Software-defined satellites: how flexible is the future?

The satellite communications market is experiencing growing pains. For decades, the satellite industry was relatively isolated from the terrestrial telecoms industry. Satellites were expensive and took years to develop, which resulted in higher-priced services that were typically used for the ‘last mile’, mainly to serve users in remote areas.

However, in the last decade, this has started to change. Satellite manufacturing has increased in scale and production timelines are shorter, and fleets of satellite constellations were developed as a means of ‘bridging the digital divide’, allowing telecoms and satellite players to cooperate, and even compete, in similar markets.

One of the driving forces within satellite manufacturing that has facilitated this change has been the development of software-defined satellites. The standardization of hardware, the shift of systems’ complexity to software have not only improved the capital expenditure (capex) of satellite manufacturing, but they have also increased operational flexibility. Software-defined satellites enable operators to change functions and capabilities post-launch, which is becoming increasingly important as downstream markets are changing more quickly than ever.

However, one size does not truly fit all, and the demand for software-defined satellites varies by customer. With that in mind, what are the considerations behind software-defined satellites, and what level of flexibility is the way forward?

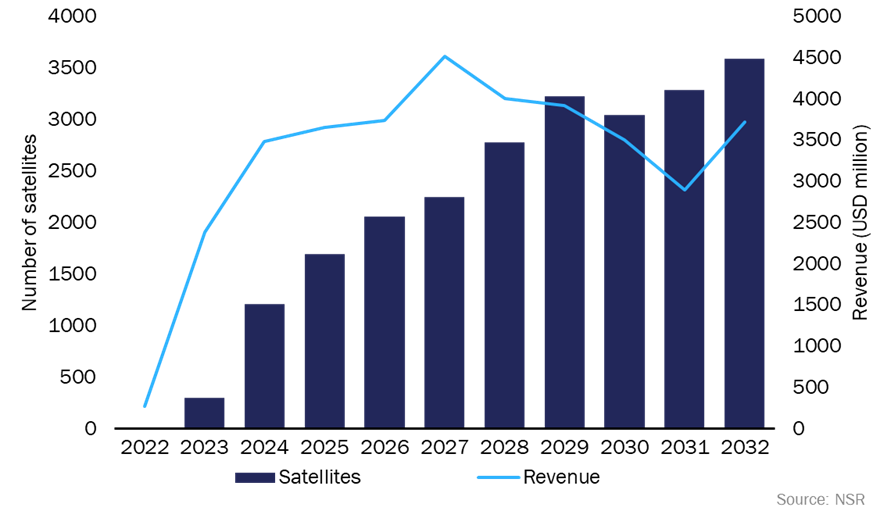

NSR’s report Software-defined satellites, 3rd edition forecasts over 23 000 software-defined satellites will be built during 2022–2032, generating nearly USD54 billion in cumulative manufacturing revenue (Figure 1). The forecast has shifted in recent years, because of the growing number and capability of satellite constellation deployments from players such as Amazon, OneWeb and Starlink, and also because of an increase in the demand for the flexibility that software-defined satellites can offer. A few years ago, software-defined satellites were merely a consideration, but now manufacturers note that almost all requests for proposals cite software-defined capabilities as a requirement. As such, NSR forecasts that over 89% of all communications satellites built in the next decade will feature at least some level of software-defined flexibility. However, as much as that demand grows, it is not uniform, and the differences between the perspectives of manufacturers and operators will cause delays and challenges in procurement unless otherwise accounted for.

Figure 1: Software-defined communications satellite orders and revenue, worldwide, 2022–2032

Indeed, an analysis of the need for flexibility across applications reveals a spectrum. Enterprise broadband and aeronautical connectivity customers require very robust networks, and capabilities such as capacity flexibility and backwards compatibility can make or break deals. However, consumer broadband and maritime customers are not as interested in these features, preferring reliability over flexibility. For them, price and consistency are more important than flexibility.

Now we begin to see the problem. The needs of a satellite operator’s target customers may vary greatly. As such, the value of flexibility is mixed, and manufacturers have difficulty demonstrating its value in their software-defined satellite platforms. Operators value flexibility, but are left unsure of how much they need, and how much it is worth. In the meantime, manufacturers may receive mixed messages regarding flexibility, resulting in inefficient technology focus and investment.

The bottom line

Full flexibility is the way forward. While operators have hesitated, and manufacturers have approached this market in several ways, both supply and demand will be better served with fully software-defined systems that can accommodate any market need, especially those that develop over the next few years. Operators will need every tool and all the flexibility at their disposal to adapt to changing markets, and manufacturers will improve their ability to compete in the market if they offer fully flexible platforms that can be modified to suit any level of flexibility in the future.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Article

Europe should bridge the gap between various international lunar efforts

Tracker report

Space infrastructure investment: trends and analysis 2024

Article

Data centres are increasingly being launched into space but must meet stringent requirements