Service design and orchestration revenue grew in 2022, driven by the need for CSPs to adapt to the 5G era

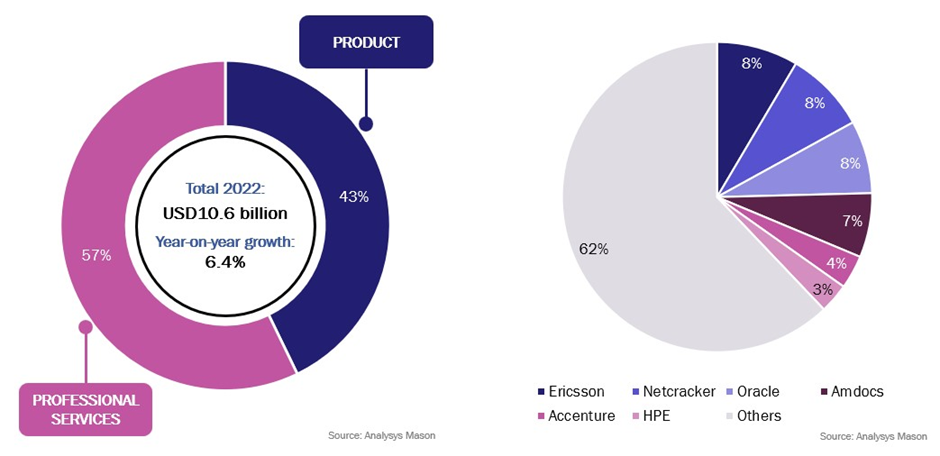

Vendor revenue in the service design and orchestration segment of the telecoms software and services market increased by 6.4% in 2022 compared to the previous year (Figure 1). This growth was even stronger than in 2021, showing that the industry can adapt well even during economically challenging times. This growth shows that vendors in the service design and orchestration segment are adjusting to changes in the wider telecoms market. The future seems to promise continuing growth in this segment because communication service providers (CSPs) will need to continue to adapt their service design and orchestration solutions to the 5G era. In particular, CSPs are investing in upgrading their operations support systems (OSS) for better automation.

Figure 1: Service design and orchestration total revenue by type and vendor, worldwide, 2022

Notably, CSPs’ spending on service design and orchestration solutions and services increased in emerging Asia–Pacific, North America and Western Europe. This article provides a brief insight into the service design and orchestration solutions and services market for the telecoms industry, and offers an overview of the strategies of the top-six vendors represented in Analysys Mason’s market share report for 2022.

5G SA is a key driver of vendor revenue in the service design and orchestration market

Revenue in the end-to-end orchestration sub-segment grew as CSPs deployed solutions to address the complexities of 5G standalone (SA) networks. The number of 5G SA deployments increased in 2022. The shift toward SA networks, offering complete 5G capabilities, gained traction to fulfil the promise of unparalleled customer experience and deliver enterprise services that will play a crucial role in recouping 5G investments. Nonetheless, if CSPs are to move to a fully cloud-native and independent 5G core, they will need zero-touch end-to-end network automation to effectively scale 5G SA deployments. One of the key capabilities enabled by this is network slicing. Network slicing requires orchestration solutions and automation tools that are capable of seamlessly spanning domains and vendors, thus delivering distinct services based on service-level agreements (SLAs).

Amdocs, Ericsson, Netcracker, Oracle and VMware were major players in the end-to-end orchestration landscape, helping CSPs to transition from the traditional telecoms operational model to the cloud-based decoupled 5G environment.

CSPs are accelerating their digital transformation journeys as automation helps them to tackle the complexities of 5G

Digital transformation is an essential catalyst for CSPs. This transformative journey is not just about meeting customers’ evolving needs; it is also about seizing novel business opportunities that lie ahead. With the complexities of the 5G era unfolding, the role of automation has become critical. Many digital transformation journeys start with updating inventory systems, which lie at the core of the OSS systems.

As the market moves towards 5G’s cloud-based architecture, services and infrastructure are changing and becoming part of the virtualised network, characterised by agility and scalability. This poses a challenge to monetising 5G services, leaving CSPs with no choice but to update their legacy inventory systems.

Established players like Amdocs, Ericsson, Netcracker and Oracle continued to dominate the segment, but ServiceNow has emerged as a formidable challenger. In September 2022, ServiceNow announced the Now Platform Tokyo release of new solutions. These include Telecom and Enterprise Legal Solutions, which are purpose-built to address the pain points that are specific to these audiences. Of the new solutions, the inventory system, based on ServiceNow’s configuration management database (CMDB) model, stands out. ServiceNow is seeking to redefine inventory systems and observability with a view to creating a comprehensive view of cloud-based networks and IT environments.

Vendors are developing solutions to simplify hybrid cloud orchestration for CSPs

CSPs with networks that operate hybrid cloud orchestration are seeking to address the challenge of moving to cloud-based operations seamlessly. The search for solutions that can bring multiple clouds under a single ‘umbrella’ is a priority, eliminating the need to manage multiple portals and OSS systems across various infrastructures. This is all about making it easy to set up multi-cloud systems and automatically adjusting applications to fit different cloud set-ups.

It is important to note that not all orchestration tools and workflows deployed across public and private clouds seamlessly integrate. This gap has spurred interest in third-party hybrid cloud orchestration solutions. These platforms act as connectors based on a common rulebook known as TOSCA and help to blend different cloud environments. These systems make quick software upgrades possible, thanks to temporary data shifts. They also help operators to manage disaster recovery on a regional level, sudden surges in activity and the smooth expansion into high-capacity cloud zones. Development of the orchestration systems to manage the set-up and analyse operations across all these clouds is on the rise, creating opportunities for less-established vendors to enter the service design and orchestration market.

Analysys Mason is at the forefront of analysing service design and orchestration systems and services for the telecoms industry

Our recent report, Service design and orchestration: worldwide market shares 2022 provides market share data for the service design and orchestration market and includes: detailed evaluations of product and professional services delivery types and specific regional developments; an assessment of the business environment and regional dynamics that influence the market; recommendations for vendors; and short profiles of ten leading vendors in the market.

Article (PDF)

DownloadAuthor

Alex Bilyi

AnalystRelated items

Article

GenAI can help cut the cost of software creation, boosting the potential of free applications to transform the market

Company profile

Netcracker: service design and orchestration

Tracker

Service design and orchestration vendor product tracker 2025