SpaceX’s entry into the optical satcom terminal market could be a game-changer

The recent announcement that SpaceX will sell optical terminals to potential competitors and other satellite operators could be a game-changer due to SpaceX’s historically low price points. However, uncertainties such as whether SpaceX’s terminals will interoperate with those of the Space Development Agency (SDA), the potential hesitation by satellite operators with existing contracts for their larger constellations, and the need for establishing sovereign capabilities independent of SpaceX will affect the adoption of its terminals.

The reliability of SpaceX’s LCTs positions SpaceX at the forefront in the market

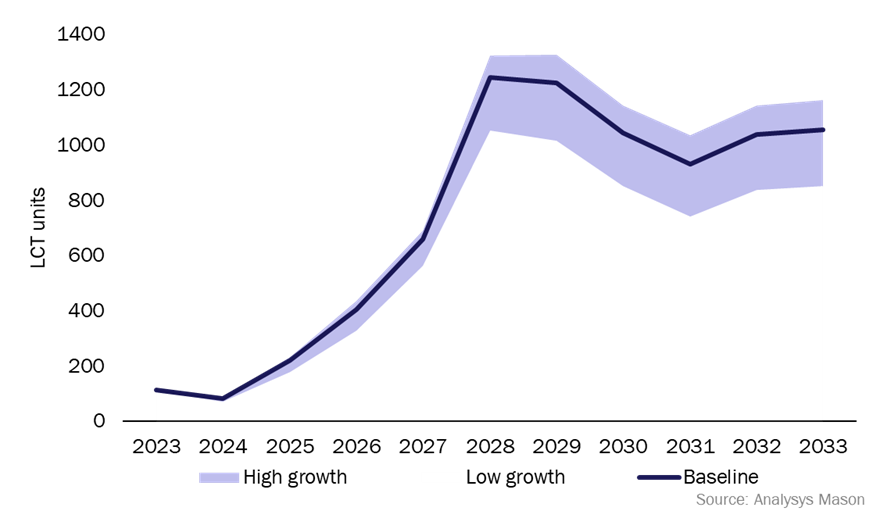

Analysys Mason’s Optical satellite communications market, 6th edition report forecasts 8000+ laser communication terminals (LCTs) to be launched during this decade, with 98% of this total driven by inter-satellite links (ISLs). The communication constellations operators, which are the target market for SpaceX’s LCTs, drive about 94% of the demand for ISLs, indicating a large addressable market for its terminals.

The North America (NAM) region drives 89% of the demand for ISLs and 85% of the total corresponding equipment revenue. This puts SpaceX, a US-based company, in a good position to address a significant proportion of the demand in this market. SpaceX has about 9000 terminals in-orbit (three terminals per satellite), sustaining a 100Gbit/s link each, thus demonstrating the reliability of its terminals and putting it at the forefront of the market compared to its competitors, who are currently at various earlier development stages. Players such as Tesat-Spacecom, and CACI have operational terminals in orbit but at lower volumes, and others are still in the testing or development stages. The entrance of SpaceX intensifies competition in the market and hinders its competitors’ ability to increase their share of the demand. Thus, it is mechanically increasing entry barriers for new market players.

Figure 1: Laser communication terminals, by scenario, worldwide, 2023–2033

However, the impact that SpaceX will have will vary by region. Support for new players in Europe will increase because of the need for autonomy and the preference for domestic suppliers in this region. This will enable further development of the market landscape, in addition to the regional space agencies working with established players such as Thales Alenia Space and Airbus. Similar repercussions are expected in Asia, where China will lead the way with larger constellations such as Guowang (Galaxy Space) and ISRO leveraging commercial capabilities for LCTs. For the purposes of sizing the market, we consider China to be a closed market and therefore we do not include it in our market forecasts of LCTs (Figure 2). Players such as Warpspace could consider SpaceX LCTs for their data relay constellation, but most of the demand is expected to be addressed by domestic suppliers.

Figure 2: Laser communication terminals, by region, worldwide, 2023–2033

Satellite operators that are planning communication constellations value high data rates and are open to switching vendors

One of the key differentiators for SpaceX terminals is their ability to support data rates up to 200Gbit/s. The terminals have the longest link distance of 5400km and a shortest link distance of 122km, thus making them versatile for applications in LEO and MEO. These data rates are higher than those of terminals from other vertically integrated players such as Kuiper, which has tested capabilities of 100Gbit/s links. Higher data rates are critical for communication constellations and the adoption of terminals that can support these rates is expected to be high. In addition, SpaceX is looking to expand capabilities for space-to-ground applications, which will increase the addressability of applications including those for Earth observation. Thus, the probability of expansion of Starlink services for data relay purposes increases, potentially affecting the opportunity for other data relay operators in the future. This effort further opens up markets for terminals across not just satellite platforms (which we estimate to be USD2.6 billion worldwide) but across land, air and sea domains too.

The government/military sector is the most immediately addressable market and is expected to drive about 72% of the demand for LCTs between 2023 and 2027, with the SDA being the major driver during the initial years. Inter-operability with SDA terminals and SDA standard compliance has become a major issue to be addressed. However, the uncertainty around SpaceX LCTs complying to SDA standards could inhibit their adoption. The Starshield solution, when combined with the LCT terminal offering, could strengthen SpaceX’s ability to address additional ‘dark projects’ from military customers. SpaceX has already received a contract from the US Space Force for USD70 million for a suite of satellites using Starshield, indicating interest from military operators in the offering, increasing the opportunity for SpaceX to leverage LCTs on such missions. Furthermore, if interoperability is established, the current SDA terminals, which have data rates of 1.8Gbit/s, could see a substantial improvement. This would occur through the adoption of SpaceX’s high data rate terminals for subsequent layers of Tranche 2 and beyond. However, the US government’s historical dual procurement strategy and need for a back-up supplier to avoid relying on a single player will keep the market landscape competitive for Starshield solutions and SpaceX’s LCTs.

SpaceX’s low-cost offering will increase pricing pressure

SpaceX is well known for disrupting the market with services at low price points. A similar trend is expected for the LCTs. The pricing pressures in the market are expected to intensify, particularly for established players that are accustomed to handling contracts with large dollar values. Thus, the established players may have to concentrate on solutions that require non-recurrent engineering (NRE) for LCT development for applications such as scientific and deep space missions, which are expected to be relevant in the optical satcom market for space-to-space and space-to-ground applications.

Given the large addressable market for ISLs and the NAM region leading the market, the potential for market capture for SpaceX is increasing. However, factors such as inter-operability with SDA, the opportunity of communication constellation operators to switch to new LCT manufacturer for subsequent contracts and the existing market competition will define whether SpaceX will establish itself as a new monopoly in the optical satcom equipment market. Other players are poised to capture demand due to factors such as the need for diverse vendor procurement, deep space missions and sovereign market needs. SpaceX’s entry in the market is expected to have significant impact, but the market response will define the landscape going forward.

Article (PDF)

DownloadAuthor

Prachi Kawade

Senior Analyst, expert in space and satelliteRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Article

Europe should bridge the gap between various international lunar efforts

Forecast report

Civil government satellite communications: trends and forecasts 2024–2034