems also use specific satellite spectrum, which means that they are not backwards compatible with the phones that are being used today. Therefore, satellite D2D offers, such as those from Apple/Globalstar or Bullit/Skylo, are very basic.

There is a group of companies, including AST SpaceMobile, Lynk and Starlink D2D (not to be confused with the current Starlink Ku-Band constellation which cannot communicate directly with unmodified phones), that want to use terrestrial spectrum from space. This would allow them to be backwards compatible with existing phones. The early offerings of these constellations will also be limited to emergency alerts and messaging, in line with the announcement from Spark and Lynk on 29 November 2023.

The willingness of mainstream users to pay for emergency alerts and messaging services is limited. Analysys Mason's satellite and space team forecasts the revenue opportunity for emergency alerts to be under USD100 million worldwide between 2022 and 2032. Revenue from satellite D2D messaging services will be higher but will not exceed USD0.5 billion worldwide. The direct revenue opportunity might not be significant for mobile network operators (MNOs), but end users value these potentially lifesaving features. MNOs should focus on incorporating these satellite D2D services as a differentiator from competitors.

Satellite D2D’s multi-billion US dollar market hinges on voice and data services; standards will be essential to this opportunity

More revenue opportunities will be unlocked as D2D capabilities evolve and when voice and wideband data services become commercially available. In the early stage of the technology, services will be basic and confined to emergency and text messaging. Therefore, the willingness of end users to pay for these early services may be limited. However, when data and voice capabilities become available, a vast and accessible market will emerge. For example, demand from recreational travellers, rural residents, IoT, first responders and many others who want to stay connected when out of the reach of the limited terrestrial network coverage will boost market penetration and adoption rates. Huge revenue opportunities await when coverage is worldwide, connections are reliable and data speeds are consistent.

Supply scarcity will need to be addressed along the way. Legacy constellations, such as Iridium and Viasat/Inmarsat, have limited capabilities and services are restricted to emergencies and messaging. More satellite capacity will need to be launched to scale the model to support voice and data services.

Standards will also play an important role in unlocking this revenue opportunity. The inclusion of the non-terrestrial networks in the 3GPP Release 17 has opened the door for advancing D2D technologies. Although Release 17 mainly focuses on narrowband capabilities of 5G non-terrestrial networks, it is expected that Release 18 will enhance and expand standards for voice and data applications over satellites. Some companies are moving away from proprietary solutions in favour of standards-compliant ones. SpaceX ceased Swarm IoT device sales, in favour of standards-based IoT solutions; Iridium, after its unsuccessful partnership with Qualcomm, is taking a standards-based approach to D2D satellite services.

MNOs and telcos that want to enter the D2D market should select ecosystem partners carefully

The satellite D2D value chain is considerable, and involves a range of players, including chipset manufacturers, original equipment manufacturers (OEMs), infrastructure equipment vendors, satellite operators, service providers and MNOs. Players are establishing a variety of partnerships with different strategies and priorities.

When contemplating partnerships, MNOs and telcos should consider various factors. For example, they need to make decisions regarding spectrum strategies (mobile-satellite service (MSS) or terrestrial), weigh the options between proprietary and standardised solutions, and define their target market (consumer or industry IoT).

Successful partnerships will probably be those that acknowledge the importance of the members of the value chain, and those that can coordinate and garner support from players across the value chain. The ineffective partnership between Iridium and Qualcomm highlights a valuable lesson for the industry: partnerships are more likely to be unsuccessful as a result of a lack of attractive offers for OEMs and the overlooked role of MNOs.

MNOs and telcos that want to enter the D2D market should select partners carefully, form right set of partnerships and evaluate their skills and market objectives to determine the best satellite D2D strategy.

Article (PDF)

DownloadAuthors